Table Of Contents

Penalty Clause Meaning

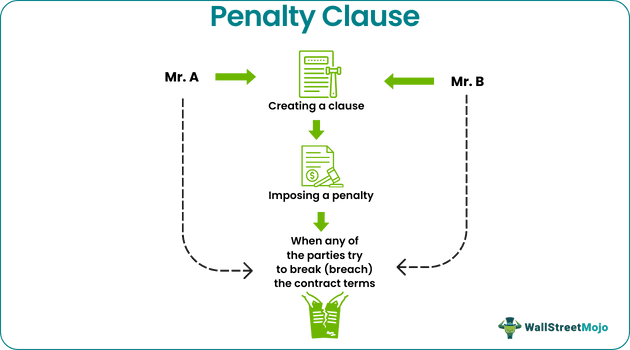

The penalty clause imposes a fine on a guilty party for breaching contractual terms. It comes under the purview of contract law. The clause compensates the suffering party for incurred damages. The agreement must be deemed valid to impose fines and contain the penalty clause. A penalty clause aims to impose a financial consequence on a party in case of a breach of contract.

The penalty clause contract is financial, intentional, and incentive in nature. This caveat is applied in four major areas: employment, commercial contracts, construction, and mortgage contracts. In most clauses, the penalty amount is predetermined.

Key Takeaways

- A penalty clause is a penalty or fine to be paid to the suffering party in case of a contract breach. The objective behind such a caveat is to discourage parties from breaching contractual terms.

- The caveat can only be exercised upon non-completion, partial completion, or negligence in carrying out contractual terms. It cannot be used to punish poor performance.

- Employers include penalty caveats to prevent employees from leaving before the end of contracts.

- A court of law imposes reasonable penalties; the fine cannot be excessive. The penalty amount depends on the damages incurred.

Penalty Clause Explained

The penalty clause remedies contract breaches by facilitating compensation to the suffering party. This practice can be traced back to the 18th century. However, under contract law, the penalty was first enforced in 1914—Dunlop Pneumatic Tyre Co Ltd vs. New Garage & Motor Co Ltd.

When the penalty caveat is included in a contract, both parties try not to violate contract terms. However, the actual disbursement of compensation is a complicated process involving court proceedings.

According to Second Restatement of Contracts, Section 356, the penalty clause is a medium through which parties claim compensation for the non-execution of any contractual terms. The penalty amount is predetermined—upon mutual agreement of both parties. Also, the validity of the penalty caveat depends on the agreement's validity. If the breaching party fails to pay the compensation, an additional late delivery penalty is imposed on them.

However, in certain cases, the enforceability of the penalty clause contract depends on certain obligations. Let us look at them:

- The penalty is enforceable if the clause is a secondary obligation, not a primary.

- The innocent or suffering party should have a "legit" interest in the contract. For example, in a house contract, the suffering party must have hired an architect, electrician, and painter for the house. Here, the party had already developed an interest in the house.

- The charged penalty should be reasonable—should not be excessive.

Types

Let us look at penalty clause types:

#1 - Penalty Caveat In Employment Contracts

As employment is a fixed-term contract, it also includes an indefinite-term or contractual basis. However, employers risk employees leaving the organization within the contract period. Thus, employers include a penalty caveat in the employment contract.

If an employee terminates the contract before completion, they must pay the employer a fine.

#2 - Penalty Caveat In Commercial Contracts

In commercial contracts, the defaulting party must pay the penalty to the suffering party. Such caveats are common in shareholder agreements and acquisition deal structures.

A breach refers to partial negligence, complete negligence, or incomplete performance. Similarly, in case of delay, the employer can claim a late delivery penalty from a contractor. However, the employer cannot claim a penalty for poor performance.

#3 - Penalty Caveat In Construction Contracts

Penalties in construction contracts were unenforceable until the amendments. Now, the suffering party can claim a penalty to cover the damages. For example, construction contracts often face liquidated damages. Here, the penalty amount is calculated based on the damages.

#4 - Penalty Caveat In Mortgages

Lenders earn from periodic interests. On the one hand, lenders are exposed to default risks. At the opposite end of the spectrum, if a borrower repays too early, the lender earns very little income from interest. To prevent this, mortgage lenders impose a prepayment penalty on homeowners. This way, early repayments are discouraged.

Examples

Let us look at penalty clause examples to understand contract law better.

Example #1

Chevelle and Michael are business partners—in the cotton and textile business. As per the agreement, Michael buys five bales of cotton lint from Chevelle. However, Chevelle fails to deliver within the stipulated time. She completes only a part of the quantity ordered.

Michel seeks remedy from a court of law—he exercises the penalty caveat. Upon further investigation, a penalty caveat was indeed found in the agreement. Accordingly, the court orders Chevelle to either pay the mentioned penalty or supply five bales of cotton lint immediately.

Example #2

In November 2022, the Competition Commission of India (CCI) activated a penalty clause of $936 million on technology giant Google LLC. This is because Google was guilty of imposing in-house payment and billing systems for paid apps and in-app purchases.

Penalty Clause vs Liquidated Damages

Both penalty caveats and liquidated damage caveats are compensations. But there is a huge difference between them. The penalty caveat is exercised when a party breaches or violates contractual terms; the guilty party must pay a fine.

For example, let us consider Mr. A, who commits a mistake; he sells goods to Mr. C instead of Mr. B. Here, the penalty caveat is exercised, and Mr. A is liable to pay the penalty to Mr. B. In contrast, liquidated damages are predetermined.

Now, let us look at a penalty clause vs. liquidated damages comparison chart to distinguish between the two:

| Penalty Clause | Liquidated Damages | |

| Meaning | A clause where the defaulter has to pay compensation to the suffering party. | Fair compensation is paid to the other party for any future breaches. The penalty is predetermined. |

| Purpose | To punish the debtor for breaching or terminating any contractual terms. | To compensate for the losses caused by contract violations. |

| Loss calculation | No estimation | Here, the extent of damage is predetermined. The guilty party is not liable to pay fines exceeding predetermined amounts. |

| Payment terms | Pay the actual amount of the penalty. | Paying the damage amount within the pre-specified limit. |

Frequently Asked Questions (FAQs)

It depends on the type of agreement and the parties involved. However, it is important to note that including such clauses can hinder business relationships (especially for startups). Otherwise, such a caveat can protect the party from unforeseen circumstances.

Exercising the clause depends on the terms and events incurred during the contract period. Penalty caveats cannot be termed unenforceable or invalid. Certain conditions, like the debtor's incompetence in performing the obligation or poor performance, are not covered under this clause. Invalid or expired contracts attract no penalty.

The suffering party benefits from penalty caveats. For example, if the opposite party is guilty of contract violation, they are liable to pay a fine.