Table of Contents

What Is Excel Payslip Template?

As an employee, we all get salary receipts, the so-called “payslip,” from our employers, which is an acknowledgment of salary credited to the employee account. In the modern world, corporate companies use sophisticated software to prepare their employees' payslips, but we can still rely on Excel to prepare them. This article will show you how to build a free payslip template in Excel.

Payslip or salary slip template in Excel is the receipt given by the employer to their employees every month upon payment of salary to the employee for the services rendered in the month. A payslip consists of all kinds of earnings and deductions under various heads as per the norms given by the government in the respective financial year.

Key Takeaways

- A payslip template in Excel is a tool used by corporate companies to prepare employee salary receipts. While sophisticated software is used, Excel can still be used to create these receipts, ensuring accurate and timely payment.

- Secretaries are not responsible for deductions in small, unregistered industries, and they can easily create payslips. Additionally, a payslip template is provided for these unorganized industries.

- The payslip is visually appealing, but the payroll team must calculate net pay using advanced software. However, if the organization’s structure differs, the template must be modified, and TDS calculations are complex.

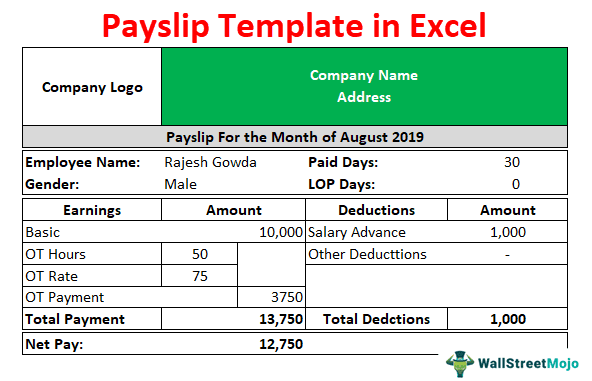

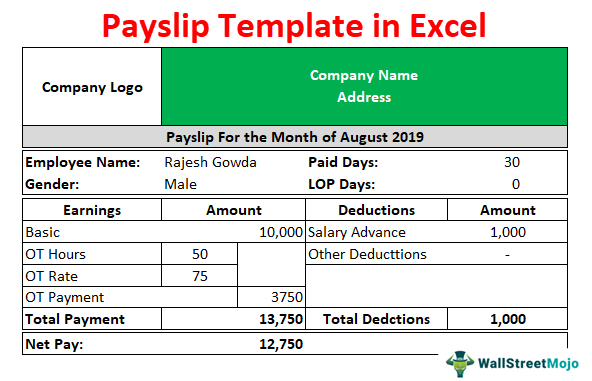

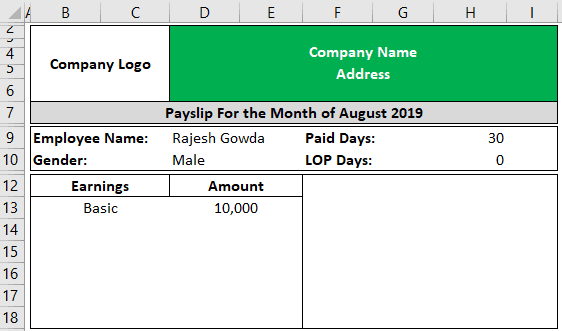

Example Of Free Payslip Template In Excel

Pay Slip For Not Registered Companies

For small industries not registered with the company, secretaries will not have any TDS, PF, or ESI deductions. For them, it is simple to make a payslip.

Keeping in mind those unorganized industries, we also provide a payslip template for them.

Small industries include basic salaries as part of their salary structure.

In small industries, employees work overtime most of the time. In such cases, factories pay overtime wages at 1.5 times of regular payment.

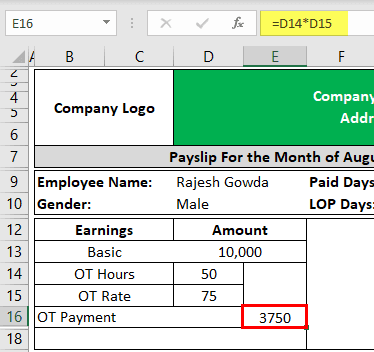

The overtime amount is calculated hourly, so it is important to mention OT hours, rate, and amount.

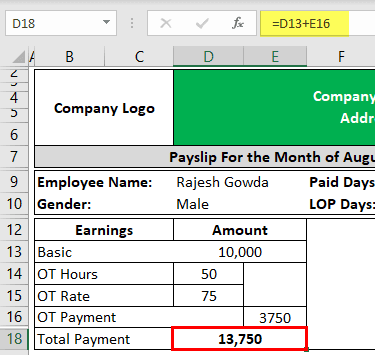

So, the basic and OT payment gives the total payment.

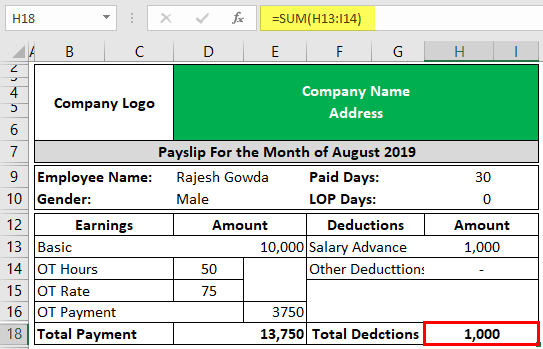

Next, in small industries, the deduction part includes only “salary advances,” so provide this column under deductions.

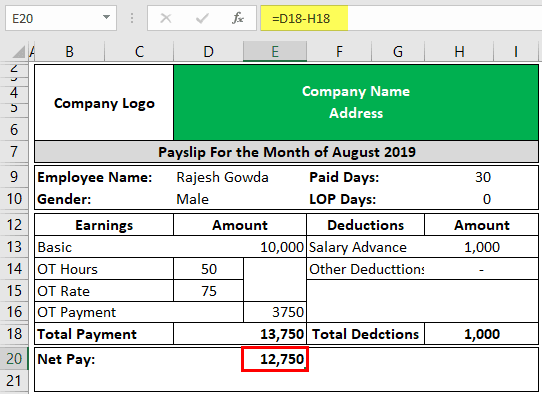

So, now arrives the final net pay.

Important Things To Note

- The payslip looks beautiful, but the payroll team must put much effort into arriving at the net pay amount.

- In today’s sophisticated software, we can design anything and everything with the help of automation.

- We must download the template and modify the contents; if the organization’s salary structure is different.

- Remember to keep ourselves up-to-date. It is because of complex TDS calculations.