Table Of Contents

What Is The Payroll Formula?

The payroll formula, calculated differently from country to country, states a process through which the net pay of the employee or worker is being calculated by deducting federal charges (such as income taxes) and all other expenses( such as social security, Medicare, etc.) from the gross earnings.

Formula

Net Amount Payable to Employee = Gross Pay - Total Withholdings

- The payroll formula is used by employers to determine the net pay of an employee or worker after deducting various withholdings. The general formula for calculating net pay in payroll is :

Net Pay = Gross Pay - Total Withholdings.

- Payroll formulas may vary from country to country, and employers need to comply with the payroll calculation methods and deductions as per the relevant laws and regulations in their jurisdiction. For example, international payroll software can standardize and simplify compliance across borders, while HR payroll software in India can automate statutory requirements like PF, ESI, and TDS.

- Accurate and timely payroll calculation and compliance with deductions are crucial to ensure employees receive their net pay accurately and on time.

Payroll Calculation

#1 - Types of Payroll

There are multiple types of employee and for that different technique of payroll calculation method is followed:

- Payroll for hourly workers - To calculate the pay of hourly workers, a few documents such as a timecard or timesheet are required. Timecard or timesheet is a piece of relevant information for payroll calculation as it contains the required details of hours worked by an employee or worker. To calculate the payroll based on hourly requirements, the organization also needs the rate assigned to the various classes of employees or workers. For example: if the worker has worked 38 hrs. A week and the payment schedule is for weekly payments with a rate of $12 an hour; the calculation would be 38 hrs. * 1 week * $12 per hour = $146.

- Payroll Calculation for Salaried Workers - The U.S Department of Labor states that employees with a fixed salary are paid in terms of salary as a fixed amount. Generally, the fixed pay receiver is not entitled to overtime bonuses. Also, the DOL( Dept. of Labor) has specified criteria for calculating overtime payments, so it is better to comply with the criteria laid by DOL and work out the salary payments. For example, an employee has an annual salary of $84000 and is being paid semi-monthly. Calculate the pay per salary for that particular person. $84,000 / 24 = $3500.

#2 - Deductions

There are multiple mandatory and voluntary deductions from the worker’s salary for federal reserves. The federal structure uses the amount for multiple causes ranging from social security to medical expenses.

- Income Taxes - The employers need to deduct and withhold the portion of the employees’ wages as an income tax to be submitted and paid to the federal agencies. Forms like IRS W-4 or tax tables in IRS Circular E or Employer's Tax guide help the employee and employer deduct taxes as per the requisite earning structure. The employee fills up a form with all the relevant details such as the amount required to be claimed by them, marital status, and other required information for filing taxes with statutory agencies. The income tax varies for different salary brackets and keeps increasing with the increase in the earning slabs.

- Social Security - An another deduction from payroll, these deductions are collected by the Federal Insurance Contributions Act (FICA) to cater to social security needs such as disability programs, retirement benefits, etc. It has a wage-based limit and other rates that keep changing from time to time..

- Medicare - It is an additional payroll tax deduction that is mandatory, and unlike social security taxes, there is no base limit for deducting the Medicare taxes. The amount deducted is utilized by state and federal insurance and medical services.

#3 - Submission of Withheld Taxes

An employer also has to regularly deposit the withheld amount with federal agencies’ data. In addition, the employers are required to report and submit to Federal Unemployment Taxes (FUTA) which also takes care of unemployment compensation issues. Finally, as per the IRS’s guidelines, an employer must submit details and withhold taxes every quarter in Form 941 (Employer’s Quarterly Federal Tax Return).

Examples

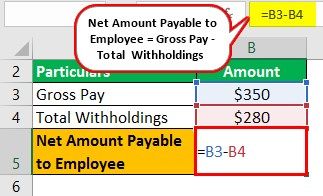

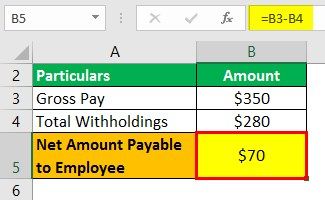

Example #1

Calculate the Net amount payable to John, a factory worker, if his Gross pay is $350 per week and Total withholdings are $280.

Solution

Below is the given information –

Calculation of net amount payable to the employee can be done as follows,

- =$350 - $280

Net Amount Payable to the Employee will be -

- =$70

So, the Net pay available to John is $70 per week.

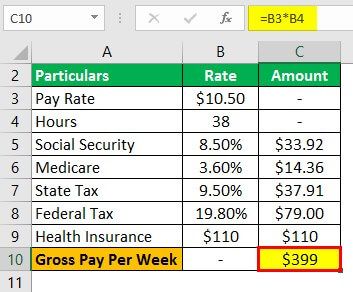

Example #2

Tony is employed in a grocery store in the U.S and gets a salary of $10.50 per hour. First, calculate the total amount to be deducted and withheld under the payroll formula. The health insurance rate is every week. Next, calculate the Net amount receivable to Tony; we need to make certain adjustments for taxes and other deductions.

