Table Of Contents

What Is A Payment Management System?

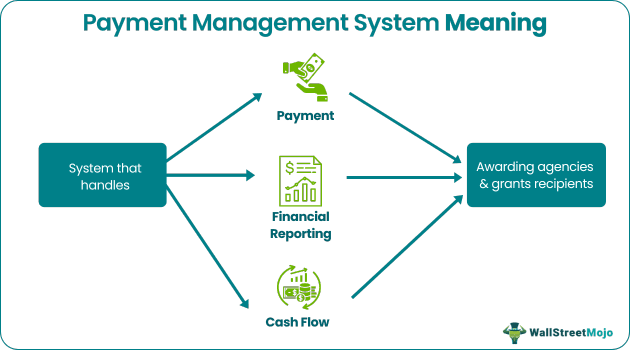

A Payment Management System (PMS) refers to a centralized system facilitating management of cash flow, financial reporting and payments related to awarding agencies and grant recipients. This platform helps expedite the cash flow, ensures financial integrity, and promotes operational efficiencies of the federal government.

It saves time and effort by automating manual tasks. A payment management system reduces discrepancies and errors in payments while giving real-time insights into the financial performance and cash flow. It lowers administrative expenses and processing fees with increased security for sensitive financial data. Businesses use it to manage processes related to accounts payable and receivable.

Key Takeaways

- A Payment Management System (PMS) streamlines cash flow, financial reporting, and payments for awarding agencies and grant recipients, enhancing financial integrity and operational effectiveness within the federal government.

- It must offer secure payment processing, versatile options, a user-friendly interface, support, integration, scalability, and robust financial controls.

- PMS needs invoicing, payment processing, discounts, billing options, centralized payments, API integration, and remote accessibility for effective operation.

- The PMS offers advantages by streamlining payment processes but poses challenges in integrating with current payment systems.

Payment Management System Explained

A payment management system is a software platform made to streamline and automate the payment processes right from invoice processing to approval to payment execution and reconciliation. Hence, it reduces manual interventions and error risks by integrating numerous payment processes. One also gets live customer support with multiple options for choosing payment methods.

It gives grant recipients a single platform for fund transfer and cash disbursement management. The payment management system offers an uninterrupted payment management experience with a secured payment management system login and organized processing. Another implacability is its accurate financial reporting, faster cash flow, and strengthened operational efficiency related to grant recipients and government agencies. Its effectiveness relies on user-friendly interfaces, robust security measures, responsive customer support, efficient payment processing, scalability, and strong integration capabilities.

As a result, it caters easily to various special needs of governments and businesses. A crucial aspect of PMS, B2B Accounts Payable Automation, further enhances efficiency and accuracy in financial transactions. It has driven transformations at its core in the financial world through secured payments and enhanced transactional efficiency. Additionally, it has led to quicker financial operations, facilitating the wider acceptance of digital payment systems.

PMS solutions like the HHS and Textura CPM payment management systems offer specific functionalities for different sectors. The HHS Payment Management System provides comprehensive cash management services and grant accounting support. And, Textura CPM Payment Management System ensures proficient construction payment management, including lien waiver collection and compliance.

PMS offers a comprehensive and versatile solution for businesses and governments, streamlining payment processes, improving financial reporting, and driving overall efficiency.

Features

An effective and optimized PMS must prove beneficial to an institution on an overall basis. Ideally, it must contain the following features:

- Invoicing and Billing: Facilitates the productive generation and administration of transaction invoices.

- Payment Processing: Reduces human interaction and mistakes by enabling electronic payment execution and tracking.

- Discounts and Refunds: Gives the system the ability to handle refunds and give discounts effectively.

- Billing Flexibility: Provides a range of payment types with distinct billing choices and structures.

- Centralized Payment System: Serves as a single platform for managing cash and award payments.

- API Integration: Gives companies access to a Payments API so they may integrate and handle payments.

- Remote Accessibility: Improves operational flexibility by enabling the administration of remote property, booking, and payment activities.

