Pennsylvania CPA Exam and License Requirements

Table Of Contents

Pennsylvania CPA Exam

Pennsylvania CPA (Certified Public Accountant) License is an official permit that accredits accountants in the state of Pennsylvania. You must fulfill Pennsylvania-specific exam, education, and other requirements to earn your initial CPA license.

Know that it is a one-tier state. Hence, no CPA certificate is issued upon completing the CPA Exam successfully. Instead, you obtain the accounting license straightaway after completing all the necessary prerequisites.

The Pennsylvania State Board of Accountancy (PSBOA) is responsible for the licensure and certification of CPAs. Moreover, the Keystone State also engages in the international administration of the CPA Exam program.

Now, let’s explore further the Pennsylvania CPA exam and license requirements.

| Particulars | Pennsylvania CPA Exam Requirements | Pennsylvania CPA License Requirements |

| Education | A Baccalaureate degree with 24 semester hours in specific subjects or 150 semester hours | 150 semester hours |

| Exam | Score a minimum of 75 points in each of the four exam sections | Score a minimum of 75 points in each of the four exam sections |

| Character References | Required | Not Required |

| Experience | Not Required | 1 year (1600 hours) |

| Minimum Age | 18 years | 18 years |

| Social Security Number | Not Required | Required |

Contents

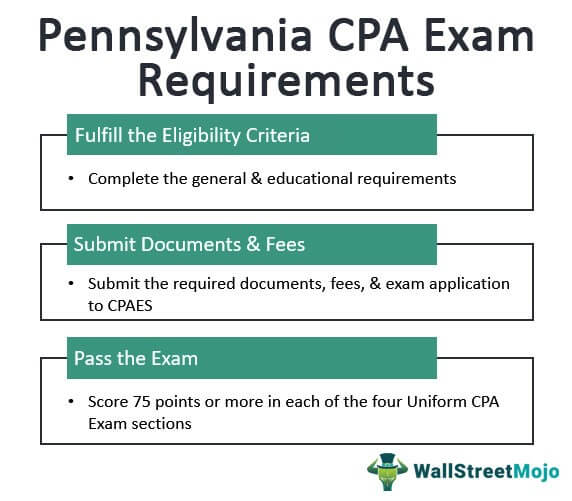

Pennsylvania CPA Exam Requirements

Pennsylvania CPA License Requirements

Pennsylvania CPA Exam Requirements

The Uniform CPA Exam is a 16-hour long computerized professional licensure test. It analyzes the candidate’s know-how and expertise required to perform as a CPA.

The American Institute of Certified Public Accountants (AICPA) and the National Association of State Boards of Public Accountancy (NASBA) are responsible for administering the test at designated Prometric centers worldwide.

Candidates must pass all four sections of the CPA exam within the rolling 18-month period. It starts from when you attempted the first passed section. Ensure to score a minimum of 75 points on a scale of 0-99 in each section.

- Financial Accounting & Reporting (FAR exam)

- Auditing & Attestation (AUD exam)

- Business Environment & Concepts (BEC exam)

- Regulation (REG exam)

The exam has five testlets with three different question types. These are multiple-choice questions (MCQs), task-based simulations (TBSs), and written communication tasks (WCTs). BEC includes WCTs along with MCQs and TBSs. Rest all sections have only MCQs and TBSs.

Eligibility Requirements

General Requirements

- Minimum age requirement – 18 years

- Character References – A CPA Exam applicant must prove good moral character by obtaining the signature of three individuals, including one CPA, on the exam application.

Education Requirements

Candidates must satisfy one of the following education requisites:

| Particulars | Education Requirements |

| Pathway 1 | A Baccalaureate degree from an institution accredited by a nationally recognized accrediting agency recognized by the U.S. Department of Education, including |

| Minimum 24 semester hours (not necessarily in undergraduate coursework) in the mentioned subjects: | Accounting & auditing |

| Finance | |

| Business law | |

| Macroeconomics | |

| Microeconomics | |

| Tax | |

| Pathway 2 | At least a Bachelor’s degree & 150 semester hours from an institution accredited by a nationally or regionally recognized accrediting agency recognized by the U.S. Department of Education, including |

| 24 semester hours (not necessarily in undergraduate/graduate coursework) in the mentioned subjects: | Accounting & auditing |

| Finance | |

| Business law | |

| Macroeconomics | |

| Microeconomics | |

| Tax | |

| 12 semester hours (not necessarily in undergraduate/graduate coursework) in the mentioned subjects: | Accounting |

| Auditing | |

| Tax |

Apply for the exam through CPA Examination Services (CPAES). Further information is specified on the NASBA portal.

Candidates may also utilize the NASBA Advisory Evaluation Service to recognize any academic loopholes in their documents before applying.

Fees

Initial candidates:

| Particulars | Amount | Total Fees |

| Application Fee | - | $105 |

| Examination Fees | - | - |

| AUD | $238.15 | - |

| BEC | $238.15 | - |

| FAR | $238.15 | - |

| REG | $238.15 | $952.6 |

| Total Fees | $952.6 | $1,057.6 |

Re-exam candidates:

| CPA Exam Sections | Exam Fees (per section) | Total Exam Fees (all sections) | Registration Fees | Total Fees |

| 4 exam sections | $238.15 | $904.6 | $105 | $1009.6 |

| 3 exam sections | $238.15 | $678.45 | $105 | $783.45 |

| 2 exam sections | $238.15 | $452.3 | $105 | $557.3 |

| 1 exam sections | $238.15 | $226.15 | $105 | $331.15 |

Under normal circumstances, you can’t withdraw from the CPA Exam or request a Notice-to-Schedule (NTS) extension. However, NASBA permits to request of an NTS extension or partial refund of the examination fees under extreme situations.

