Mastering Personal Finance: Essential Budgeting Tips for Long-Term Wealth

Table of Contents

Introduction

Although people may earn a lot of money, they find it difficult to grow their wealth over time. In fact, some individuals often fail to meet certain expenses or get into financial trouble even if their income should be enough to have a sound financial position.

What does this tell us about us? Many people lack personal finance knowledge and money management skills. Yes, earning money is tough, but you can eventually get a job or start a small business and earn by selling any product.

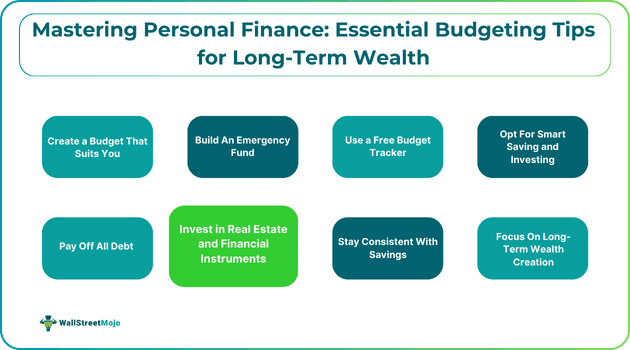

What is more crucial than earning is mastering the art of maintaining and regulating your finances in such a way that you are always secure. This is not something you can achieve in a week, a month, or a year. When we talk about long-term wealth, you have to not only become financially stable but also financially disciplined. With that note, let us elaboratively go on and understand some of the essential personal finance budgeting tips that will help you all to have a better financial future.

Tracking Your Expenses With A Free Budget Tracker

If you are struggling with tracking your budget and find writing every single expense down manually in a journal tedious, you can opt for a free budget tracker online. Yes, there are many good budget tracking tools available on the internet that you can choose from and start monitoring your expenses.

Building A Budget That Works For You

When you try to budget your finances, please do not go with the flow or follow the herd. Of course, there are different types of budgets that you can look for, but our pro tip would be to create a budget that works for you and not use any template that some economist or financial analyst introduced. However, it is highly possible that you can find a good fit among the different types of budgeting methods. Let us look at the different types of budgeting techniques.

Popular Budgeting Methods

Here are three main types of budgetary methods -

The 50/30/20 Rule

It simply divides your entire income into three categories where you use 50% for your needs, 30% for your wants, and then you allocate the remaining 20% to your savings. You have to be consistent with this rule to grow your savings.

Zero-Based Budget

In this method, every expense is justified. The budgeting begins at zero base, and every need and expense is analyzed, and according to this, the budget for a certain period is created. This means that according to the justified expenses, budgets can be higher or lower with no fixed markers.

The Envelope System

The envelope system divides the income into multiple cash envelopes, each representing a particular expense category. Once the cash in the envelope gets spent, no more spending on that particular category will be done until the next budget. This is a good budgeting method that assists people in controlling their spending.

Creating A Realistic Budget

Life is unpredictable. Any moment, a new expense can come your way and ruin your entire month’s budget. This is why you need to create a realistic budget that understands that unpredictability is a major element in financial planning and that anything can go wrong or bring in a new expense that simply cannot be postponed. Examples of unforeseen expenses include car repairs, medical expenses, urgent home repairs, and so on.

Remember, you are creating a budget for long-term wealth management, and you need to consider all factors and cover all scenarios that may materialize. In other words, always keep in mind to create a flexible yet comprehensive budget.

Smart Saving And Investing for Long-Term Wealth

Smart saving is a way of ensuring you save every month without compromising on your needs and important expenses. It is the key among many money management strategies. Through smart savings, you can unlock the door to long-term wealth. Smart saving goes hand in hand with investing and consistently contributing capital to your portfolio.

Types Of Savings Accounts

Here are different types of savings accounts that are part of smart budgeting techniques. You can choose any of these to save money:

Emergency Fund

An emergency fund is what keeps you financially stable on rainy days. It is considered one of the best personal finance budgeting tips that almost every financial advisor will offer. Create an emergency fund that will be separate from your savings and investments and keep it intact only to use in the case of emergencies.

Retirement Savings

Start planning for your retirement. There are a variety of retirement plans, investment options, and government schemes available that you can take a look at and choose. If you don’t like to try them, start investing in your portfolio with the mindset of retirement savings because the earlier you start, the more benefit you will get over time.

Short-Term Savings

Short-term savings are savings that are made to attain a particular goal, for example, buying a particular thing such as a car, television, or home appliance, or paying off a small debt. These savings are done ideally for one year. Most people do short-term savings to ensure they can buy things and upgrade their lifestyle without stopping their investments and taking money out of their other savings.

Investing For The Future

Once you are consistent with your savings, the next best move is to start investing. Here are some of the basic investments that you can choose:

Index Funds And ETFs

If you think you don’t have the ability and knowledge of capital markets, opt for mutual funds, exchange-traded funds (ETFs), and index funds. Plan for long-term wealth creation and invest consistently without failing. ETFs may cost you less compared to mutual funds and are more tax-efficient.

Stocks And Bonds

Explore the financial markets and create a trading account to start investing in equity. Make sure to read about businesses and keep yourself updated about stock market news. Get updates from different online platforms, join communities, and create a small portfolio based on thorough research and analysis concerning stocks. If you have a low risk appetite and are not too keen on investing in equity, you can try fixed-income securities, like bonds. However, investing in bonds would also require you to open a trading account and make buy-and-sell decisions based on market research and analysis.

Real Estate

Real estate is a good investment but demands higher capital. However, many new financial instruments allow you to invest in real estate with low capital. Real estate, again, is very important from a retirement perspective. Again, this is one of the best personal finance budgeting tips for individuals. Investments in real estate may require a long time to grow in value, but that’s the point of long-term investment and wealth creation.