Table Of Contents

What is Optimum Capital Structure?

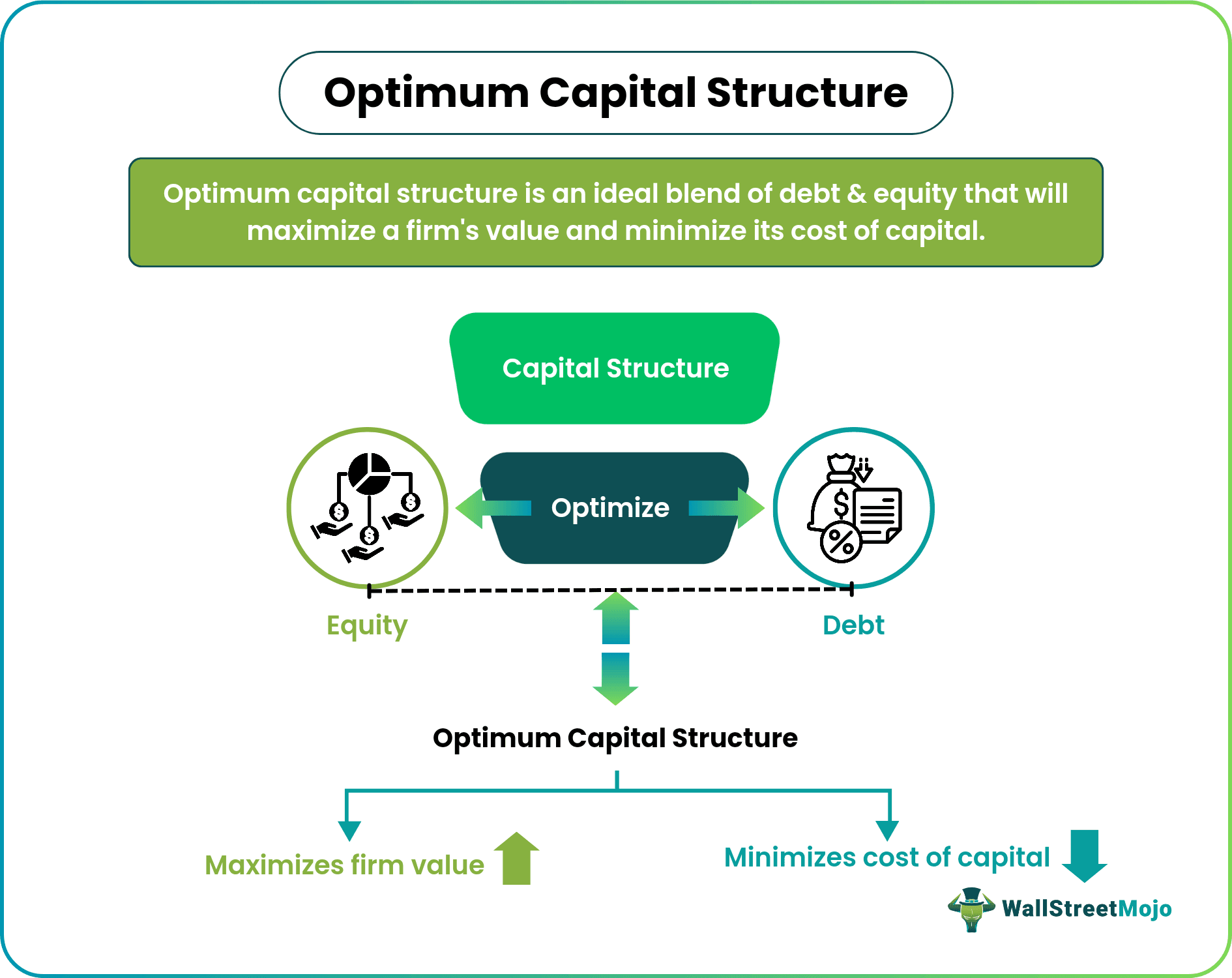

Optimum capital structure (OCS) is the proportion of equity and debt a company adopts to maximize its wealth and market value and minimize its cost of capital. Thus, it is calibrated to balance the company's worth and its cost.

