Table of Contents

Free Payslip Template

Every organization issues payslips or salary slips to its employees whenever the latter’s salary for the period is cleared by the former. A payslip details a detailed breakdown of an employee’s earnings and deductions. Companies can now also use this template for designing payslips for their employees. As a result, they can save a lot of time by offering the necessary information and skipping on information that is just not required.

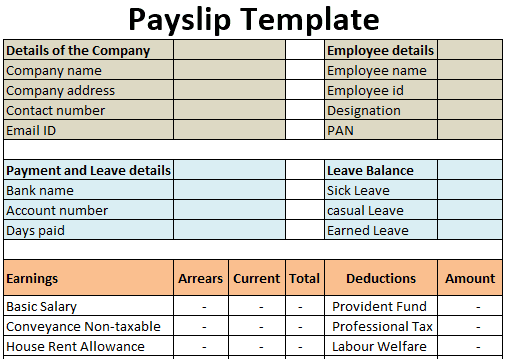

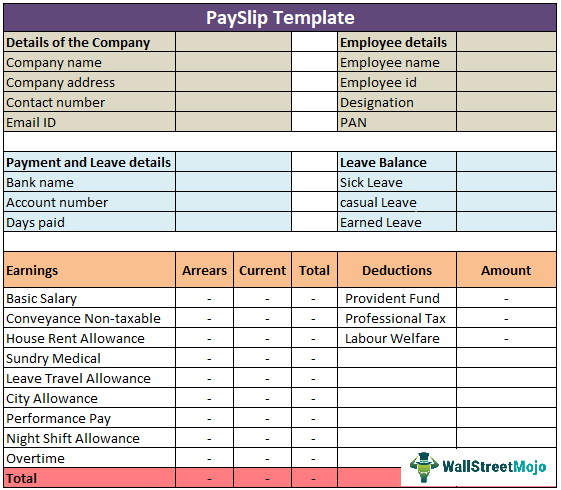

An ideal payslip template includes the company logo, company details, month and year (for which the payslip document is prepared), employee name, employee ID, designation, PAN, bank name and account number, days paid, leave balance concerning earned leaves, casual leaves and sick leaves, location details, earnings (basic salary, conveyance non-taxable, house rent allowance, city allowance, overtime, performance pay, sundry medical, night shift allowance, etc.) and deductions (provident fund, professional tax, and labor welfare).

About the Payslip Template

- A payslip is more or less a comprehensive document that projects the calculation of an employee’s salary for the month or a designated period, making it easy for the employee to evaluate his various types of allowances, deductions, overtime, arrears, and tax as well.

- It is highly resourceful for organizations as it can help them save a lot of time compared to creating normal payslips. It is a comprehensive document requiring an employer to offer information instead of wasting time by providing unnecessary information.

Elements

The elements and particulars are attached in this article as discussed:

Part #1 – Company Details:

The payslip template even offers the users the segment where they can fill up their company’s details, such as its name and address.

Part #2 – Time Frame:

The time frame segment enables the employers to mention the month and the year for which one must pay the salary. However, it requires generating the payslip.

Part #3 – Employee Details:

The employee segment will enable the users to mention the details of the employee for whom the current payslip was processed. Of course, the users will need to provide employees’ details like their full name, employee id, designation, and PAN number.

Part #4 – Bank Details:

The bank details segment allows employers to mention the bank details of their employees in which the latter is supposed to receive their salary. These details must include the bank’s name and account number.

Part #5 – A number of days paid and unused leave balances:

One must mention the number of days the employee paid and the current status of unused leave balances in earned, sick, and casual leaves.

Part #6 – Location Details:

The location segment enables the users to provide the location details of the company. However, this segment is optional and can be skipped.

Part #7 – Earnings:

The earnings segment offers an extensive breakdown concerning overtime, house rent allowances, night shift allowances, basic salary, sundry medical, conveyance non-taxable, city allowance, performance pay, etc. The earnings segment can divide into arrears and current. First, one must note the arrears balance concerning any earnings, which also applies to current balances. The total of both arrears and current balance will be the total earnings inclusive of deductions, which it will do in the next step.

Part #8 – Deductions:

The deductions section will display a provident fund, professional tax, labor welfare, and other deductions. The sum of all these deductions shall be the total deductions.

Part #9 – Net Pay:

One can further calculate the net pay for the month by taking the total earnings and deducting total deductions from the same.

How to Use this Template?

There is no hard and fast rule for using this template. The users can customize the attached template according to their needs, requirements, convenience, and suitability. The users of this template are supposedly employers. Below are the steps that one can follow while using this template:

- The users must start by downloading the template and filling up all the details as and whenever asked.

- The users will need to proceed with providing their company’s logo, name, and address.

- In the next step, the employers must mention the month and year they generated the template.

- The employers will then need to provide the employee’s details, such as their name, employee ID, designation, and PAN number.

- The users will then need to fill up the employee’s bank details, like their name and account number.

- In the next step, the users will need to mention the number of days based on the salary one must calculate and pay and the remaining leave balances. The users might also need to mention the location details. However, one can skip this segment.

- The users must mention all the employee earnings and will also need to mention the deductions on their salary. The employers will also need to ascertain the employee’s total earnings and deductions.

- In the last step, the users will need to determine the total pay for the employee by reducing total deductions from total earnings.