Table Of Contents

What Is Personal Monthly Budget Template?

A personal monthly budget template helps an individual plan for his finances and manage their expenses most effectively. It has to be made sure that the user doesn’t fall into any debt trap where his expenses are more than his income. Instead, they only adapt to a debt-oriented style of living.

This useful document of layout is a great tool to keep track of monthly finances and manage them so that there is financial stability and security. Any individual or business can use this process to effective make budget and keep track of all cash inflow and outflow and also plan for the future needs and investments.

Personal Monthly Budget Template Explained

The personal monthly budget template is complete layout of all the income and expenses that an individual or a business may maintain in order to keep track of all cash flows. This free personal monthly budget template acts as a guide to creating budgets and provisions for future expenses so that there is financial stability and efficiency.

While designing such a personal monthly budget template in excel, it is necessary to categorize the subheads in a way so that the user is easily able to understand the channels from and to which the funds are flowing. Better tracking creates transparency and clarity in the entire financial process and identifies flaws and ambiguity in the system. Any irregularity can be easily traced, and changes can be made immediately.

The layout can also be customized as per the needs and requirements of the user. Thus, essential details can be included in it, which may be used later for future reference. The extra columns, rows and notes add better clarity and provides more useful information.

This is also a great way to create a saving habit along with disciplined spending. In this manner, there is no overspending, and finances are easily managed along with keeping funds for emergency needs.

One can create this templet using a simple excel sheet of a google sheet that can be accesses from anywhere at any time.

It can be used for the purpose of maintaining income details, like various sources of income, amount earned, amount spent from it, and the type of expenses, which may be related to a utility like rent, electricity, telephone bills, water, or internet connections, transportation and entertainment expenses, like traveling, dining, etc. It can also be related to the management of funds for credit cards and loan repayments, insurance, and so on.

How To Make?

The personal monthly budget template in excel will capture all the available sources of income and expenses one needs to bear daily. Therefore, this template can help the user to keep track of his expenses and make sure they are spending within manageable limits where even if there is the utilization of debt that can be easily paid back with the income one generates.

Part #1

- This section of simple personal monthly budget template gives us a snapshot of the entire income figure, which one has. Henceforth, the expense figure is too. The net balance calculation happens here, which, if positive, means the person has enough income to capture all his expenses. On the other hand, if the amount here is negative, it should be the first trigger or warning where certainly the expenses are more than the income level of the concerned user.

- The projected balance gives us the final amount the user planned to save at the beginning and matches it accordingly with the month-end balance, which is nothing but the difference between income and expense.

Part #2

One may use this section of free personal monthly budget template to classify all an individual's income. It may consist of various income streams: salary, interest from savings, dividends, freelancing income, etc. All the monthly income stores and records in this segment, and a total is calculated based on the same.

Part #3

- This section is more like the necessary amenities needed to run a living. Here the user will capture the electricity bill, gas bill, and groceries. These expenses concern the individual's day-to-day living, and to some extent, the budget doesn't vary much every month.

- This field of simple personal monthly budget template has even any kind of home loan, property repair, and tax records. As stated above, these amounts tend to vary monthly to a minimal extent. The cost of electricity and water is also shown here as they belong to the basic amenity for living. Any furniture purchased or repairs made should also be captured in this section.

Part #4

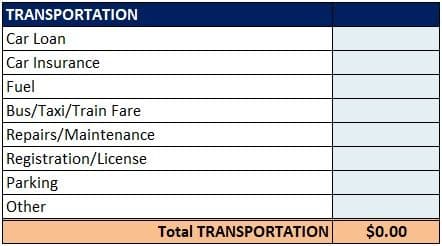

Commuting plays a vital role in everyone's living, and thus monthly, there should be a certain amount allocated towards this thing too. Either personal transport or public transport has a particular cost of usage. Fuel, in the case of private transportation, is the main category, which gets recorded here along with the parking charges and insurance premiums. Also, one should capture the cost of the ticket to utilize public transport here.

