Table Of Contents

What Is Ordinary Income?

Ordinary income is the income that an individual or a business earns, and that are in the form of wages or salaries, rent, commissions, short-term capital gain, etc They gets taxed at the normal tax rate. However, income from long term capital gains and qualified dividends are taxed at special tax rates.

Thus, they are the income earned from the ordinary, day to day business operations. Is is important for an entity to keep a record of the same for tax payment purposes. The method and forms used to pay the tax on ordinary income depends on the type of business.

Ordinary Income Explained

Ordinary income is the type of income taxed at ordinary rates, and it is earned regularly from day to day operations. It does not include capital gains and qualified dividends, where the tax on ordinary income are less.

Unqualified dividends ordinary income are taxed at standard rates of tax; for example, dividends paid by REIT (Real Estate Investments Trust), income paid on ESO (Employee Stock options), income from money market operations.

Salaries and wages received by the individual from his employment can be considered as the best example of expected ordinary income. There are many other examples like rent received, business and trading income, etc. The government is encouraging people to invest in government bonds, shares, stock, etc. where tax on ordinary income earned by the people from these investments are less.

It is the income regularly earned from day to day operations or activities, and it does not include qualified dividends, capital gains. Individuals are taxed at the prescribed rates according to their income levels, but companies and partnership firms are taxed at fixed rates irrespective of their income levels.

Types

There are two forms of Ordinary income.

- Personal income – Personal income is the income earned from any activity which is subject to income tax. Personal income means any cash inflow which is subject to income tax as defined by IRS (Internal Revenue Service)

- Business income – They are earned from day to day business operations except for income from capital gains i.e., income from the sale of capital assets, or for example, income earned from the regular sale of land, buildings, etc. They are the income earned before taxes i.e., PBT (profits before taxes). There are some deductions and exemptions that are allowed while paying taxes.

Revenue vs Income Explained in Video

Examples

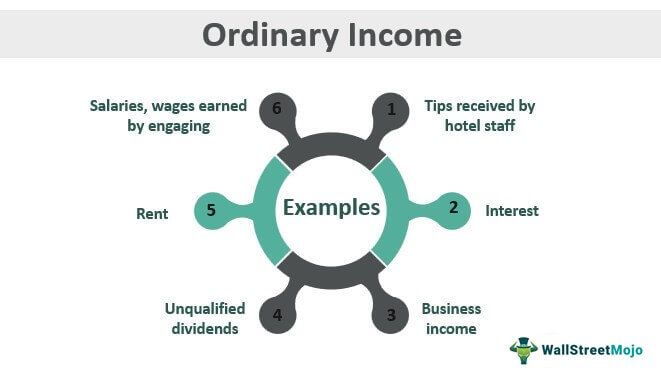

Some common examples of ordinary income are as follows:

- Tips received by hotel staff due to its periodic nature;

- Salaries, wages earned by engaging in

- Interest

- Rent

- Unqualified dividends ordinary income

- Business income

However, let us look at some cases explaining examples of ordinary income:

Example #1

If the transaction involves income either in the present or future, then that transaction is considered as ordinary income.

If the business is engaged in buying cars and reselling cars for profit after some modifications made to cars, then the income earned from selling that used cars will be considered as ordinary income but not capital gain.

Example #2

Money earned from an asset.

Interest earned from a savings bank account, rent earned from the property.

Advantages

- A basic exemption limit is given to individuals within that income limit, so no need to pay tax on expected ordinary income.

- Individuals, HUF, BOI ( Body of individuals) need to pay tax according to their income levels at prescribed rates for different income levels.

Disadvantages

Companies and partnership firms need to pay at a rate of 30%+ surcharge if applicable+4% health and education cess. Even if there is a small amount of profit earned, one needs to pay tax at prescribed rates.

Ordinary Income Vs Capital Gain

| Sr. No | Ordinary Income | Capital Gain |

|---|---|---|

| 1. 1 | Earned regularly from employment, trading, business activities, etc. | Earned from selling investments like shares, buildings, etc. |

| 2. 2 | Income is taxed according to the slab rates for different income levels. | Capital gain is taxed at a lower rate according to the nature of transactions short term gain or long term gain. |

| 3. 3 | Ordinary income can be offset with standard tax deductions. | Capital gains can only be offset with capital losses. |