Table Of Contents

What Are Performance Bonds?

Performance bonds are financial instruments used by the investor to have guaranteed the contractor's successful execution of a contract. Financial institutions, such as insurance companies and banks, are the issuers of these types of bonds. Often, performance bonds are curated for a period of twelve months, some also last for 36 months depending on the initial contract.

Also known as surety bonds or contract bonds, performance bonds are common in the construction and real estate industries. Contractors use it to reassure their clients that the project will be completed on time and meet all the standards. If they fail to do so due to unexpected events, such as insolvency and bankruptcy, these bonds will compensate the investor for the losses or damages incurred.

Key Takeaways

- A performance bond is a type of insurance that guarantees the investor that the contractor will carry out the terms of the contract. The investor might also receive payment for any losses or harm sustained due to the project's failure.

- They consist of three parties or entities – the principal (contractor), the obligee (customer), and the surety (financial institution).

- These are common in the construction and real estate industries working for government-related or private-sector projects.

- The cost of surety bonds is typically equivalent to 1% of the contract value. However, this rate can vary depending on financial stability.

How Do Performance Bonds Work?

A performance bond is a surety bond issued by a financial institution such as a bank or an insurance company to signify that the terms of a contract would be fulfilled by the contractor. These bonds usually last for twelve months or sometimes are extended for 36 months. It is also important o understand these bonds can be renewable or non-renewables depending on the terms of contract that is drafted at the initial stages of the agreement between the parties involved.

The history of performance bonds construction dates back to the ancient Roman and Persian empires. But it was in the 19th century, much-desired changes were made to them, allowing private contractors to place these bonds. The reason behind this was increasing cases of contractors failing to complete their projects or paying subcontractors that resulted in huge losses of funds for investors or taxpayers.

In its most basic form, performance bonds provide financial protection to a project owner when the contractor does not fulfill the duties agreed upon in the contract.

It is a common practice in public works. However, private-sector construction projects can also place these bonds. They guarantee the completion of the work by the contractor or compensate the investor for unfinished or low-quality work.

Many constructions and real estate projects use performance bonds to protect those interested in the project, including taxpayers and investors.

Components

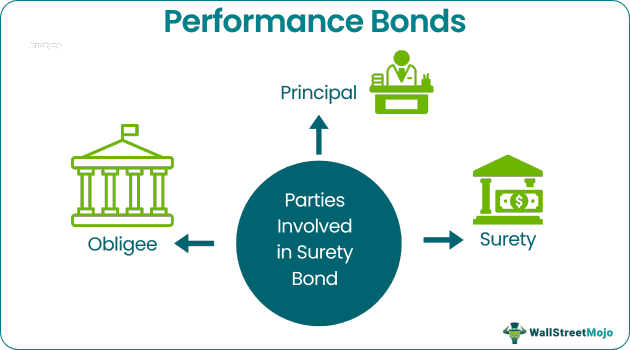

A performance bond consists of three separate entities or parties, including:

- Principal

- Obligee

- Surety

Here, the principal is the main person or party working on the project. In most cases, it could be a contractor that has agreed to the specifications outlined in the contract.

On the other hand, the obligee is the customer or party contracting their work to the principal. It can be an individual, government, or another type of entity.

The third party, the surety, is the financial institution, assuring the obligee that the principal will complete the work. The surety guarantees the obligee timely completion of the job by the principal, or they will intervene if necessary.

It all starts with multiple projects going through a bidding process and the winning project receiving the performance bond guaranteeing completion of the project. If the principal fails to uphold their part of the contract, the obligee can claim the bond.

When this happens, the surety will compensate the obligee for the bond amount or hire another contractor to finish the project. However, the financial institution will then require to be paid back by the principal.

The eligibility criteria for contractors to apply to these bonds include certified financial statements for two years, a copy of the contract, surety application, and collateral owned. Since many projects are complicated, performance bonds can give investors peace of mind and project performance security.

