Table Of Contents

What is the Operating Ratio Formula?

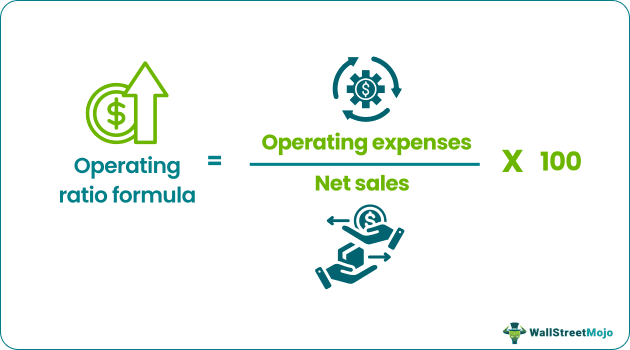

The operating ratio formula is the ratio of the company’s operating expenses to net sales. Operating expenses include administrative expenses, selling and distribution expenses, cost of goods sold, salary, rent, other labor costs, depreciation, etc. It is also called the operating cost ratio or operating expense ratio. The ratio is generally expressed in percentage terms. The lesser the operating ratio, the better it is for the company. A lower ratio indicates it is carrying out its operations efficiently.

The cost of goods sold is added to operating expenses to determine the operating ratio.

Operating Ratio Formula = Operating Expenses / Net Sales* 100

Explanation

Certain items such as goods returned are deducted from the gross sales to find net sales.

- The following steps are to be undertaken to calculate the operating ratio in case the operating expenses include the cost of goods sold.

- Aggregate all the operating expenses.

- Find out the net sales. Certain items such as goods returned are deducted from the gross sales to find net sales.

Use the following to find the operating ratio:

Operating Ratio Formula = Operating Expenses / Net Sales * 100

The cost of goods sold is given separately from operating expenses in certain cases. In such cases, the cost of goods sold is added to operating expenses.

Video Explanation Of Operating Ratio

Calculation of Operating Ratio

The following examples will give us more clarity on the subject matter.

Example #1

The net sales for Blue Trust Inc. are $5,000. The operating expenses are $3,000. The cost of goods sold, which are not included in the operating expenses, is $1,000. Calculate the operating ratio for the company.

Solution

Use the below-given data for the calculation of the operating ratio.

- Operating Expenses: 3000

- Cost of Good Sold: 1000

- Net Sales: 5000

Therefore, the calculation of the operating ratio is as follows,

=(3000+1000)/5000

- The operating ratio for Blue Trust Inc. is 80%.

Example #2

The Cost Accountant of Radley Inc. was going through its records. He found out that the following expenses were incurred in January:

- Sales & Marketing Expenses: $400

- Salary: $1,000

- Repair & Maintenance Costs: $500

- Direct Material: $600

- Direct Labor: $1,200

- Office Supply Costs: $300

- Rent of Factory: $500

The sales were $11,000, and the sales returns were $1,000. Calculate the operating ratio.

Solution

First, we need to calculate Net sales

Net sales

- = $11,000 - $1,000

- Net Sales = $10,000

Operating Expenses

=$400+$1000+$500+$600+$1200+$300+$500

- Operating Expenses = 4500

Therefore, the calculation of the operating ratio is as follows,

=4500/10000*100%

Note

Interest expenses are not added as they are not operating expenses.

Example #3

An Economist compares the operating ratios of different firms in the same industry. He gets the following data: Calculate the operating expenses for each of these firms. Which firm has the highest degree of operating efficiency?

| Firm | Net Sales | Operating Ratio |

|---|---|---|

| A | $50,000 | 60% |

| B | $10,000 | 70% |

| C | $40,000 | 50% |

| D | $10,000 | 80% |

| E | $100,000 | 70% |

| F | $600 | 70% |

| G | $20,000 | 40% |

Solution

Therefore, Operating Expenses can be calculated using the below formula,

Operating Expenses = Operating Ratio * Net Sales

=60%*$50000

- Operating Expenses = 30000

Similarly, we can calculate operating expenses for firms B, C, D, E, F, and G.

The firm with the lowest operating ratio has the highest operating efficiency. Firm G has the lowest operating ratio of these firms. Hence, firm G has the highest degree of operating efficiency.

Relevance and Uses

- If the operating ratio shows an increasing trend over a period, it is considered a negative sign for the company. It may indicate that the cost control system is not working well or is absent. In such a scenario, the company needs to improve its cost control system. It will ensure that the margins of the company will increase over time.

- A decline in the operating ratio is viewed as a positive sign over a period. It indicates that operating expenses account for a lesser percentage of net sales, implying that the company is working more efficiently.

- Inter-firm comparison of an operating ratio is to be made as it will help compare the efficiency of two companies in the same industry. Norms differ from industry to industry. Thus, a high ratio for a particular industry may not be the case for another industry.

- One of the limitations of this ratio is that it does not consider debt and interest payments. In other words, this ratio is not affected by the company's capital structure. Thus, two companies, say the first one is debt-free, and the other one is highly leveraged, will have the same operating ratio if their operating expenses are the same. Thus, while carrying out an analysis, the debt-equity ratio has to be used with the operating ratio.