The differences between OLV and Forced Liquidation Value have been given in the table below:

Table Of Contents

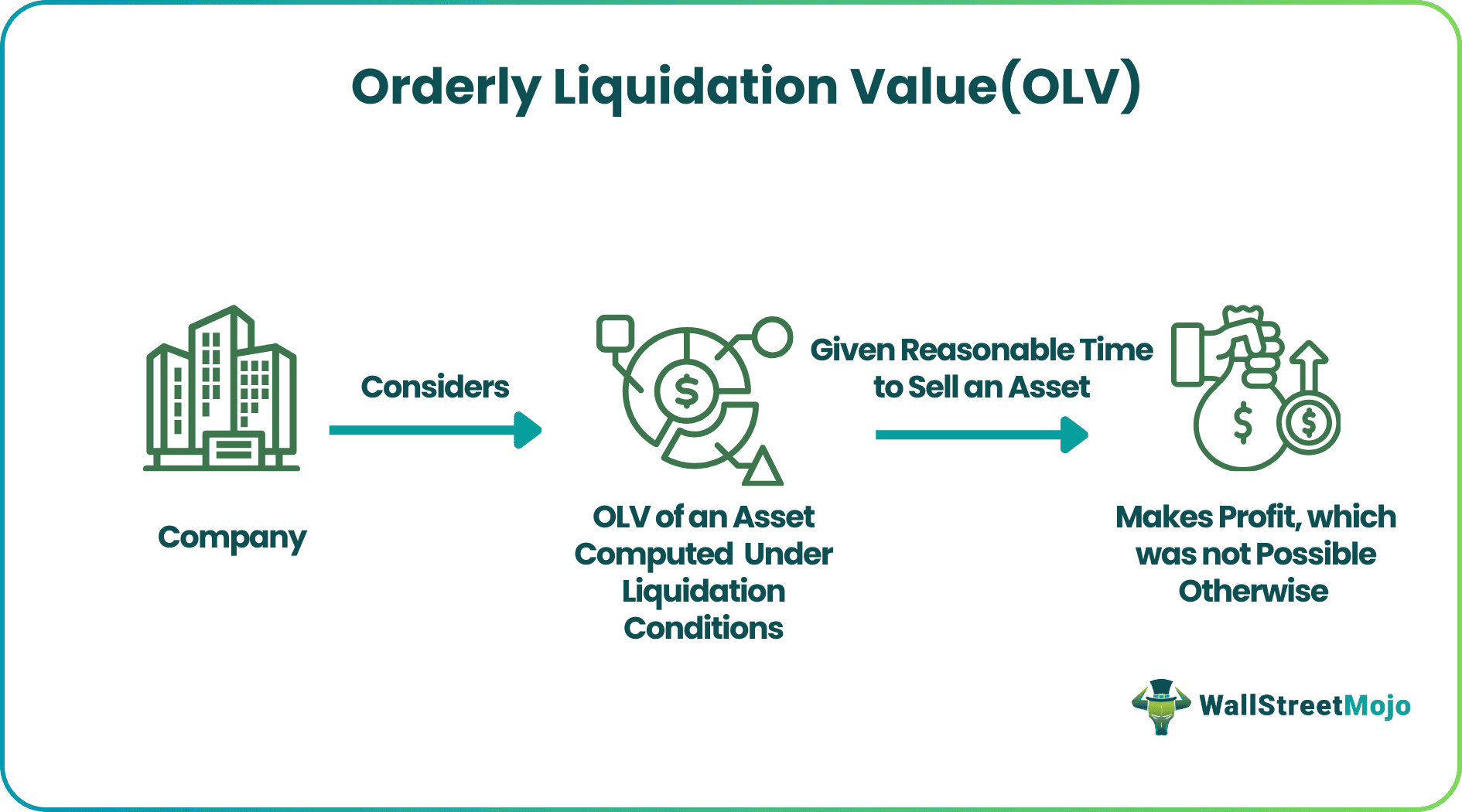

Orderly Liquidation Value, or OLV, is the price or value at which an asset or group of assets are sold in a methodical manner, given enough time to dispose of them. The purpose of selling at OLV is to maximize the sales proceeds. The OLV figure is provided by appraisers. The asset's fair value is another figure they provide to facilitate liquidation.

