Table Of Contents

Payment in Arrears Meaning

Payment in arrears refers to the practice of making a payment to a service provider after a good or service has been delivered or after terms of an agreement is met. The term “arrears” indicates that the payment will be done after a specific period and not in advance.

It may also refer to a payment that was due but was unpaid. Although both definitions are perfectly valid and frequently used, more often than not, arrears is used to refer to missed payments. It could be scheduled payments such as rent, insurance premiums, bank EMIs, etc. Accounts, dividends, and investments can also face arrears.

Key Takeaways

- Paying in arrears refers to the payment made upon completion of a contract or after a service has been delivered. It is a common business practice and has tremendous implications for small and large companies alike.

- A prudent agreement that covers the terms of payment in arrears will also list penalties in case the payments are delayed to the service provider. The arrears due to be paid will then be inclusive of the said penalties and fees

- Although useful, arrears, at the end of the day, come with their own few caveats. Companies may have to keep a sterner eye over account payables when arrears get delayed repeatedly.

Payment in Arrears Calcuation

Payment in arrears can be calculated fairly easily. One just needs to add the outstanding amount due for the period and any possible penalties for late payment such as interest and late payment fees, and finally reduce any partial payment made during that period.

Arrears = accrued amount at the end of the period + late payment fees + interest -partial payment

The late payment and interest fees are usually agreed upon and written into any sales agreement or contract between two parties.

Example

For example, let’s say The Carpet Company Inc.(TCC) had agreed with The Textile Corporation (TTC) to purchase raw material for six months. TCC agreed to buy one shipment of textile material from TTC for $1000. The two companies also agreed to make the payment within 30 days of receiving the shipment. A late payment fee amounting to 1% of the outstanding amount will be levied if payment is not made.

After it signed the agreement, TCC made the payments promptly for three months. But, an unexpected fire caused the company significant financial losses. Because of the economic duress, the company produced only 30% of the payment for the remaining three months.

To calculate the amount due for payment in arrears for TCC, we can use the calculation mentioned earlier in the article.

Arrears = accrued amount at the end of the period + late payment fees + interest -partial payment

where the accrued amount = payment that was to be paid for the last 3 months

= $1,000 x 3

= $3,000

Partial payment =$300 x 3

= $900

Late payment fees = 1% of the outstanding amount

(note that partial payment needs to be accounted for)

= 1% x ($1,000-$300) x 3

=$21

Once we have the above information, we can easily compute the arrears.

Total outstanding payment in arrears = $3,000 + $ 21 - $900

= $2,121

When is Payment in Arrears Used?

Payment in arrears is a particularly useful concept for managing cashflows and credit cycles in a business. Proper management of payments through a disciplined system could be invaluable, especially during a crisis when cash is hard to come by.

Instead of paying for goods and services upfront, a business owner can delay payments by a negotiated fixed period. Normally, most businesses set up payment cycles of 30,45,60 days where payment is only paid after a certain number of days after receiving the invoice or upon delivery of goods. The additional time would help one secure more deals, focus on providing core services, and perhaps even negotiate with a bank to secure more financing if necessary.

For a business owner, the more time they have between receiving the invoice and its payment, the better it is. But, this decision has to be taken based on a market study of other players and existing credit practices in their industry. If the payment period is too long, then vendors and suppliers may get irked and seek out someone else to do business with. Therefore, it will be wiser to increase the payment periods in baby steps from the existing one with vendors if one wishes to do so.

For the people on the receiving side of the payment, such cases usually result in possible penalties or renegotiations of terms of the contract, such as the ones below

- A late payment fee

- Interest on the unpaid amount

- Reduced payment terms

- Reduction in credit extended

- Revocation of credit

Arrears may not necessarily mean a negative thing as the goods or service provider is not stripped of their remuneration. It simply means that the payment is late or paid at the end of a specific period.

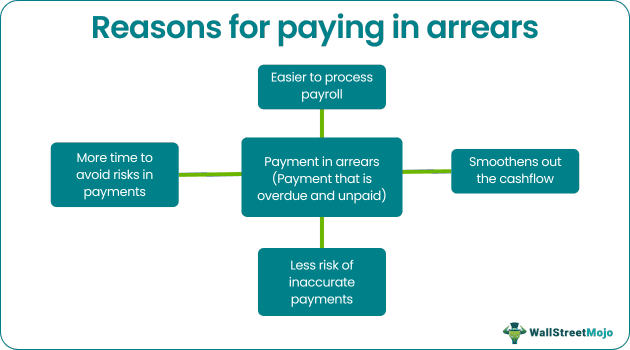

Payment in Arrear of Salary

In general, payrolls worldwide are paid in arrears, i.e., after an employee works for a fixed period. In most countries, many things come into account for payroll calculation, such as retirement benefits, deductions, and tax withholdings. Therefore, companies opt to pay salaries in arrears to manage these financial responsibilities better.

Other benefits of arrears payment are that businesses only need to process payrolls at the end of a period and focus on their core business activities at different times.

Also, if an employee calls a day off or falls sick during a weekday, the current pay hours become harder to predict. An arrears payment system helps businesses better manage such unexpected eventualities.