Please note that both application and examination fees are non-refundable. Also, your NTS is valid for only six months. So, sit for the applied exam section(s) within this period.

Required Documents

CPAES requires the submission of certain documents. These are mentioned in the image below.

The following are the approved evaluation agencies:

- NASBA International Evaluation Services (NIES)

- Foreign Academic Credentials Service, Inc

- Educational Credential Evaluators, Inc.

- Josef Silny & Associates, Inc.

Remember not to submit photocopies of transcripts as they are unofficial and unacceptable.

Pennsylvania CPA License Requirements

Pennsylvania CPA aspirants must:

- Be a minimum of 18 years

- Get a valid Social Security Number (if no SSN, then complete a waiver)

- Complete 150 semester hours

- Obtain one year of work experience

Know that you don’t have to attain U.S. citizenship or state residency.

Moreover, submit the licensure application, associated fees, and documents to PSBOA. Kindly visit the State Board website to know the complete process.

Education Requirements

Applicants must hold a bachelor’s degree or higher with 150 semester hours from a regionally or nationally recognized accrediting agency recognized by the U.S. Department of Education, including:

- 24 semester hours in the following subjects:

- Accounting & auditing

- Finance

- Business law

- Macroeconomics

- Microeconomics

- Tax

- 12 semester hours in the following subjects:

- Accounting

- Auditing

- Tax

The required semester hours in specific subjects may not necessarily be in undergraduate/graduate coursework. The content of the subjects must be to the satisfaction of the board.

Exam Requirements

You must complete the Uniform CPA Exam with at least 75 points in each section. Please note that you have a rolling 18-month period to pass the test. Refer to the Pennsylvania Exam Requirements section for more information.

Experience Requirements

Candidates must earn one year (1600 hours) of qualified employment within five years immediately preceding the date of licensure application. An active CPA must verify your work experience. You may not receive credit for attaining the required hours if obtained in less than 12 months.

Here are all the details.

| Acceptable Areas | Acceptable Services | Non-qualifying experience |

| Government | Accounting | Bookkeeping and paraprofessional work |

| Industry | Attest | Non-professional work experience, including recruiting, marketing, administration, etc. |

| Academia | Compilation | Non-verified experience |

| Public Practice | Management Advisory | - |

| - | Financial Advisory | - |

| - | Tax | - |

| - | Consulting | - |

Continuing Professional Education (CPE)

Pennsylvania CPAs must renew their accounting license every two years. They must gain the required 80 CPE credit hours through CPE providers approved by one of the following agencies:

- PSBOA

- National Registry of CPE Sponsors

- Accountancy regulatory body of a state allows the public accountancy practice under the substantial equivalency rule

- An institute accredited by a nationally recognized accrediting agency recognized by the U.S. Department of Education

Let’s check out all the details.

| Particulars | Requirements | |

| Renewal date for license | December 31 (every odd-numbered year) | |

| CPE reporting period | January 1-December 31 (every two-year ending on an odd-numbered year) | |

| CPE credit required | 80 hours every two years (20 hours annually) | |

| Ethics requirement | 4 hours | |

| Other requirements | 24 hours in accounting & auditing if engaged in attest services | |

| Credit limitations | Instruction | Maximum 40 hours |

| Published materials | Maximum 20 hours per instance on a self-declaration basis | |

| Maximum 40 hours for all publications combined | ||

| Published materials & self-study combined | Maximum 40 hours | |

| Self-study | Maximum 40 hours | |

| Only ½ of the total credit hours (if the delivery method is non-interactive) | ||

| CPE credit calculation | University/College credit | 1 semester hour = 15 CPE hours |

| 1 quarter hour = 10 CPE hours | ||

| Instruction | 50 minutes of presentation = 3 CPE | |

| Partial credit | Permitted in quarter hour increments after the first full hour of credit is acquired |

As per the U.S. Bureau of Labor Statistics, Pennsylvania has one of the highest employment levels for accountants and auditors. It offers an average hourly wage of $37.41 and an annual average pay of $77,810. Also, the state provides 50,240 job opportunities for accountants.

Undoubtedly, Pennsylvania is a gateway to numerous career opportunities for CPAs. So, now that you know what it takes to achieve the title in Pennsylvania, start fulfilling the state-specific license requirements and prepping up for the CPA Exam as soon as possible. Learn more about CPEs for CPA

Pennsylvania Exam Information & Resources

1. Pennsylvania State Board of Accountancy (https://www.dos.pa.gov/ProfessionalLicensing/BoardsCommissions/Accountancy/)

Mailing Address

State Board of Accountancy

P.O. Box 2649, Harrisburg, PA 17105-2649

Physical Address

One Penn Centre, 2601 N. 3rd Street

Harrisburg, PA 17110

Toll-Free: 1-833-DOS-BPOA

Ph: (717)783-1404

Fax: (717) 705-5540

Email: St-Accountancy@pa.gov

2. Pennsylvania Institute of CPAs

1801 Market St, Ste 2400, Philadelphia, PA 19103

Ph: 1-215-496-9272

3. NASBA (https://nasba.org/)

150 Fourth Ave. North

Suite 700

Nashville, TN 37219-2417

Tel: 615-880-4200

Fax: 615-880-4290

CPAES

800-CPA-EXAM (800-272-3926)

International: 615-880-4250

Email: cpaexam@nasba.org

4. AICPA (https://www.aicpa.org/)

220 Leigh Farm Road

Durham, NC 27707-8110

Fax: 1.800.362.5066

Ph: 1.888.777.7077

Recommended Articles

This article is a guide to Pennsylvania CPA Exam & License Requirements. Here we discuss all aspects of a Pennsylvania CPA license like eligibility, fees, etc. You may also have a look at the below articles to compare CPA with other examinations –