Table Of Contents

Pari-Passu Meaning

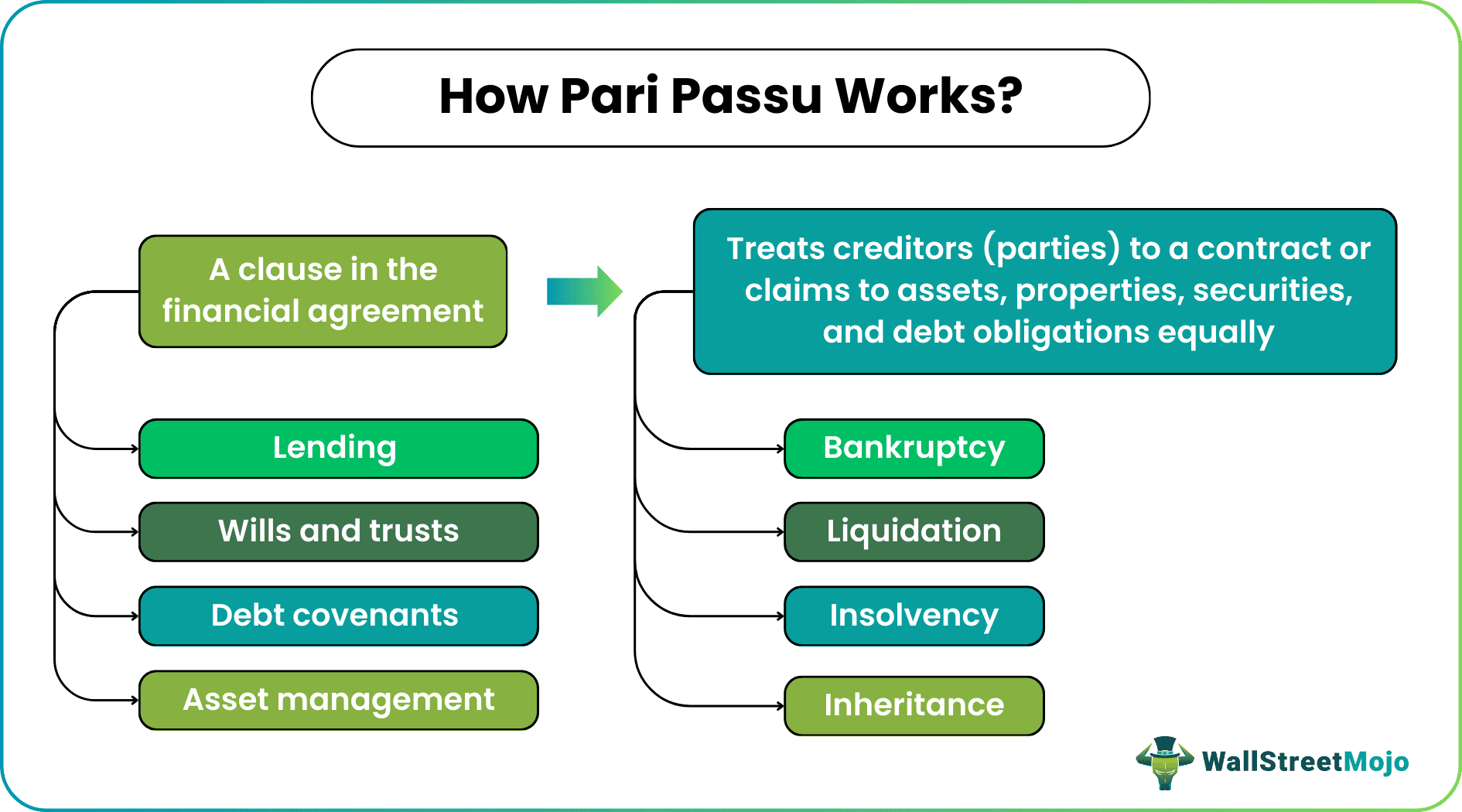

Pari Passu is a standard clause in a financial agreement that ensures equal management and distribution of assets, securities, and debt obligations among creditors. Parties to a contract or claim are treated without discrimination and at the same time under this arrangement.

Pari passu is a Latin term meaning “an equal footing” and is commonly applied in bankruptcy, liquidation, inheritance, and insolvency. These are the scenarios wherein different parties claim equal rights and a proportionate share of the asset allocation. With this clause in place, the designated entities do not have to bear the good and bad sides of the contract.