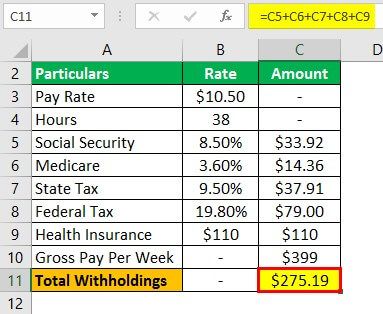

Solution

Below is the given information –

Calculation of Gross Pay Per Week -

- =$10.50 * 38

- =$399

Calculation of Total Withholdings -

- =$33.92 + $14.36 + $37.91 + $79.00 + $110

- =$275.19

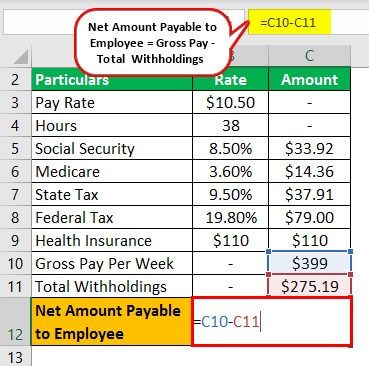

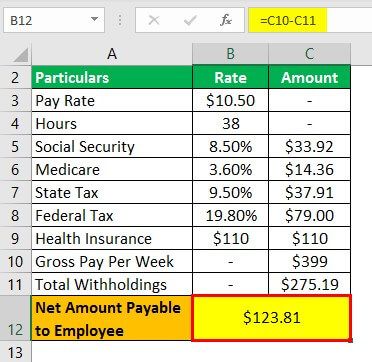

Calculation of net amount payable to the employee can be done as follows,

- =$399 - $275.19

Net Amount Payable to the Employee will be -

- =$123.81

It indicates that out of total earnings or gross pay of $399, only $123.81 would be received by Tony after all deductions.

Example #3

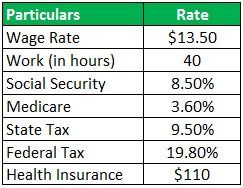

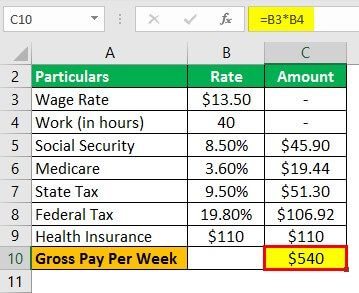

Alisha is hired by a California salon and gets a $13.50 an hour wage. Under the payroll formula, determine the total sum to be deducted and withheld. The cost of health insurance is chargeable every week.

Solution

Below is the given information –

Calculation of Gross Pay Per Week -

- =$13.50 * 40

- =$540

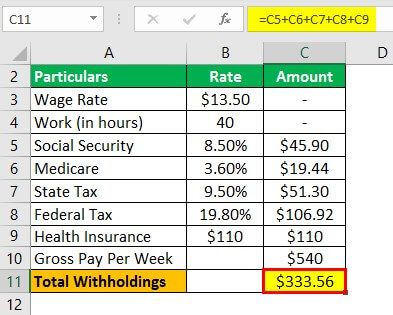

Calculation of Total Withholdings -

- =$45.90 + 19.44 + 51.30 + 106.92 + $110

- =$333.56

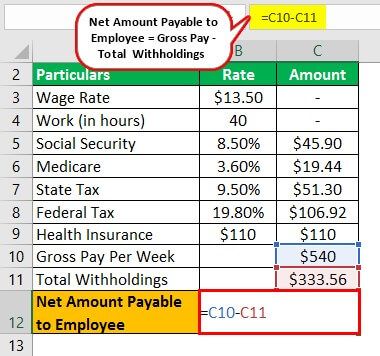

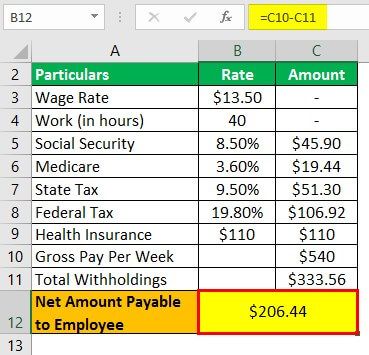

Calculation of net amount payable to the employee can be done as follows,

- =$540 - $ 333.56

Net Amount Payable to the Employee will be -

- =$206.44

It indicates that out of total earning or gross pay of $399, only $206.44 would be received by the Alisha after all deductions.