Table Of Contents

Difference Between Passive Income vs Active Income

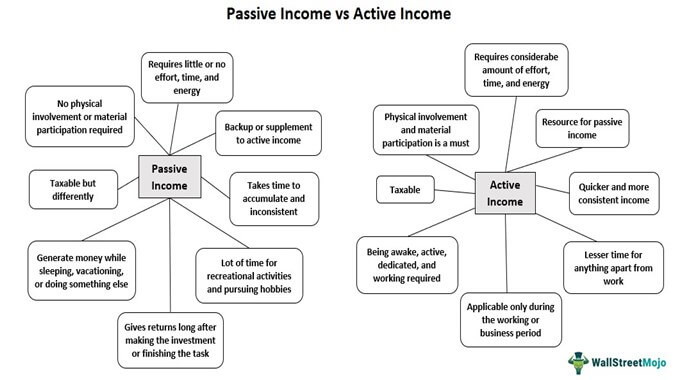

Passive income refers to money earned with little or no effort, whereas earning active income necessitates a significant amount of time and energy. While the former does not require physical or active involvement to generate an income, material participation is a must in the latter case.

Passive sources of income may include money generated from interest and dividends on investments, limited partnerships, and rental property. Likewise, salary, hourly wages, commissions, and tips are examples of active sources of revenue. One can have one of these income sources or both of them to enjoy financial freedom and lead a desired lifestyle. Passive earning is a better choice than active one in terms of practicality, but one must have a regular source of money to earn passively.

Table of contents

Passive Income vs Active Income Comparative Table

The difference between active income and passive income are as follows:

| Particulars | Passive Income | Active Income |

|---|---|---|

| Definition | • Can be earned with little or no effort and without material participation • Individuals become their boss | • Requires physical involvement and material participation • Individuals work under a boss to whom they report |

| Interrelation | • Serves as a supplement to regular income | • Provides resources for passive revenue |

| Consistency | • Can take months or years to accumulate and might not be consistent | • Quicker and ensures regular income stream |

| Lifestyle Effect | • Allows individuals to devote more time and energy to recreational activities and hobbies | • Individuals may not be left with enough stamina to pursue their hobbies or may not even have time for their families |

| Taxability | • Subject to potential tax deductions | • Taxable income |

| Results | • Generates money while sleeping, vacationing, or doing something else | • Necessitates being awake, active, dedicated, and working |

What Is Passive Income?

The income generated from an income-producing asset without requiring much work on the part of the individual is considered passive. Also, it does not obligate the person to be physically present to continue making money. However, the initial investment or effort required to earn passively comes from active revenue streams. Once opted, it keeps giving returns long after making the investment or finishing the task.

The effort required to maintain the passive cash flow usually depends on a specific skill set and strategy. Even though earning through passive means might take months or years to accumulate, it provides tax benefits on income, Social Security, and Medicare. Real estate investment can act as both passive and active income. Besides rental properties, several other sources can help people generate passive income, such as:

- Interest income on savings, bonds, and guaranteed investment contracts

- Stock dividends

- Real estate investments or rental income

- Peer-to-peer lending

- Display advertising

- The silent partner in limited partnerships

- YouTube Channels

- Online course sales

- Write and publish a book or eBook to earn royalty

- Affiliate marketing

- Self-charged interests

- Digital advertising

Examples

- A retired property owner with no more energy left to work daily can put a portion of the residence on rent. In doing so, the homeowner will keep receiving the payment from tenants for years without putting in any additional effort.

- Blogger Marcus writes product reviews for an e-commerce website. He writes honest reviews so that readers may trust his judgment and buy or check out the products he recommends. Thus, through affiliate marketing, Marcus earns a commission for every customer redirecting through his blogs.

If Marcus could not provide reviews for a few days due to health issues, his old articles continue to drive traffic to the e-commerce website. It will bring him a significant passive income at regular intervals. Thus, Marcus will never stop earning even though he stops working.

In passive income, therefore, an individual does not have to work daily. Instead, the money or time invested upfront continues to pay off every day, allowing the investor to generate additional income.

What Is Active Income?

It is the income earned from a part-time or full-time job or from performing a time-consuming task or service. Here, the individual receives a fixed hourly wage or salary. It also involves earning money by running a business or opting for self-employment. The amount earned and saved this way forms the basis for investing in passive sources of income.

Having an active source of income mandates an individual’s physical presence and material participation. If there is no active engagement, there will be no income in this arrangement. It is both quicker and more consistent than passive income. Some of the active income examples include:

- Salary

- Hourly wages

- Tips

- Sales Commissions

- Consulting services

- Freelancing

Examples

- Dentist Sophia gets paid for the tooth treatment when her clinic is open. However, days she could not open the clinic due to some personal emergency result in zero income. Thus, her presence and participation are a must to generate money in the form of fees paid by her patients.

- Sarah was not allowed any leave during her probation period in a new company. Unfortunately, she was hospitalized for surgery during probation and remained absent for two weeks in a row. Though her job was secure, she lost her pay for the days of absence. It signifies the working of an active source of income.

An active source of income pays individuals only when they are desirably productive. Else, they either lose their pay or their job.

Passive Income vs Active Income Infographics

Recommended Articles

This has been a guide to Passive Income vs Active Income. Here we discuss top differences between Passive Income vs Active Income, along with infographics and a comparison table. You may also have a look at the following articles –