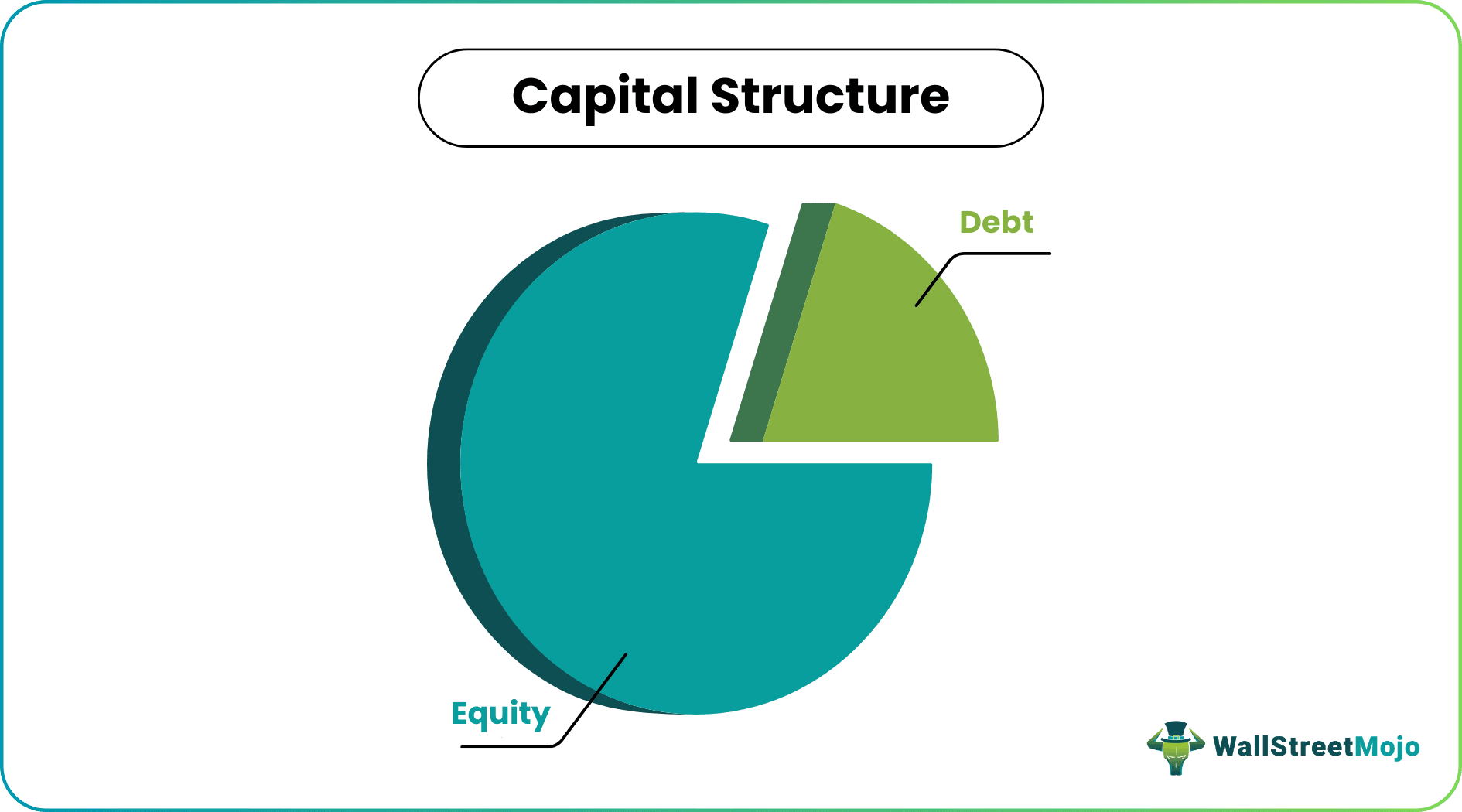

Capital structure refers to the sources of financing, namely, debt and equity, employed by the firm to finance its operations. Though debt financing is relatively cheaper than equity, it may inflict a financial risk. To prevent this, companies optimize their capital structure by raising enough equity to alleviate the risk of debt defaults.

Key Takeaways

- Optimum capital structure refers to an ideal blend of equity and debt that a company maintains to maximize its market value and minimize its capital cost.

- Equity and debt are the two forms of capital, and hence an optimized balance between them is necessary.

- Optimization of WACC - the weighted average cost of capital is one way to calibrate hybrid financing.

- The significant determinants of optimum capital structure are risk, cost of capital, flexibility, conservatism, sales and growth, inflation, and cash flow.

Understanding Optimum Capital Structure

Optimum Capital Structure is required for the smooth running of an enterprise. Its meaning is to reach a point where the two primary forms of financing-debt and equity-complement each other.

In a business, numerous factors affect a company's finances and cash flow The sources of capital have significant implications for the firm as they affect its value. It is easy for a company to take debts to keep the production going as it is the least costly form of capital. It is due to the fact that the cost of debt (interest) is a tax-deductible expense and relatively less risky.