Table of contents

- Pari-Passu Meaning

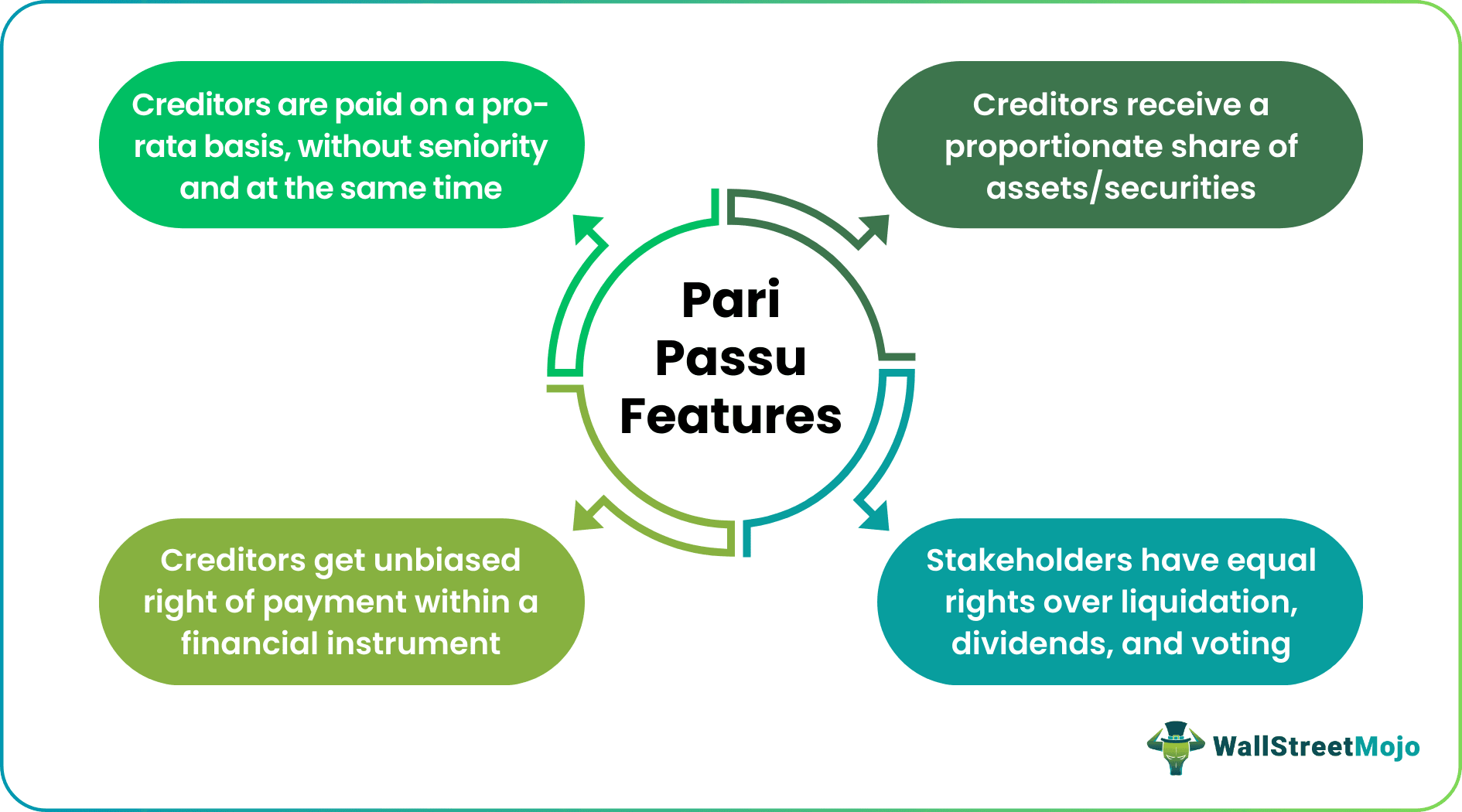

- Pari Passu is a clause in a financial agreement that ensures that assets, property, securities, and debt obligations are managed and distributed equally among creditors.

