Table Of Contents

What Is Out-Of-Sample Testing?

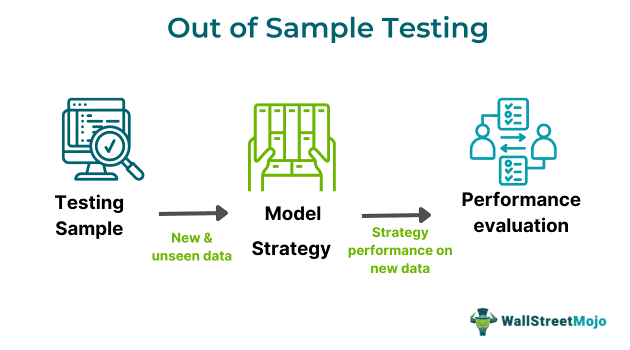

Out-of-sample testing refers to an assessment of the efficiency of a strategy on a set of data that was not included in the development and optimization stage. The assessment determines the successful performance of the strategy on unseen data.

Out-of-sample testing is one of the realistic methods of sample testing, provided that the characteristics and performance statistics remain constant. Incubation periods are often regarded as the best form of out-of-sample backtests. This method is less sensitive to data mining and outliers, making the empirical evidence obtained from its forecast more dependable than others.

Key Takeaways

- Out-of-sample testing is a technique of evaluating the effectiveness of a trading strategy using data sets that were not used in its creation and optimization.

- It helps investors verify the efficiency of the strategy in predicting market movement when used with new data.

- It evaluates models on new data, presenting the effectiveness of trading strategies, prevents overfitting, assesses the generalizability of the model's learning, and enhances investment decisions.

- Contrary to out-sample testing, in in-sample testing, the data used for testing remains the same as what was used in training.

Out-of-Sample Testing in Trading Explained

Out-of-sample testing is a technique involving historical data in two categories: an in-sample data set to build and refine a trading strategy and an out-of-sample data set to evaluate a strategy's efficiency on previously unseen data. Traders conduct this testing to validate their strategy and understand its potential implications.

Traders follow the steps below to conduct out-of-sample testing:

- Use in-sample data to formulate the trading strategy.

- Measure the performance of the devised strategy.

- Measure the performance of the devised strategy by applying it to a new or unknown data set.

Out-of-sample testing prevents over fitting, where the model becomes too closely tailored to the training sample and fails to generalize to new data. It also offers a trustworthy and precise assessment of a strategy's true performance. This testing assists traders in evaluating the effectiveness of their strategies, leading to more informed stock trading or investment decisions.

Traders can achieve better returns on their investments using this testing method. Since it helps streamline and refine trading strategies, out-of-sample testing has become an important component of robust trading strategy development. In the financial world, traders use this testing for portfolio allocation, creating effective investment strategies, and forming efficient risk management strategies.

Examples

Let us use a few examples to understand the topic.

Example #1

Let us assume that a financial analyst, Alina, has formulated a fresh algorithm to predict market movements. Alina uses historical market data from 2015 to 2019, called in-sample data, to train and optimize algorithms in different market conditions. However, to test the efficacy of her model, Alina uses the model on an unknown and newer set of data from 202-22 called out-of-sample data.

The out-of-sample used acted as an unseen market and future scenario. After the tests were conducted, the model successfully predicted market trends with a higher degree of accuracy. Hence, the results indicated that the model has not only fitted the past data but also acquired genuine future predictive capabilities of the market to help investors trade with lesser risk.

Example #2

The online news, dated April 26, 2022, has underscored the use of out-of-sample testing in generating custom trading strategies based on client data. The platform – START, created by Abel Nose, utilizes historical order segmenting and subjecting resulting strategies to pass through stringent out-of-sample testing for future market trend prediction.

Moreover, the strategies used by the platform have been working well on unseen data, as evidenced by potentially saving 4-30 bps of clients. Since they handle more than $500 billion in notional volume yearly, they constantly optimize their algorithm. As a result, they have reached the pinnacle of achieving the best execution concerning clients in a dynamic trading environment.

Importance

The importance of out-of-sample testing is outlined as follows:

- The testing method allows for the evaluation of models or strategies, ensuring they perform well on new and unseen data.

- This complex technique helps prevent overfitting, ensuring the model is not just tailored to the initial dataset.

- It provides a realistic assessment of how the model will function in real-life situations when interacting with new and different data.

- The method evaluates the effectiveness of trading strategies on unseen data.

- It specifically assesses the model's ability to generalize its learning to new, unseen data.

- It also contributes to enhancing investment decision-making by offering a more accurate depiction of a strategy's true performance.

Out-Of-Sample Testing Vs In-Sample Testing

Out-Of-Sample Testing

- The data used for testing was not used in building or training the strategy.

- Evaluates the model’s ability to generalize to unseen data.

- Helps prevent overfitting.

- A realistic method for estimating real-world robustness.

- Tests the model using a new set of data.

- Requires larger datasets.

- Determines the workability and robustness of the strategy on new data.

- Centers on predictive performance on newer data. Uses methods like Monte Carlo simulation and cross-validation for robustness.

- Needs continuous adjustments and monitoring for ongoing success.

In-Sample Testing

- The same data sample is used for both testing and developing the strategy.

- Evaluates the model’s performance on the data used during training.

- Vulnerable to overfitting, leading to imperfect performance forecasts.

- Simpler and faster to execute, but may not accurately represent real-world performance.

- Relies on the same data used to create the initial model.

- May not require large datasets.

- Helps in backtesting a trading strategy using historical data.

- Focuses on evaluating the model’s fit to the historical data used during training.

- May not require continuous adjustments,