OLV plays an important role in assessing the value of an asset, especially in situations where quick asset liquidation is necessary. During orderly liquidation, assets are sold in markets where supply is limited, resulting in the generation of demand (and thus liquidity) for the assets being sold. As opposed to this, selling under pressure in a rushed manner does not return or yield the expected or desired value. Without OLV, the asset value usually declines, particularly if it is a distress sale. The absence of markets and the lack of liquidity have adverse effects on the asset in question.

Key Takeaways

Orderly liquidation value reflects the maximum profit that can be made from the asset when it is sold in a planned manner while considering the state of the market and taking adequate time to execute the sale. As opposed to a forced liquidation scenario, OLV assumes that the sale is neither urgent nor forced, allowing for a more accurate assessment.

In terms of monetary compensation, the OLV figure falls between the fair market value and the forced liquidation value. Through OLV, a company receives more money compared to forced liquidation but less than the asset’s fair market value. It is often estimated based on the assumption that there is some time in hand—a few months at the least—to sell an asset that needs to be sold.

Market conditions, location, desirability, and the asset’s condition are all factors that determine the final OLV. The Orderly Liquidation Value (OLV) provides quick access to funds and effective asset disposal. If companies know the value, it helps management decide whether certain assets must be sold to clear debts. Understanding OLV enables business owners to make judicious choices in partnership dissolution, corporate dissolution, or other unforeseen circumstances. Another significant factor is that banks consider OLV when extending loans. Businesses that adopt OLV can improve their financial results and reduce risks in a dynamic, quickly changing business environment.

Several variables are considered while determining the orderly liquidity value, including market conditions, the asset's demand, age and condition, and sale-related expenses. Although a single commonly accepted methodology for determining OLV is not available, companies often combine input from market analysis, evaluation techniques, and expert judgment.

The market value of tangible assets, which includes fixed and current assets, is obtained, after which all liabilities are subtracted from the total liquidation value of the assets to obtain the OLV.

Orderly Liquidation Value (OLV) formula = Market Value – Business Liabilities

Here are a few examples of OLV to facilitate further discussion.

Let us take a hypothetical example of Dan.

Dan wants to retire and sell his manufacturing business. OLV estimation helps Dan make informed financial decisions based on the estimated value of his business. It helps him evaluate investment opportunities, assess potential loans or financing options, or determine if additional capital infusion is required to improve the company’s value before selling it.

Dan also has the option to engage a professional appraiser to arrive at the required figures. If he does, the appraiser will assess tangible assets and analyze the market and industry conditions. They will also review the sales value of Dan’s competitors, evaluate the company’s growth potential, and study debts and liabilities. Based on such estimates, Dan will be able to make the right decisions and sell the company’s assets.

Let us assume ABC & Co. wants to sell a piece of machinery. Based on market research and appraisals, the following values have been derived.

ABC's market value is $460 million and its liability is $50 million. Using this data, ABC & Co. arrive at the following figures:

Orderly Liquidation Value (OLV) = Market Value – Business Liabilities

i.e., $460-$50= $410 million

This price reflects the projected profit that can be made when the equipment is sold under regulated circumstances while taking the market and a reasonable period into account.

The differences between OLV and Forced Liquidation Value have been given in the table below:

| Key Points | Orderly Liquidation Value | Forced Liquidation Value |

|---|---|---|

| 1. Essence | The OLV represents the net proceeds obtained following the liquidation settlement within a given time frame. It projects the total price physical assets would generate under the conditions of an auction-style liquidation, where the seller would be required to sell the assets “as-is, where-is”. | The Forced Liquidation Value (FLV) is the sum of money a business gets when it promptly sells all its assets in an auction. It is computed based on the idea that the company will sell its assets as soon as possible, resulting in a low price. |

| 2. Goal | It gives the estimated amount a company can earn through asset liquidation. The phrase “orderly” states that the liquidation is controlled and not haphazardly executed. It means the seller has a reasonable amount of time to find suitable potential buyers. | The purpose of liquidation in this form is to estimate the company's financial position under the worst-case scenario. |

| 3. Value | The OLV is often greater than an asset's forced liquidation value. This is because it assumes a more urgent and desperate sale but one that fetches an amount lower than Fair Market Value. This is because FMV estimates assume a normal market and willing buyers and sellers. | The Forced Liquidation Value (FLV) is the amount a company earns when it sells assets to get rid of them and pay off liabilities. Hence, companies are willing to get any price obtainable in the market. |