- It refers to an unbiased right of payment within a financial instrument, such as a loan, bond, or share class, subject to the clause. The creditors are paid on a pro-rata basis, without regard to seniority, and all at once.

- It is frequently used in bankruptcy, liquidation, inheritance, and insolvency cases where multiple parties claim equal rights and a proportionate share of the assets.

- The concept finds applicability in bankruptcy, asset management, lending, wills and trusts, and debt covenants.

How Pari Passu Works?

Pari Passu agreement signifies the equal or unbiased right of payment under a specified clause within a financial instrument, such as loan, bond, or share class. As soon as the interested parties enter the contract, the pari passu clause would give every stakeholder equal right over liquidation, dividends, and voting. That is why the company clarifies that no priority would be given to any specific set of people involved in the deal while issuing the agreement.

The clause is applicable in any situation where two or more parties have equal rights over an asset, property, or debt obligation. The creditors receive the payment on a pro-rata basis, i.e., in proportion to their investment, without seniority and at the same time.

The clause is put in the financing agreement to ensure parties get access to the company's financial products, which could include anything from a bond to an obligation. It is common in bankruptcy, liquidation, and insolvency proceedings.

This clause also safeguards unsecured creditors' rights to assets held by the company. It implies that equities must be distributed evenly and without preference among them. However, it is critical to remember the debts owed to each creditor while dividing their portion. The court of law always rules in favor of equal pay to the insolvent company's creditors in proportion to the debt they still owe.

Pari Passu Examples

Let us consider the following pari passu examples to understand the concept better:

Example #1

Suppose company A is about to go bankrupt and that it has five stakeholders who have been with it through all of its ups and downs. The corporation has $1 million in assets and securities. Shareholders will receive assets worth $200,000 each, according to the provision.

Example #2

SunStream Bancorp provided a $100 million acquisition facility to cannabis business Jushi Holdings. It will enable the company to boost its financial flexibility, fund acquisitions, and expand in existing and emerging markets. This facility was secured over the company's specific assets and on a pari-passu basis.

