Table Of Contents

Pigouvian Tax Definition

A Pigouvian tax is a tax imposed by the government on economic activities, creating an adverse effect on society. Private individuals or businesses may perform such activities. This tax aims to induce the producers of negative externalities to decrease production to a level ideal for society.

A product’s final cost does not include the cost arising from socially harmful effects, leading to market inefficiency. According to economist Arthur C. Pigou, correcting the adverse impact is possible by imposing taxes equivalent to externalized costs. The taxes would equal the adverse side effects, reducing external costs.

Key Takeaways

- Pigouvian tax is a tax levied on market transactions that generate negative externalities. Its primary aim is to resist economic inefficiencies by redistributing the cost to the entity producing the externality.

- Tax levied on plastic bags, noise taxes, and carbon taxes are a few examples of Pigouvian tax.

- The term was coined after economist Arthur C. Pigouvian, a prominent contributor to the externality theory.

- It has a few disadvantages, but the Pigouvian tax's advantages outweigh them. For example, it generates revenue for the government and fosters economic efficiency.

Pigouvian Tax Explained

Pigouvian tax meaning refers to a tax placed by the government on goods generating socially harmful externalities. Externalities are activities that create an adverse effect in society but do not impact the individual or organization carrying out the activity. Environmental pollution and the sale of tobacco are two examples of negative externalities.

Under free market conditions, the adverse effects caused due to certain activities establish a market equilibrium when the social marginal benefit (SMB) equals the personal management cost (PMC). The latter is lower than SMC or social marginal cost owing to the additional costs generated by the economic activity. This market equilibrium is inefficient.

Ideally, a government levies the Pigouvian tax at an amount equal to the costs related to the negative externality. The supply of the product or service producing the adverse side effect will decrease when the government imposes the tax. As a result, the demand for the offering will rise while its market price will fall. This leads to the market equilibrium becoming socially efficient as the SMC will be equal to the PMC.

How To Calculate?

One can find it extremely challenging to calculate Pigouvian tax accurately. This is because the computation will not work the same in different situations. Theoretically, the tax amount must equal the net cost of the negative externality it tries to correct. As a result, the tax amount must equal the difference between the MPC or marginal private cost and the social cost at a certain production level.

Example

Suppose company GoodCrops, a pesticide manufacturer, poisoned the groundwater for seven years since its inception. In addition, the company emitted 150,000 gallons of waste during that timeframe. Because of this, the town nearest the organization’s manufacturing unit spent roughly $1.5 million cleaning up the groundwater.

The town levied a fine worth $1.5 million for the company’s past actions. Moreover, the town announced that it would impose a $20 Pigouvian tax per gallon of waste to cover the cost of the negative externality in the future.

Graph

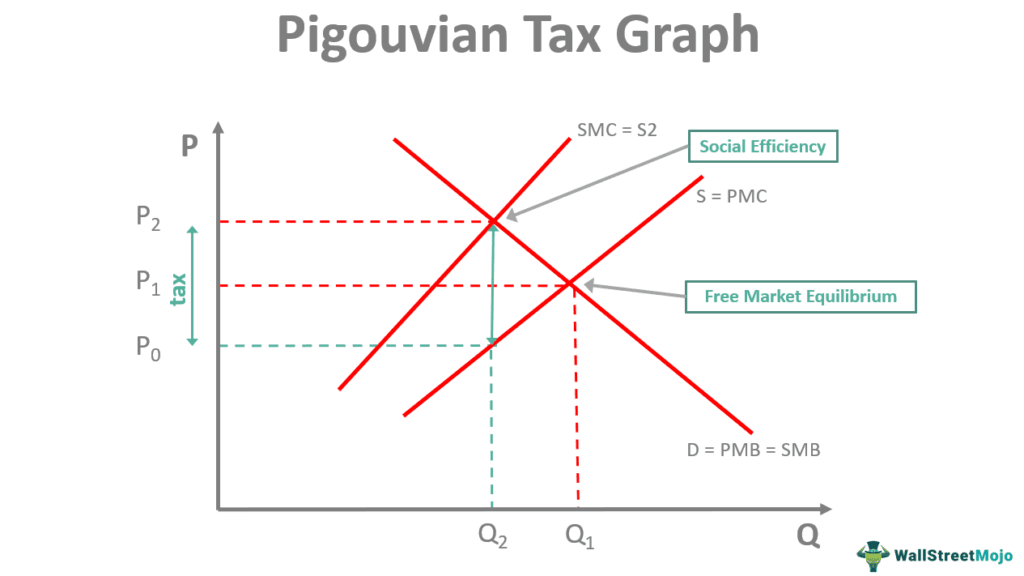

Let us look that this Pigouvian tax graph to know how the concept works.

One can go through these points to understand the graph.

- Under free market conditions, the equilibrium will be in Q1. At this output level, social efficiency will exist.

- In Q1, there was overconsumption. In other words, SMC is higher than SMB.

- Consumers will pay the SMC in full if the government levies a tax equal to the external marginal cost. As a result, demand will fall to Q2 from Q1, and at this output level, the market equilibrium will become socially efficient.

Advantages & Disadvantages

Let us look at the benefits and limitations of this tax.

#1 - Advantages

- Discourages Socially Harmful Activities: The imposition of this tax by the government effectively discourages economic activities leading to adverse side effects for society. For instance, introducing carbon taxes can put an organization producing high amounts of emission gases under tremendous pressure. As a result, the organization operates differently to produce lower amounts of emission gasses.

- A Source Of Revenue For The Government: Pigouvian tax is an additional source of revenue for a government. It can use the extra funds to challenge the externalities further.

- Encourages Market Efficiency: Another key advantage of the Pigouvian tax is that it fosters economic efficiency by including the extra costs imposed by the negative externalities.

#2 - Disadvantages

- Political Problems: The imposition of this tax is often associated with political issues. When a government tries to introduce this tax, political parties against such taxation may strongly oppose it. Hence, this tax may not be an ideal solution from a political standpoint.

- Difficult To Measure: Theoretically, the tax amount must equal the total cost created by the negative externality. That said, accurately measuring the cost is impossible in reality. As a result, this tax is not that effective in practice.

- Another important limitation of this tax is that it is regressive when it increases the burden on individuals with lower earnings compared to the ones with higher earnings.

Sin Tax vs Pigouvian Tax

There are some similarities between the sin tax and the Pigouvian tax, which often leads to confusion among individuals new to finance. However, knowing their critical differences is key to understanding the two concepts. So, this table highlights the distinct characteristics.

| Sin Tax | Pigouvian Tax |

| A government levies this tax to minimize negative internalities. | The purpose of imposing this tax is to reduce negative externalities. |

| Governments levy this tax on products or services to increase their price so that their demand decreases. | Private individuals and organizations pay this tax for the damage caused by the goods and services adversely affecting society. |