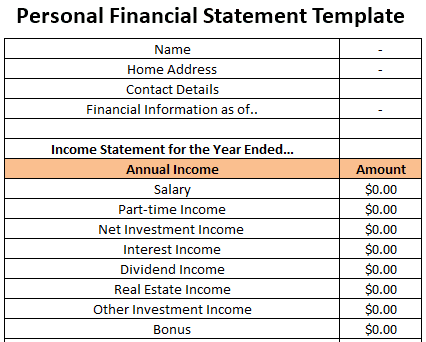

Free Personal Financial Statement Template

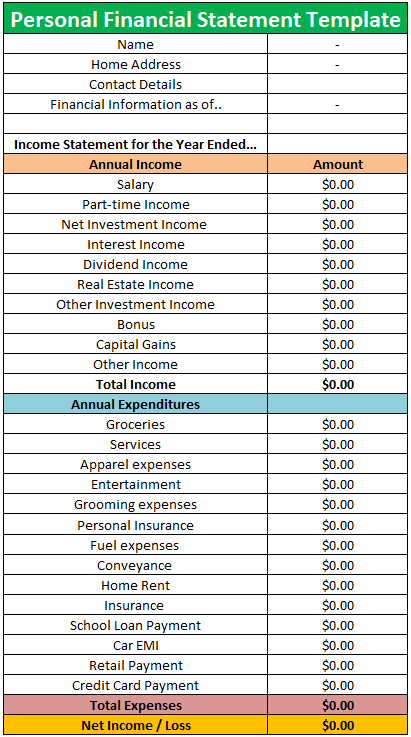

A personal financial statement template is a spreadsheet that summarises an individual’s financial situation over a specified period. This spreadsheet typically contains personal and financial information about an individual, such as his name, address, a breakdown of his total assets and liabilities, and his total income and expenses.

This template can be immensely useful in tracking the individual’s overall wealth, mostly used when an applicant seeks to apply for a bank loan. It comprises all the assets owned and liabilities owed by an individual. This statement may or may not include the income and expenses of an individual.

You are free to use this image on your website, templates, etc.. Please provide us with an attribution link.

Understanding Personal Finance Statement Template

The personal financial statement template comprises an individual’s income statement and balance sheet where all their expenses are borne. In addition, provides the income earned and the total of all their assets and liabilities. This template of an individual also provides their general personal information like name, address, contact details, etc.

#1 – Income Statement

- The income statement of an individual signifies the inflows and outflows of money. The results of an income statement could be either a net profit or a net loss.

- The net profit is earned by an individual when their total income exceeds their total expenses, while the net loss takes place when their total expenses exceed their total income. An income statement’s particulars are divided into two segments: income and expenses.

- The expenses and income of an individual are recorded when they take place, along with the value. The personal income statement of an individual is prepared to evaluate their financial results for a particular period.

- The personalized income statement reflects the total revenue generated and an individual’s expenses for a given period. The difference will be a net profit or a net loss.

- The positive numbers would mean net profits, while the negative numbers would ideally mean net losses. The income statement is a concept that states debit the expenses and credit the income earned.

- The revenue or income earned by an individual might come from their salary, part-time income, bonus, dividends income, net investment income, interest income, dividend income, other investment income, other income, real estate income, capital gains, and so on. The total of all this will be termed total income.

- On the other hand, an individual’s expenditures shall include services, groceries, personal insurance, grooming expenses, entertainment, conveyance expenses, fuel expenses, home rent, insurance, taxes, retail payment, credit card payment, car EMI, etc. The total of these annual expenditures would be a total expenditure. The difference between total expenses and income will be an individual’s net profit or a net loss.

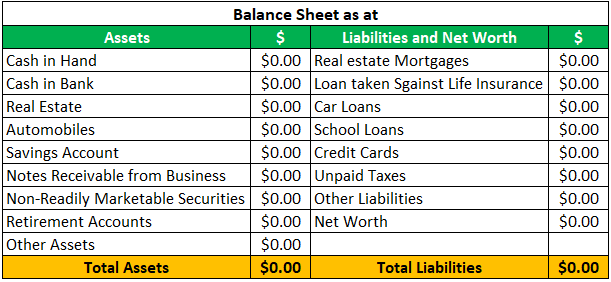

#2 – Personal Balance Sheet

- An individual’s balance sheet can be resourceful for learning about their current financial standing or well-being. The balance sheet of an individual has two particulars: assets and liabilities.

- The asset side is to record financial entries like cash in hand, cash in the bank, real estate, automobiles, savings accounts, notes receivable from business, retirement accounts, non-readily marketable securities, other assets, etc.

- The liabilities side of an individual’s balance sheet displays financial items like real estate mortgages, loans taken against mortgages, car loans, school loans, credit cards, unpaid taxes, other liabilities, etc.

- The total of all the assets and liabilities provided in an individual’s balance sheet must have equal balances. If the total assets and liabilities mismatch, then the individual will need to recheck if any entry has been missed or wrongly passed or if any amount is wrongly mentioned and accordingly redress the required changes.

How to use this Template?

- An individual provides the above template, which can be used by an individual to input all their details like name, contact number, address, period, etc. After filling up all the required information, an individual can fill in the actual amount borne as expenses and earned as an income in the income statement account.

- Once all the entries pass, they must total all the expenses and income and calculate the difference between them. Based on the results, they must determine whether they have earned a profit or a loss for that period. Once the net income/loss for the period ascertains, an individual must proceed with the balance sheet.

- They must provide the date and then fill up the actual figures of all sorts of their assets and liabilities. Once the figures are incorporated, they must tally the total assets with total liabilities and check whether the total of both balances is the same. If the balance does not tally, they must recheck and make the necessary rectifications to ensure that the balance sheet is accurate.

Financial statements have multiple aspects and a wider applicability. Therefore, it is better to widen the understanding of these topics as well through this derivatives course.