Table Of Contents

What Is Portfolio Backtesting?

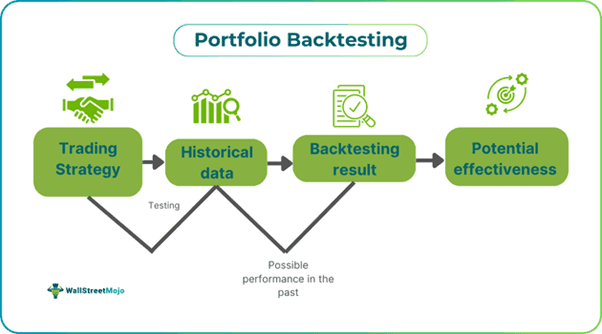

Portfolio backtesting refers to the process of simulating an investment strategy using historical prices to examine how well the strategy might have performed in the past. It refines traders' techniques, helps avoid potential pitfalls, identifies optimal exit and entry points, and improves decision-making accuracy.

You are free to use this image on your website, templates, etc.. Please provide us with an attribution link.

Developing a reliable and robust trading system has become essential. A well-executed backtest that yields positive results reassures traders of the strategy’s soundness, suggesting that it can be used to generate profits in real-world execution. Conversely, if the backtest produces subpar results, it prompts traders to either reject or modify the strategy.

Key Takeaways

- Portfolio backtesting is the process of evaluating an investment strategy's performance by using historical data to test how it would have performed in the past. It helps in identifying optimal entry and exit points and enhances decision-making accuracy.

- It involves defining a strategy, obtaining historical data, testing for confidence, executing the strategy, monitoring trades, evaluating performance, and revisiting parameters.

- Benefits include identifying gaps in portfolio management, assessing market risk, optimizing resource allocation, evaluating strategies, guiding asset decisions, and offering unbiased assessments for profitability.

- Backtesting relies on historical data, while forward testing applies trading strategies to portfolios and securities in real-time markets.

Portfolio Backtesting Explained

Portfolio backtesting is the process of evaluating the performance of an investment strategy using historical data to assess its potential effectiveness. This technique allows investors to simulate how a trading strategy might have performed in the past, offering valuable insights into its potential future performance when applied to real capital.

Any trading idea that can be quantified can be backtested, but it requires programming the idea into a testable system using the trading platform’s customized language. Traders can incorporate user-specific input variables, allowing for adjustments during the simulation. For example, traders can modify the duration of two moving averages used in the strategy. Traders can determine the optimal moving average length by backtesting the portfolio based on historical data. This process helps validate trading strategies, improve risk management, and build trader confidence.

Backtesting is widely applicable across different market conditions, making it essential for both institutional and individual investors. By reviewing a strategy's historical performance, traders can identify strengths and weaknesses, allowing them to refine their approaches before applying them in real-world scenarios. Additionally, backtesting supports data-driven decision-making, helping traders avoid emotional choices. Widely available tools for ETF portfolio backtesting also enable users to efficiently evaluate multiple strategies.

Successful backtesting requires careful attention to biases like overfitting and look-ahead bias. Addressing these issues is critical to ensure reliable results. Backtesting has become a cornerstone of quantitative trading strategies and plays a significant role in investment decisions by providing empirical evidence of a strategy's viability, thereby influencing portfolio management practices.

How To Conduct?

It is important to conduct backtesting properly to obtain accurate results; otherwise, financial losses may occur. Below are the steps to do it:

- Define the trading strategy by specifying rules for risk management, entry and exit points, and position sizing.

- Obtain accurate historical data for the markets or financial instruments, including information such as volume and price.

- Select the testing duration by choosing a time frame that aligns with the strategy and provides the needed level of confidence.

- Execute the strategy on the historical data, simulating live trades according to the defined rules.

- For thorough analysis, monitor trade details such as profit or loss, entry and exit points, and trade duration.

- Evaluate performance using key metrics such as drawdowns, profitability, and risk-adjusted returns.

- Review and refine the strategy by identifying areas for improvement, adjusting strategy parameters, and validating them through additional testing to ensure robustness.

Examples

Let us use a few examples to understand the topic.

Example #1

Imagine a trader wants to test a trading strategy by building a portfolio with the following assets:

- Vanguard Total Stock Market ETF (VTI): 60%

- Vanguard Total Bond Market ETF (BND): 30%

- Vanguard International Stock ETF (VXUS): 10%

The trader uses a portfolio backtesting tool to see how this combination would have performed over the last 10 years using historical data. The tool provides key metrics, such as annual return, volatility, and drawdown. Based on the backtest results, the trader can adjust the portfolio by increasing or reducing allocations to manage risk or improve returns.

Example #2

Portfolio backtesting plays a critical role in identifying high-performing investment strategies. A Forbes article highlighted three strategies (Uber Cannibals, Shameless Cloning, and Spinoffs) that were extensively backtested to ensure their potential to outperform the S&P 500. Backtesting enabled the traders to simulate past performance using historical data, helping validate these strategies' success before implementing them. In 2017, these portfolios outpaced the S&P 500, with significant gains proving the importance of testing strategies to reduce risk and improve returns.

Benefits

In the realm of portfolio risk management, portfolio backtesting offers several benefits, as outlined below:

- It helps identify potential gaps in advanced portfolio management.

- It allows one to assess the level of risk in specific markets related to trading investments.

- Portfolio managers can optimize resource allocation by testing various backtesting portfolios.

- As a risk management tool, portfolio backtesting is ideal for evaluating innovative trading strategies in real markets.

- It assists traders in making informed decisions about buying or selling assets.

- It provides an unbiased method for assessing trading strategies.

- This approach leads to actionable strategies, enabling profitable investment decisions and contributing to positive potential returns.

Portfolio Backtesting Vs. Forward Testing

Portfolio Backtesting

- Utilizes historical data to test a trading strategy.

- Evaluates past performance to assess strategy effectiveness and feasibility.

- Depends on historical market variables and price data.

- Does not involve any real financial risk.

- Provides a virtual environment for extensive testing across various historical scenarios.

- Traders avoid emotional stress and bias during testing.

- Offers insights into the theoretical performance of a strategy.

Forward Testing

- Applies trading strategies to portfolios and securities in real-time markets.

- Examines the strategy’s effectiveness in live market conditions.

- Relies on current, real market data in live trading situations.

- Carries the potential for financial losses if the strategy fails.

- Rapid scenario testing is more limited, as it depends on live market conditions.

- Traders experience emotional and psychological challenges in live trading.

- Offers deep insights into the adaptability and challenges of implementing the strategy in current market environments.