Table Of Contents

What Is Portfolio Construction?

Portfolio Construction is the process of investing in different types of asset classes and financial products, keeping market types and risks, diversification needs, fund management efficiency, risk tolerance, investment time horizon, and long-term and short-term financial goals in mind. The purpose is to strategically allocate capital to improve portfolio returns.

A well-structured portfolio ensures long-term returns and profit maximization for investors. It balances risks and safeguards investors from direct or indirect market fluctuations. It facilitates diversification by helping an investor place their capital in various assets like stocks, bonds, real estate, commodities, etc. Strategic portfolio construction enables compounding, controls market exposure, brings investment discipline, and facilitates liquidity management.

Table of contents

- What Is Portfolio Construction?

- Portfolio construction is a strategic process that enables investors to achieve optimal returns and manage risk through diversification.

- Individual investment goals, risk tolerance, and time horizons are considered in this process. Traditional and modern are two well-known portfolio construction techniques.

- Key steps in effective portfolio construction include identifying suitable assets, analyzing associated risks, implementing a suitable asset allocation strategy, choosing a solid management approach, making mindful investments, and ensuring consistent monitoring for portfolio performance optimization.

- Investors face several challenges while making investment decisions. The hurdles revolve around investment style selection, portfolio balancing, emotional decision-making, market fluctuations handling, etc. Overcoming these challenges is crucial to earn good returns.

Portfolio Construction Explained

Portfolio construction involves investing in different assets and financial products, creating a diversified and balanced collection of investments that is protected from potential market risks and abrupt shifts. In other words, it is the simple practice of investing funds in a variety of assets so that an investor receives long-term protection against market movements and enjoys returns from various sources at the same time. It ensures investors do not invest in a single asset, which can be highly risky.

The portfolio construction meaning states that this method empowers investors by allowing them to invest in different types of assets while balancing and protecting their assets from risks across different time horizons. However, it requires investors to study the markets well and invest in specific assets after gathering the required information about them. For instance, investing in complex and volatile markets like cryptocurrencies and currency exchange requires considerable research and understanding of the associated risks.

The portfolio construction theory describes the many constraints and challenges encountered while selecting assets and maintaining a portfolio. Investors are required to regularly monitor their investments, stay updated about market conditions, and make prompt adjustments to their portfolios to secure the required returns. This is because portfolio management is a continuous process that involves a cycle of learning and improvement. Investors must seek professional advice, when necessary, particularly in situations where their investment knowledge seems lacking.

For those new to investing, Hargreaves Lansdown offers simple steps to get started with building a portfolio.

Process Steps

Most portfolio construction methods involve the following steps.

- Asset identification: The first step in portfolio construction is identifying the different types of assets available in the market. They must also be suitable from an investor's perspective. These can be cash, fixed deposits, stocks, real estate, or other forms of short- or long-term assets and financial instruments.

- Risk determination: The second step is to understand the risks associated with each asset an investor wishes to select for investment. Risk is studied in the context of returns; if the risk is high, the returns are usually high, and vice versa.

- Asset allocation: Asset allocation is a vital step in portfolio construction, determining how investors distribute their capital across different asset classes based on their specific goals and risk tolerance. Dynamic, strategic, static, and tactical are the prominent asset allocation methods that investors usually employ.

- Management approach: The two main approaches in portfolio construction are traditional and modern. The former focuses on achieving a balance between income generation and capital appreciation, especially useful to investors with regular income needs and long-term wealth accumulation goals. The modern approach prioritizes capital appreciation for investors seeking higher growth potential.

- Investment: This step involves investing the available funds in different assets that have been selected after careful analysis.

- Review: The final step in portfolio construction demands consistent portfolio monitoring. This is arguably the most important step. Investors must track the market well to make timely decisions about exiting or modifying their positions. Adjusting their position to hedge risks and improving diversification are crucial aspects of good portfolio management.

Examples

Let us study two examples in this section.

Example #1

Suppose Jenny is a new investor looking for assets for investment. She reads many books, watches finance videos, reads stock market blogs, and seeks advice from fellow investors to arrive at a decision. Jenny’s investor friends regularly talk about diversification. She understands that it refers to not placing all her money in a single asset or asset class. She also gathers more information about how to invest and begins investing.

To ensure diversification, Jenny keeps some portion of her funds in fixed deposits. She invests 15% of her funds in stocks and employs 55% of her capital in real estate markets. With the remaining money, she purchases government bonds to receive regular income in the form of interest payments for the next nine years.

In this way, Jenny’s portfolio is diversified and balanced. While Jenny considered several asset classes and asset types, she decided to invest in the ones mentioned above based on her existing financial condition, risk tolerance levels, and investment time horizon needs.

Example #2

In a November 2023 article, Josh Lohmeier, Portfolio Manager at Franklin Templeton Fixed Income, discussed a portfolio management process that deviates from the traditional approach and integrates a data-driven portfolio construction and management strategy. He highlighted the importance of exploring new methods since traditional options may not offer adequate returns in current markets that pose significant challenges.