Things To Look for in a Payment Management System

Before installing any PMS, one must check for the following capabilities:

- Payment Processing: A system should safely and smoothly handle different payment methods.

- Security Measures: To protect transactions, prioritize PCI DSS compliance, tokenization, and strong risk management features.

- Versatile Payment Options: For flexibility, the system should provide a variety of payment options and enable several payment gateways.

- User-Friendly Interface: Both users and administrators may perform payment activities more easily and intuitively thanks to an intuitive interface.

- Customer Support: Having access to dependable and accommodating customer service guarantees timely assistance in the event of any problems or inquiries.

- Integration Capabilities: For productive operations, take into consideration solutions that provide smooth API connection with other corporate applications.

- Scalability: Scalability to manage rising transaction volumes and corporate expansions is a requirement for the system to support growth.

Besides these, other things to look for in a PMS are - generating reports, eliminating duplicate entries, customizing configurable systems, securing funding request transfers, having customizable systems, and implementing effective financial internal controls.

Examples

Let us use a few examples to understand the topic.

Example #1

International Bank selected CheckPlus Financial software as the payment management solution for its Jamaica branch. The multinational bank with over 120 years of experience operating in 25 countries, through this software integration, aimed to ensure the checks from several accounts in various currencies and formats are processed by the bank's OPIC system. The bank has over two million clients and wants to enhance payroll and accounts payable processes by utilizing CheckPlus Financial to centralize payments.

The bank had previously utilized pre-printed checks. However, after implementing CheckPlus Financial and switching to secure blank check stock, there have been considerable cost reductions, and the checks now appear professional. Furthermore, the bank has included OM Plus Delivery Manager software to enhance the efficiency of its check printing processes, guaranteeing appropriate connectivity with equipment to ensure check printing of every check. Cost reductions, increased output, and greater security and dependability in payment processing processes have all resulted from the deployment.

Example #2

Suppose in the bustling city of Louisville, renowned researcher Dr. Emily Park secured a grant from Luminary Sciences Inc. to study bioenergy. Using a payment management system, Luminary Sciences disbursed $100,000 to Dr. Park's firm, BrightBio Labs. However, after completing her research ahead of schedule, Dr. Park had $20,000 remaining. Following PMS guidelines, she returned the excess funds, ensuring compliance.

The system facilitated a continuous process, transparently recording the return to Luminary Sciences, strengthening their partnership. This displayed the effectiveness of PMS in managing grant finances and fostering trust between researchers and funding entities.

Advantages And Disadvantages

The table below lists the main advantages and disadvantages of the PMS:

| Advantages | Disadvantages |

|---|---|

| Streamlines payment processes. | Poses difficulty in integrating with existing payment systems. |

| Improves cash visibility. | High cost of initial setup |

| Payables and disbursements are tracked in real-time. | Becomes vulnerable to online hacking threats. |

| Makes financial management easier. | The system may face potential downtime. |

| Offers varied payment systems | Does not suit hourly staff |

| Eliminates duplicate entries | Lesser satisfied employee |

| Live customer support | Has three paycheck months |

| Effective plus accurate payment systems | Gives technical problems. |

Frequently Asked Questions (FAQs)

Textura Payment Management's cloud-based technology was created specifically for the construction sector. The whole payment process—including billing, payment, and lien waiver management—is automated and streamlined by it.

Funds are returned via the Payment Management System for unused grants, ensuring accurate accounting and grant compliance through precise guidance.

Payment management systems have several advantages, such as:

Enhanced productivity: Reduce time and effort by automating manual procedures.

Increased accuracy: Lessens inaccuracies and disparities in payments.

Improved visibility: Get up-to-date information on financial performance and cash flow.

Lower expenses: Processing fees and administrative expenditures are decreased. • Enhanced security: Safeguard private financial information.

The best payment management solution will depend on one’s spending limit and unique requirements. The following actions will help in choosing:

Determine what one needs: Characteristics that are essential to one’s needs.

Examine choices available: Compare the offerings of various providers.

Examine the reviews: Learn from other users' perspectives.

Ask for demos: The software must be tried from Zapier, Forbes, G2, & Software Advice before buying.