Regulations

In the US, all construction contracts issued by the federal government require performance bonds. The Miller Act mandates contractors to post surety bonds on any contract or project valuing $100,000 or more. Aside from protecting the federal government against losses incurred due to an unfinished project, this law ensures that contractors and subcontractors will get paid for their finished work. One can find the same obligations for construction projects that involve state officials under the Little Miller Act.

Examples

Let us understand the concept of performance bonds insurance and its basic intricacies with the help of a couple of examples.

#1 - Construction Contract

Performance bonds in construction ensure all project participants fulfill their obligations. For example, a state government hires an independent contractor to build a new public school building.

The project is valued well over the required $100,000 and will cost $10 million to complete. In this case, the project requires using a performance bond that the ABC Bank will issue.

- Principal = Independent Contractor

- Obligee = State Government

- Surety = ABC Bank

In this scenario, the independent contractor will have to fulfill its contract obligations, which will be to complete the building. The state government will also be required to meet the contract terms and pay the contractor once the work is complete.

ABC Bank is the surety and will be the performance bond issuer. It will ensure the work gets done and the contractor gets paid. If the contractor does not meet its expectations and fails to complete the project, ABC Bank will compensate the state government for the loss. Then, the bank will come after the contractor looking for reimbursement.

#2 - Real Estate Development

Performance bonds are also common in the real estate industry as they share many of the risks present in the construction industry. For example, Dave's Property Management Services hires a real estate developer to build a new office building for its real estate portfolio in downtown Manhattan, New York. As a result, the developer agrees to complete the work and gets a performance bond issued by the ABC Bank.

- Principal = Real estate developer

- Obligee = Dave’s Property Management Services

- Surety = ABC Bank

The contract outlines certain milestones of progress the developer will be making on the office buildings with specific due dates. The agreement also states that Dave's Property Management Services will pay the developer according to the progress it makes.

If the developer does not uphold its obligations in the contract, ABC Bank will have to step in. On the other hand, if Dave's Property Management Services does not pay the developer accordingly, ABC Bank will have to intervene.

Cost

The cost of performance bonds construction can fluctuate depending on various factors, such as the type of project, the contract value, and the contractor qualification. However, the price typically remains around 1% of the contract value. More significant contracts can sometimes cost 2% or higher, depending on the financial stability or creditworthiness of the contractor.

With that said, certain factors can influence the cost of a performance bond, such as:

- Financially stability of the business (creditworthiness)

- Project type (real estate, construction)

- Past project completions by the contractor

- Amount of work required

The bond issuing company, such as a bank, considers these factors to determine the risk of providing the bond to the contractor.

Performance Bonds vs Bank Guarantee

People often confuse performance bonds insurance with bank guarantees. Although both aim to protect contractors from certain risks and ensure that liabilities are met, they have significant differences, including:

Claims

The obligee can claim when the contractor fails to fulfill contractual obligations in performance bonds. After receiving the claim, the surety will have to provide the funds to pay the bond amount or find another contractor to complete the work.

In a bank guarantee, a claim states the party did not fulfill the contract accordingly. Therefore, the bank will have to pay the amount as it is "guaranteed."

Type of Contract

Performance bonds are contracts involving three entities – the obligee (customer assigning the job), the principal (contractor doing the job), and the surety (financial entity issuing the bond).

As the name implies, the bank guarantees that a borrower will fulfill its obligations to a contractor with bank guarantees. The bank will typically charge a fee for providing the services and taking on risks.

Purpose

Performance bonds protect a party against monetary losses caused by a contractor not meeting the obligations of a contract. The bank or other financial institution will pay the obligee when the contractor does not meet contract requirements or find a new contractor to complete the job.

On the other hand, a bank guarantee ensures a transaction is completed between two parties using a bank or other financial institutions' funds. Bank guarantees will require security or collateral for the risk associated.