He further advised investors to implement robust risk management strategies to protect their capital and minimize losses. For this, he suggested using quantitative models that offer key insights for risk management and portfolio diversification, which may not be highlighted when a traditional approach is followed. Through this article, he proposed employing a dynamic approach that involves quantitative and qualitative assessments before making investment decisions. This article offers useful input that can guide portfolio construction decisions.

Challenges And Solutions

In this section, the challenges and solutions involved in this process have been discussed.

#1 Challenge - Right investment style

Picking the right investment style is a major challenge for many investors. Given the market dynamics and constant shifts, investors are required to choose the aspects on which they wish to focus. These include growth, returns, risks, etc. They may need to take a mixed or customized approach based on their investment and financial goals. The investment style must be tailored to their objectives.

Solution

- Investors should study the market well and define their financial goals before investing.

- They should look for significant value generation from their investments and choose companies with innovative, long-term vision.

#2 Challenge - Striking a balance between investments

Striking a balance between investments is an ongoing challenge for many investors. The urge to second-guess investment decisions, particularly when markets seem fluid and stocks fluctuate, can be strong. Comparing investment decisions that lead to unreasonable conclusions is also a possibility. This can result in emotional decisions and poor investment choices. It can hamper judgment while selecting asset classes and markets for investment.

Solution

- Investors should prioritize logic over emotions.

- They should have a long-term vision.

- They should understand the risks involved in investing in specific assets and markets and consider their risk appetite before making significant decisions.

#3 Challenge - Reacting to fears, notions, and market rumors

Anxiety, fear, and panic are triggered by misinformation and rumors. Reacting hastily based on market rumors, news, and personal fears is a significant challenge many investors struggle with frequently. Such behavior can lead to poor investment decisions and ultimately hinder long-term success.

Solution

- Investors should focus on fundamental analysis.

- Before making decisions, they should ascertain the validity of specific news or rumors.

#4 Challenge - Building a portfolio with a time horizon

When investors start investing, they are driven by the idea of securing the highest possible returns in the shortest possible time. Every investor has short and long-term financial goals, and it becomes challenging to maintain a portfolio with conflicting time horizons.

Solution

- A portfolio should be constructed keeping in mind that market conditions change over time.

- An investor must practice patience, especially with stock market fluctuations.

- They must set their goals in advance and invest in assets that offer the required returns within the required timeframe.

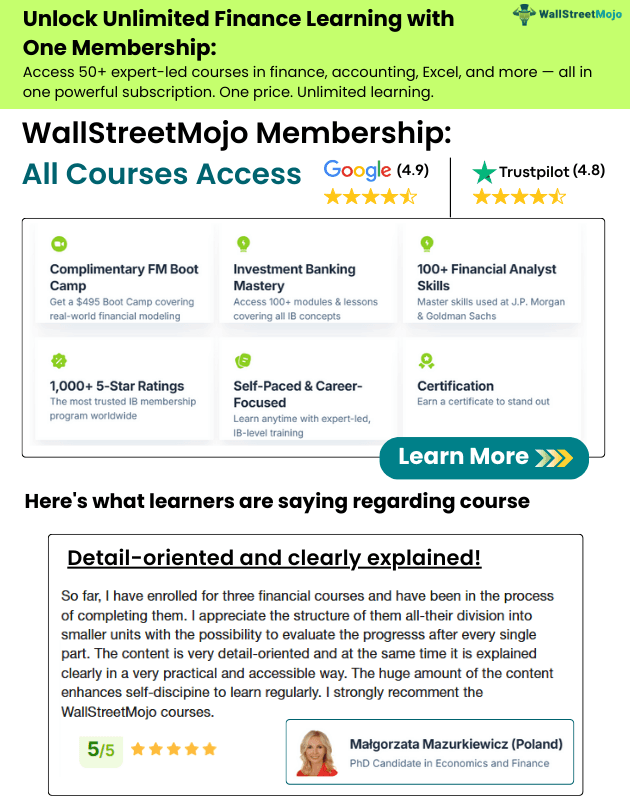

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

1. What are the factors affecting asset selection during portfolio construction?

The factors that affect asset selection include:

- Investment goals, risk tolerance, financial condition, investment knowledge, liquidity, and investment time horizon of an investor are important considerations.

- Asset types and expected returns are vital, too.

- A country’s economic condition and taxation policy steer investment decision-making.

- The investing style and mindset of an investor affect their asset selection.

2. Which type of assets should be included during portfolio construction?

Investors can consider primary and alternative investment options while constructing their portfolios. The primary asset classes include equity, bonds, cash, and real estate. Alternative investment options include hedge funds, commodities, private equity, cryptocurrencies, etc. Depending on their financial condition, age, risk appetite, and investment goals, investors can select suitable assets.

3. What are the advantages of portfolio construction?

The main advantages of portfolio construction are:

- Diversification: Overall risks can be reduced through diversification.

- Risk management: It ensures protection from market fluctuations and corresponding risks by tailoring asset allocation to individual risk tolerance.

- Capital appreciation: Long-term growth is possible, and investors can enjoy returns from multiple sources by building a reliable investment portfolio.