Part #5

Health and medical-related expenses are things from which no one can escape. This section primarily records all health-related expenses, including medical insurance premiums, doctors' fees, and medicines costs. The life insurance premium also gets captured here, along with the medical cost of pets and vets.

Part #6

Gifts and donations are common today as most people adhere to donations, which are used as an avenue to bring about tax savings. Also, the culture of gifting people as a token of memory or appreciation is a common thing that one should record here.

Part #7

- This section targets daily expenses like groceries, personal supplies, clothing, cleaning, salons, etc. Again, these expenses are part of the day-to-day lifestyle, and one cannot avoid them under any circumstances. Moreover, these expenses are common for having a healthy lifestyle. Therefore, one can conveniently allocate a set budget against them.

- This section also captures the cost of education or dining, especially when eating out. Having a pet in houses is very common, and this section also bears the cost of maintaining a pet.

Part #8

- Entertainment these days is part and parcel of every individual's lifestyle. From movies to OTT applications, one has to allocate a certain amount towards these attributes to enjoy a life apart from only working. Even books or the amount spent on activities related to one's hobbies are captured here.

- Any sports subscription fee or gadgets purchased records here. The most crucial cost spent on travel also gets captured here, which is a high cost for every household in the US/UK.

Part #9

Any amount spent toward saving-related or investment-related activities is captured here and recorded accordingly. For example, nowadays, everyone plans for retirement and another investment fund for a secure future. Thus, all these bear a monthly or yearly premium, which should be recorded here accordingly.

Part #10

Credit cards and line of credit is a common thing that every individual possesses these days. Therefore, credit card usage is widespread. Thus, one should also record to check the spending if someone is over-utilizing the credit card compared to the income earned.

Part #11

The cost of oversubscriptions records here. For example, this section captures the monthly spending on newspapers and magazines. Moreover, this personal budget template segment shows any dues or subscriptions to online platforms.

Part #12

Last and finally, one can put all the other miscellaneous expenses under this section. Even petty expenses like the cost of postage and couriers or other meager expenses can be recorded in this part and included in the total expense of the month.

Example

Let us assume that Mac is a teacher who runs a private tuition centre and teaches 40 kid of different age groups. Mac’s main source of income is the fees that he earns from teaching these kids. However, along with teaching he also owns a grocery shop which gives him substantial income each month. He has a group of suppliers from whom he purchases goods that are sold to individual customers. Thus, he has two income sources, which are grocery store and teaching.

But his expenses happen in many ways. He has to pay rent for the shop premises, electricity and utility charges, arrange for transportation for bringing goods to his store from suppliers, pay for the classroom arrangement in his tuition class in the form of furniture, stationery, storage, electricity, and other utility inside the classroom, etc. He also has to meet his expenses like medical, household, entertainment, etc.

Thus, as we see the above case, the best way to keep track of all the funds that are coming in and moving out is to use a personal monthly budget template that will have an all-in-one view of the above and help Mac to plan his financial calendar in a methodical and strategic manner.

How To Use?

This best personal monthly budget template is very useful in a number of ways.

- The template is very useful in managing day-to-day expenses compared to the overall income.

- A personal budget template helps an individual plan finances and manage their expenses most effectively.

- Here, it has to be made sure that the user doesn't fall into any debt trap where his expenses are more than income, and they only adapt to a debt-oriented style of living.

- Best personal monthly budget template creates a disciplined spending habit so that the user is able to restrict themselves from going overboard with spending and ensure there is no unnecessary deviation from the financial plans.

- It is a method that can be used to point out gaps and discrepancies in the financial process. This will help to rectify them as early as possible so that the gaps do not increase and become unmanageable in the future.

- Since spending is done as per the income and not going beyond it, there is always funds left for investment in useful investment sources that may yield good returns and multiply the existing fund balance, which can further be reinvested for future requirements.

Therefore, this template containing details related to income and expenses is a guide to planned savings and spending in order to maintain financial security and stability.