Table Of Contents

Formula to Calculate Operating Income

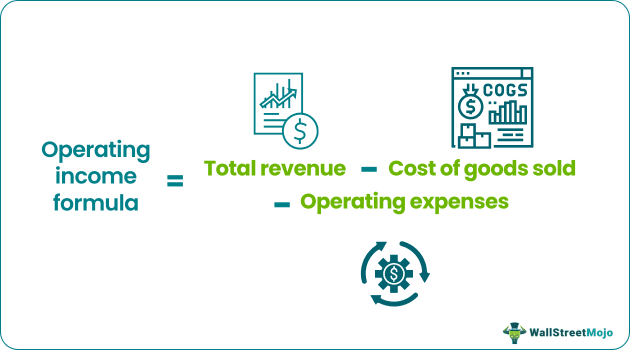

The operating income Formula (also referred to as the EBIT formula) is a profitability formula that helps calculate a company's profits generated from core operations. The operating income can be calculated by deducting the cost of goods sold and operating expenses from total revenue. The formula is a decision tool for an investor to calculate how much gross income will eventually result in profit for a company.

Mathematically, operating income can be calculated using two methods

Method 1

Operating Income Formula = Total Revenue – Cost of Goods Sold – Operating Expenses.

Method 2

Alternatively, the Formula for operating income can also be calculated by adding back interest expense and taxes to the net income (adjusted for non-operating income and expense), which is mathematically represented as,

Operating Income = Net Income + Interest Expense + Taxes

Key Takeaways

- The operating income formula (EBIT) assesses a company's profitability based on its core operations, showing how much gross income translates into profit. It is valuable for investors to understand the company's financial health.

- EBIT calculates profitability by determining profits before interest and taxes, providing insights into the company's earnings in dollars rather than percentages.

- Comparing companies of different sizes within an industry using EBIT can be challenging as it solely evaluates financial profit, making it harder to assess small and medium-sized enterprises alongside larger corporations.

- Additional metrics may be needed for a comprehensive analysis.

Steps to Calculate Operating Income

Method 1

The first method can be calculated in the following four simple steps:

- Firstly, the total revenue has to be noted from the profit and loss account. For example, the total revenue will be computed in a manufacturing company by multiplying the number of units produced with the average price per unit.

Total Revenue = Number of Units Produced * Average Price Per Unit - The cost of goods sold is also available in the profit and loss account. It is calculated by adding the raw material purchase during the accounting period to the beginning inventory and then deducting the closing inventory.

Cost of Goods Sold = Beginning inventory + Purchase of raw material - Closing inventory - The operating expenses are also gathered from the profit and loss accounts. It includes various direct and indirect costs like labor, depreciation, administrative expenses, etc.

- Finally, the EBIT is arrived at by deducting the values derived in Step 2 and Step 3 from the value in Step 1, as shown below.

EBIT = Total revenue - Cost of goods sold - Operating expenses

Method 2

On the other hand, the following four steps help in the calculation of the Operating Income by using the alternate method:

Step 1: Firstly, the net income must be captured, which is easily available in the profit and loss account as a line item. Ensure that non-operating income (deducted) and expense (added back) have been adjusted as these are not part of the core operation.

Step 2: The interest expense is also available in the profit and loss account. It is the product of the effective rate of interest and outstanding borrowing across the year.

Step 3: The taxes are also collected from the profit and loss account.

Step 4: Finally, the EBIT is derived by adding back the values derived in Step 2 and Step 3 to the value in Step 1, as shown below.

EBIT = Net income + Interest expense + Taxes

Calculation Examples of Operating Income

Let’s see some simple to advanced examples of EBIT to understand it better.

Example #1

Let us consider an example to calculate EBIT for a company called ABC Limited, which manufactures customized roller skates for both professional and amateur skaters. At the end of the financial year, the company had generated $150,000 in total revenue and the following expenses.

In the below-given Screenshot is the data used for the Calculation of Operating Income

| Particulars | Amount |

|---|---|

| Salaries | $50000 |

| Rent | $20000 |

| Total Revenue | $150000 |

| Interest Expense | $10000 |

| Depreciation Expense | $25000 |

| Taxes | $4000 |

We will use the following values for the calculation of Operating Income.

Cost of Goods Sold

Net Income

Therefore, Net income = $41,000

At the end of the financial year, ABC Limited's net income stood at $41,000.

Now, Using the first method to calculate Operating Income is as follows –

i.e. EBIT = $150,000 - $70,000 - $25,000

EBIT will be -

So, EBIT = $55,000

Now, we will calculate Operating Income using the second method mentioned above.

i.e. EBIT = $41,000 + $10,000 + $4,000

EBIT will be -

So, EBIT = $55,000

Example #2 (Apple Inc)

Let us take the real-life example of Apple Inc.’s annual report on September 29, 2018. The following information is available:

| Particulars | Sep 29, 2018 |

|---|---|

| Net Sales | $265,595 |

| Cost of Sales | $163,756 |

| Research and Development | $14,236 |

| Selling, General and Development | $16,705 |

| Non-Operating Income | $5,245 |

| Interest Expense | $3,240 |

| Taxes | $13, 372 |

| Net Income | $59, 531 |

The calculation of Operating Income will be as follows –

Therefore,

- EBIT (in Millions) = Net income + Interest expense + Tax - Non-Oper. Income

- EBIT = $59,531 + $3,240 + $13,372

Operating Income will be -

- EBIT = $70,898

Revenue vs Income Explained in Video

Relevance and Use

EBIT is a profitability metric that helps assess how a company is performing, which is calculated by measuring profit before payment of interest to lenders or creditors and taxes to the government. It is a profitability calculation measured in terms of dollars and not in percentages like most other financial terms.

However, the operating income formula remains a limitation that is particularly useful when comparing similar companies in the same industry. Since the EBIT formula only measures profit in terms of dollar amount, investors and other financial users usually find it difficult to use this metric to compare differently sized (small & medium enterprise, mid-corporate, and large corporate) companies across the industry.

Calculate Operating Income in Excel (with template)

Now let us take the Apple Inc.'s published financial statement example for the last three accounting periods. Based on publicly available financial information the EBIT (in dollar terms) of Apple Inc. can be calculated for the accounting years 2016 to 2018.

In the below-given table is the data for the calculation of EBIT using both the formula mentioned above.

| Particulars | Sep 29, 2018 | Sep 30, 2017 | Sep 24, 2016 |

|---|---|---|---|

| Net Sales | $265,595 | $229,234 | $215,639 |

| Cost of Sales | $163,756 | $141,048 | $131,376 |

| Research and Development | $14,236 | $11,581 | $10,045 |

| Selling, General and Development | $16,705 | $15,261 | $14,194 |

| Non-Operating Income | $5,245 | $5,068 | $2,804 |

| Interest Expense | $3,240 | $2,323 | $1,456 |

| Taxes | $13, 372 | $15, 738 | $15, 685 |

| Net Income | $59, 531 | $48, 351 | $45, 687 |

Calculation of Operating Income using the first formula.

EBIT = Total revenue – Cost of goods sold – Operating expenses

So EBIT for Sep 29, 2018, will be -

Similarly, we will calculate the EBIT for Sep 30, 2017, and Sep 24, 2016

Calculation of Operating Income using the Second formula.

EBIT = Net income + Interest expense + Taxes

So the Income for Sep 29, 2018, will be -

Similarly, we will calculate the EBIT for Sep 30, 2017, and Sep 24, 2016

From the above table, we can see that the EBIT of Apple Inc. in dollar terms has been growing during the period, which is a positive sign for the company.