Table Of Contents

What Is Personal Budget Template In Excel?

A Personal Budget is deciding our expenditures, and keeping our earnings in mind to make sure we don’t run into deficit. The Personal Budget Template in Excel helps users to create a template w.r.t the various expenses we may incur for a month, quarter, or a year. So that every month, we can keep track of the same without missing out on any parameters.

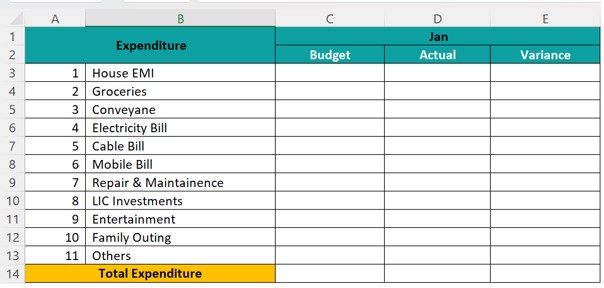

For example, we can create a Personal Budget Template with the parameters of our main expenses, as shown below.

It does not matter whether you manage a company’s financials or your personal home’s expenditure; making the budget ready for your spending for the year, quarter, or month is very important. In this article, we will learn to create a budget file template and a financial budget template.

Table of contents

- The Personal Budget Template in Excel is a customized template created according to our earnings, savings, and expenses. It helps us keep track of our needs and wants and the money spent on useful and unnecessary things, to remain debt-free.

- These templates are useful because we do not have to remember the parameters every month while preparing the budget. We just have to enter the amount spent for the particular month. The rest remains the same, such as the savings, income, etc.

- Since we have entered the formulas for the total amount spent, total income, and total savings, any modification in the calculation cell range will automatically reflect in the template. However, when we add/delete a row or a column, we must be careful because the formulas might not work. In such scenarios, we can make the formulas absolute or create a Dynamic table for the templates.

How To Create A Personal Budget Template In Excel?

The Excel sheet follows the steps below to create a personal expenses budget.

Budget is not all about our expenses. It is about our income too. Therefore, we must be perfectly aware of our income to plan our costs.

The steps to create a Personal Budget Template in Excel are as follows:

- First, we must not list the expenses but list the income sources. For example, it could be from salary, house rent, or a loan on interest.

Create this list given below in the Excel spreadsheet.

- We must apply the SUM function in the C8 cell to capture the total income.

Drag to all the remaining months.

- Now, apply a formula to capture variance. Apply this to all the months.

- Now, list all the expenditures.

- Apply the SUM formula for total expenditure in cell C22.

- Apply a formula for the “Variance” column for all the months.

- Now, our template is ready. We need to create a template for capturing daily expenditure details. Create a format as per the below image in a new sheet.

- After inserting headings, create a table by pressing the shortcut keys “Ctrl + T.”

Enter the cell range in the “Create Table” pop-up, as shown below.

The table is created, as shown below.

- Now, we have the expenditure template ready. To get a month, we need to put one formula: the TEXT formula.

- Create a dropdown list in Excel for “Expenses Head” from the result sheet. We are creating a dropdown list of expenses from the result sheet.

- Applying the SUMIFS function in Excel, we need to link the total expenses to a sheet.

Apply the formula for all the months. - Now, manually insert the income-expenditure numbers for all the months under the “Budget” column.

- Enter the monthly income in the “Actual” column according to the monthly earnings. If the income is per the budget, a variance will be zero.

- Now, enter the daily expenditure on the “Expenditure” list according to the headings formula, which will show the results in the result sheet.

It is the final result of income and expenditure.

For the demo, we have entered a few numbers. Download the attachment and start entering the real-time values.

Download Personal Budget Excel Template

- Now, we have learned the personal budget creation techniques. Similarly, we can create a simple corporate budget file.

- We have already made a template and downloaded personal and financial budget templates using the link below.

You can Download this Personal Budget Excel template here - Budget Excel Template

Important Things To Note

- We must always use table format for capturing data from another sheet to the main sheet. Excel tables do not require auto-updating of numbers when the data increases.

- We must know Excel’s SUMIF, SUMIFS, and SUM formula in excel to link the entry sheet data to the main sheet.

- A financial template needs regular updating of costs every month.

- According to the requirement, we can alter the template. Similarly, update the formula cells.

Frequently Asked Questions

Excel does not have inbuilt Budget templates. However, we can create the templates and save them for future use according to our requirements, such as,

• Personal Budget Template to track our earnings, savings, personal expenditures, etc.

• Financial Budget Template created by companies to keep track of the company’s profits, expenses, losses, and savings.

A few reasons why the Excel Personal Budget Template may not work are,

• The Excel file may be corrupted. Then, we must reinstall the application.

• We have entered formulas, but inserted columns or rows that might have moved the formulas outside the defined cell range.

We can use the Personal Budget Template in Excel further by breaking it down as follows:

• Household Expense Budget Template.

• Home Budget Template when you are building a house of your own.

• Wedding Budget Template if we or our children are getting married.

• Children Studies – School or College Budget Template.

• Retirement Budget Template

• Holiday Budget Template when we are planning a vacation that involves shopping.

We can use the Financial Budget Template in Excel further by breaking it down as follows:

• Company’s Infrastructure Expense Budget Template.

• Company’s Income and Stocks Template.

• Employee’s Salary Budget Template.

• Employee’s Service & Retirement Budget Template.

• Employee’s Vacations & Holiday Benefits Budget Template.

• Another name for Personal Budget Template is Expense Planning or Tracker. It also helps us to keep our finances in check for our monthly, quarterly, half-yearly, or yearly spending.

• We may have some templates available in Excel or some third-party websites, but it is always better to custom make as per our requirement and maintain fixed and variable expense templates, such as,

• Fixed Expenses include Monthly Loan amounts (car, home, personal) & mortgage remains constant month after month.

• Variable Expenses include Groceries, Home & utilities, Personal, and medical expenses & Entertainment that vary monthly according to our spending.

Recommended Articles

This article is a guide to Personal Budget Template in Excel. Here we create, customize budget template for our income, savings, expense, downloadable template. You may also learn more about Excel from the following articles: -

- VLOOKUP from Another Workbook

- Project Timeline in Excel

- Timeline in Excel

- Timesheet in Excel