Table Of Contents

Operating Expense Definition

Operating Expense (OPEX) is the cost incurred in the normal course of business. It does not include expenses such as the cost of goods sold directly related to product manufacturing or service delivery. They are easily available in the income statement and other costs subtracted from the operating income to determine net profit.

Following are some of the common Operating Expenses -

- Selling General and Admin Expenses (SG&A) - are usually regarded as "overhead." The SG&A category includes expenses such as sales commissions, advertising, promotional materials, rent, utilities, telephone, research, and marketing.

- Management Expenses - It also includes costs such as management & staff compensation and other expenses that do not belong in COGS. This expense category is recognized as an operating expense in the income statement because it is not practically possible to operate the main business without incurring these expenses.

- Labor Cost, Factory Overheads, etc. - This expense can also include costs referred to as COGS (cost of goods sold), and the category comprises of inventory cost, freight expense, labor cost, factory overhead, etc.

However, it is to be noted there are a few other expenses that are not included in the calculation of OPEX as it is considered unrelated to a company's core operations. This category of expenses includes costs such as interest expense or other costs of borrowing, one-time settlement, accounting adjustments, taxes paid, etc.

Examples

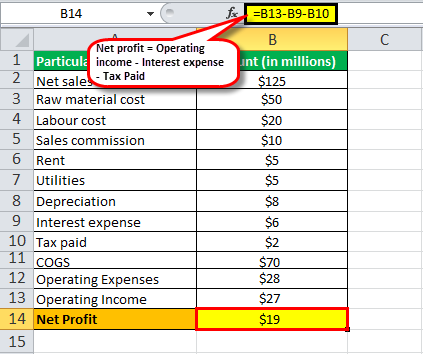

Let us take an example of an income statement of a company named XYZ Ltd to illustrate how OPEX is deducted from net sales in determining operating profit and the net profit. All the amounts shown in the table below are in millions.

| Particulars | Amount (in millions) |

|---|---|

| Net Sales | $125 |

| Raw Material Cost | $50 |

| Labour Cost | $20 |

| Sales Commission | $10 |

| Rent | $5 |

| Utilities | $5 |

| Depreciation | $8 |

| Interest Expense | $6 |

| Tax Paid | $2 |

For the calculation of Net Profit first, we will calculate the following values.

COGS

- COGS = ($50 + $20) million

- COGS = $70 million

Operating Expense

Operating Expense Formula = Sales commission + Rent + Utilities + Depreciation

- = ($10 + $5 + $5 + $8) million

- = $28 million

Operating Income

Now, Operating income = Net sales – COGS – Opex

- Operating income = ($125 – $70 – $28) million

- Operating income = $27 million

Net Profit

Finally, Net profit = Operating income – Interest expense – Tax Paid

- Net profit = ($27 – $6 – $2) million

- Net profit = $19 million

Relevance and Uses of OPEX

It is essential to understand the concept of this expense as it is a crucial component in the calculation of operating profit, which is then used to calculate net profit, which is again a critical factor in the assessment of a company's financial performance. The thumb rule states that the lower a company's OPEX, the more profitable the company is.

The formula for calculation of net profit (as per popular practice) is given below,

Net profit = Operating profit – Taxes paid – Interest expense

where,

Operating profit = Net sales – COGS – Opex

It is to be noted that several factors can impact this expense, which includes (not exhaustive) pricing strategy, raw materials price, labor cost, etc. However, these expenses are part of daily decisions, and such financial performance based on OPEX can be regarded as a measure of managerial flexibility and competency, especially during a difficult economic scenario.

Although it is seen as a measure of financial performance, it is essential to note that it varies across industries, i.e., some industries tend to have higher operating expenses than others. Consequently, comparing this expense among companies within the same industry is more meaningful, such that the designation of "high" or "low" expenses should be made within that context.

Another interesting thing about controlling it is to find the right balance, which can be difficult, but once achieved, it can yield significant returns. There are several examples where the company has successfully reduced the OPEX to gain a competitive advantage, which has eventually resulted in increased earnings. Nevertheless, it is to be taken into cognizance that the reduction of these expenses can also compromise product integrity or quality of operations, which may lead to the deterioration of the company's reputation in the long run.

Recommended Articles

This article has been a guide to what is Operating Expenses (OPEX). Here we discuss how to calculate Operating expenses using its formula and practical examples and uses. You may also have a look at the following accounting articles –