However, excess borrowing not only increases a firm’s risk of bankruptcy but also affects its ability to pay dividends. In the event of loss, the firm still has to make interest payments on debts. As a result, it reduces the profit available for dividend distribution. It leads to increased risks to equity shareholders. In such an event, shareholders have to be compensated for the enhanced risk. Thus, the cost of equity rises, eroding the benefits of cheap debt.

On the one hand, it is beneficial for a company to reduce equity, which is relatively expensive, and take debt. But, on the other hand, a company has to constantly look for cheap resources and sound financial planning and execution to ensure they do not take a heavy debt on them. Thus, the company designs the optimum capital structure to beat it.

One of the most practical and observed ways of designing the optimum capital structure is lowering the weighted average cost of capital (WACC). WACC is the average cost of raising equity and debt funds to the firm. So, if a firm can lower its WACC, that is, raise capital by giving off less dividend and paying lower interest on debt, it can maximize its value. So, ideally, the objective of a company must be to come up with an ideal mix of debt and equity to achieve the lowest cost of capital.

Determinants of Optimum Capital Structure

There are various determinants of optimum capital structure that leave a significant impact on the operations and management of the organization. Let us understand some of its determinants along with their importance.

#1 - Cost of Capital

Every single penny invested in a company is a cost. Therefore, a company must be able to return the finance provided by suppliers. The return offered to the equity holders is called the cost of equity and is directly proportional to the degree of risk assumed by them. In contrast, the interest paid on debts is referred to as the cost of debt.

The capital structure must return the cost of capital to its stakeholders to be called optimum capital structure. A capital structure must be inclined towards using cheap resources to finance its assets, operations, and future growth.

#2 - Sales Growth, Profitability, and Stability

It goes without saying that if the company is earning well in the market, has a customer base, and has a constant demand for its product and services, its goodwill ensures a smooth business run. At the same time, low sales and growth can create a vice versa situation with higher risk and debt issues. Sales and development enable the company to deal with debt and interest repayments. Hence, it is vital in determining capital structure.

#3 - Cash Flow

The ability to generate cash flow plays an essential role in attaining optimum structure. Conserving the cash flow and predicting future requirements and shortages can help a company create a lower debt or preference capital structure. Thus, the predictability and variability of cash flow are crucial determinants of capital structure.

#4 - Company size

In the early business stage, a small company may find it challenging to raise the required capital. Alternately, a well-established firm can easily obtain any amount of equity or debt. Therefore, a company’s size or stage has significant consequences on the capital structure.

#5 - Risk

Every business assumes, anticipates, and struggles with risks in operations and management. When a company designs an optimum capital structure, it usually comes across two types of risk factors: business risk and financial risk.

Business risk is directly related to the change in the company's earnings, demand, supply, income, and revenue generation. In contrast, financial risk refers to the market changes, substitutes available, or entry of new competition, typically not in control of the company. So, the company's strength to overcome all types of risk impacts its overall capital structure.

#6 - Inflation

Inflation is a critical factor. With a sudden rise in goods and services, a company suffers a hike in raw materials, electricity or power consumption, transportation, equipment, and machinery costs. A slight rise in the price of such expenses can negatively impact the budget and production level of the companies. Thus, it becomes evident that an enterprise must design an optimum capital structure to take into account inflation uncertainty.

#7 - Market Conditions

Market conditions are dynamic, so a firm can never work in an active market with static and old measures and business ways. The market sometimes faces recession, and at other times rides high on a massive boom. Hence a company must optimize its capital structure to remain stable and relevant.

Examples

To understand the concept, let's take an example of a small textile company that incurred heavy debts due to not analyzing its capital structure. Everything went well with the orders and demand of their finished goods in the initial phase.

However, due to the unexpected turn of events, it started making losses. Despite losses, it still had to pay its fixed interest obligation on the debt. As a result, it affected its ability to pay out dividends. It eventually came to the brink of bankruptcy due to the considerable capital cost owing to its substantial debts to the market and its suppliers. The company had to incur a high cost for opting a capital structure with a huge debt.

Last year, Altice Europe, the telecom and cable manufacturing organization, simplified its capital structure to clear its debt burdens. It planned two funding pools for Altice France Arm and Altice International Unit, which helped reduce the average cost of its debts.

One of the recent OCS examples is Nigeria's telecom sector. In the last 15 months, many companies have struggled with debt, inflation, rise in competition, and pandemic crisis. As a result, the Nigerian Communications Commission (NCC) had set parameters for regulating capital structure to ensure the sustainability of the industry.