Pari Passu vs Pro Rata

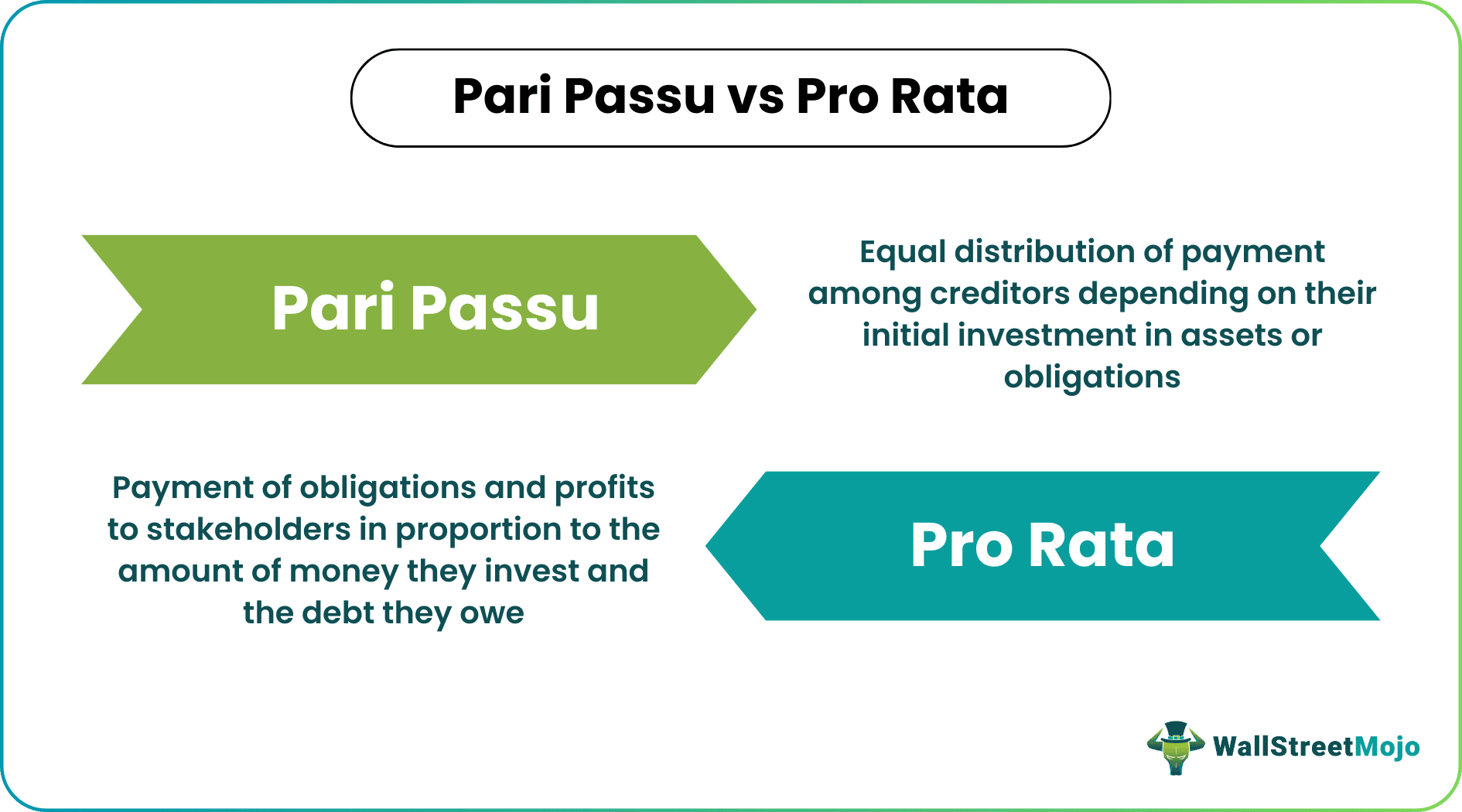

Pro-rata and pari passu are two important principles in commercial real estate transactions. However, even though they are used in asset distribution simultaneously, they have different meanings.

The former means “in proportion.” It implies paying obligations and profits to stakeholders in proportion to the amount of money they invest and the debt they owe.

The latter means "on an equal footing." It refers to the equal distribution of payment among creditors depending on their initial investment in assets or obligations.

| Pari Passu | Pro-rata |

|---|---|

| Means “equal distribution of payment” | Means “in proportion payment” |

| Treats investors with equal rights, ranks, and seniority | Treats creditors based on the initial investment |

| Signifies relationship between investors | Signifies fund distribution among investors |

For example, if one investor makes 80% of the initial investment and the other two make 10% each, their share proportions will be distributed in the same way.

Uses of Pari Passu

The Pari Passu principle is applicable in different niches, including:

#1 - Bankruptcy

Pari passu agreement protects the initial investments made by shareholders when a company goes bankrupt. The clause allows equal distribution of assets among investors in proportion to their initial investment and debt. However, it does not find applicability in cases where banks are creditors.

If a firm becomes bankrupt, liquidates its assets, or has outstanding loans or debts, it must repay its creditors first. In such cases, the court treats all creditors equally in its decision. In other words, the lack of equality in the right to payment nullifies the provision in such situations.

#2 - Asset Management

The pari passu clause is useful in asset management. It helps in managing assets or securities of creditors equally.

#3 - Lending

It is applicable in lending and credit scenarios, as stated in the loan agreement. As a result, creditors can get secured loans with equal claims on assets.

#4 - Debt Covenants

The concept holds significance in debt covenants. When companies issue bonds to raise capital, the clause assures that each bond is equal.

#5 - Wills & Trusts

The pari passu rule allows equal distribution of assets among parties specified in a will or trust.

Frequently Asked Questions (FAQs)

Pari passu is a standard clause in a financial agreement that ensures that creditors to a contract or claims to assets, properties, securities, and debt obligations are treated equally. It is commonly employed in bankruptcy, liquidation, inheritance, insolvency, asset management, financing, wills and trusts, and debt. The clause would provide every stakeholder equal rights over liquidation, dividends, and voting as soon as the parties sign the contract.

Pari passu is not applicable in circumstances when banks are creditors. For example, if a company becomes bankrupt, liquidates its assets, or has outstanding loans or debts, its creditors must be paid first. In such instances, the court renders a fair judgment to all creditors. In other words, the clause is nullified by the lack of equality in the right to payment in such cases.

Recommended Articles

This has been a guide to Pari Passu and its meaning. Here we explain how does pari passu basis work along with examples and uses. You may also learn more about financing from the following articles -