Table Of Contents

What Is The Operating Cycle Formula?

The Operating Cycle Formula refers to the expression that helps businesses calculate their operating cycle, which is defined as the time a firm takes from getting the inventory onboard to receiving the payment after its sale. Calculating this cycle plays a significant role in assessing the efficiency of a business.

The operating cycle formula in accounting represents a cash flow calculation that intends to determine the time taken by a company to invest in inventory and other similar resource inputs and then return to the company’s cash account.

Key Takeaways

- The operating cycle formula shows a cash flow calculation that estimates the time the company invests in inventory and other identical resources put in and then returns to the company's cash account.

- Analysts use it to know a company's operating capability. They use a shorter cycle since it represents the business's efficiency and success.

- Also, the company can make up the investment rapidly and has sufficient cash to satisfy the business obligations.

- It collates similar industries or performs trend analysis to examine the performance across the years. It can help determine whether the company is operating versus other players in the industry.

Operating Cycle Formula Explained

The operating cycle formula in financial management helps determine the time a business takes to purchase inventory, then sell the inventory and then collect the cash from the sale of the inventory. Using the equation to calculate the operating cycle enables the management of a firm be aware of the cash flow in and out of their business.

The business, through this calculation, can check the total time taken from receiving the inventory to storing them, selling them, and customers paying for them. The cash inflow and outflow with respect to the inventory moving in and out becomes easier to observe when the operating cycle is known.

Studying the number of days taken for the inventory to be received, sold, and paid for allows business to check on the debtors creditors, and also the cash they receive or pay for various activities, be it purchase or distribution.

If the operating cycle shows less number of days, it shows the business is on the right track. On the other hand, if the figure obtained is more than what it should be, the businesses are found to be inefficient and lagging behind competitors.

When the operating cycle is shorter, it indicates frequent sale of products, which lets the businesses learn about the extensive demand for the product in the market. On the contrary, if the operating cycle formula reveals longer cycle, it comes as a warning sign for the businesses, indicating lesser movement of inventory in the market, which means the items might not be performing well.

Mathematically, it is represented as,

Operating Cycle Formula = Inventory Period + Accounts Receivable Period

- The first part is about the current inventory level, and it assesses how quickly the company will be able to sell this inventory. It is represented by the inventory period.

- Then, the second part is about the credit sales, and it assesses how much time the company can collect the cash from their sales, represented by the account receivable period.

Video Explanation of Operating Cycle

How To Calculate?

The formula is straightforward as all the required information is easily available in the balance sheet and the income statement, and it can be derived by using the following three steps:

- Firstly, determine the average inventory during the year, calculated as the average of opening and closing inventory from the balance sheet. Then, the COGS can be computed from the income statement. Now, the inventory period can be calculated by dividing the average inventory by COGS and multiplying by 365 days.

Inventory Period = Average Inventory / COGS * 365 - Next, determine the average accounts receivable during the year, calculated as the average of opening accounts receivable and closing accounts receivable from the balance sheet. The accounts receivable period can be calculated by dividing average accounts receivable by net credit sales and multiplying by 365 days. Then, the net credit sales can be taken from the income statement.

Accounts Receivable Period = Average Accounts Receivable / Net credit sales * 365 - Finally, it can be calculated by adding the inventory and accounts receivable periods.

Examples

Let us see some simple to advanced examples to understand them better:

Example #1

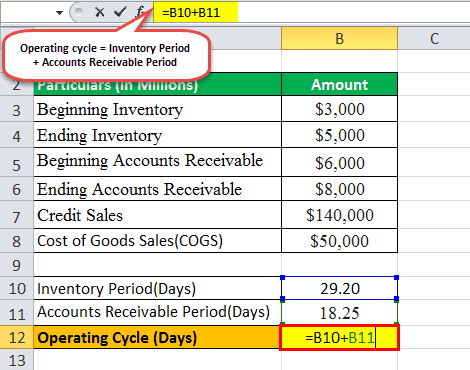

Let us consider an example to compute the operating cycle for a company named XYZ Ltd. As per the annual report of XYZ Ltd for the financial year ended on March 31, 20XX, the following information is available.

The following table shows the data for calculation of the operating cycle of company XYZ for the financial year ended on March 31, 20XX.

| Particulars | Amount |

|---|---|

| Beginning Inventory | $3,000 |

| Ending Inventory | $5,000 |

| Beginning Accounts Receivable | $6,000 |

| Ending Accounts Receivable | $8,000 |

| Credit Sales | $140,000 |

| Cost of Goods Sales (COGS) | $50,000 |

So, from the above-given data, we will calculate company XYZ's Inventory Period (days).

Inventory Period = Average Inventory / COGS * 365

= ($3,000 + $5,000) ÷ 2 / $50,000 * 365

= 29.20 days

Now, we will calculate the Account Receivable Period (Days) of company XYZ.

Accounts Receivable Period = Average Accounts Receivable / Net credit sales * 365

= ($6,000 + $8,000) ÷ 2 / $140,000 * 365

= 18.25 days

Therefore, the calculation of the Operating cycle of company XYZ will be as follows:

Therefore, Operating cycle Formula = Inventory Period + Accounts Receivable Period

= 29.20 days + 18.25 days

OC of company XYZ is as follows:

OC of XYZ Ltd is =47 days.

Example #2

Let us take the example of Apple Inc. to calculate the operating cycle for the financial year ended on September 29, 2018.

The following table shows the data for calculation of the operating cycle of Apple Inc for the financial year ended on September 29, 2018.

| Particulars | Amount |

|---|---|

| Beginning Inventory | $4,855 |

| Ending Inventory | $3,956 |

| Beginning Accounts Receivable | $17,874 |

| Ending Accounts Receivable | $23,186 |

| Credit Sales | $265,595 |

| Cost of Goods Sales (COGS) | $163, 756 |

So, from the above-given data, we will first calculate the Inventory Period (days) of Apple Inc.

Therefore, Inventory Period = Average Inventory / Cost of sales * 365

= ($4,855 Mn + $3,956 Mn) ÷ 2 / $163,756 Mn * 365

= 9.82 days

Now, we will calculate the Account Receivable Period (Days) of Apple Inc.

Accounts Receivable Period = Average Accounts Receivable / Net credit sales * 365

= ($17,874 Mn + $23,186 Mn) ÷ 2 / $265,595 Mn * 365

= 28.21 days

Therefore, the calculation is as follows:

Operating cycle Formula = Inventory Period + Accounts Receivable Period

= 9.82 days + 28.21 days

OC of Apple Inc is as follows:

OC of Apple Inc. is =38 days.

Relevance and Use

It is essential to understand the concept of the operating cycle formula as it helps to assess how efficiently a company is operating. An analyst can use this cycle to understand a company’s operating efficiency. An analyst would prefer a shorter cycle because it indicates that the business is efficient and successful. Besides, a shorter cycle also indicates that the company will be able to recover its investment fast and has adequate cash to meet its business obligations.

On the other hand, if a company has the longest cycle, it means that it takes a long time to convert its inventory purchases into cash. Such a company can improve its cycle either by implementing measures to quickly sell off its inventory or reduce the time needed to collect receivables.

The operating cycle formula can compare companies in the same industry or conduct trend analysis to assess their performance across the years. A comparison of a company's cash cycle to its competitors can be helpful to determine if the company is operating normally vis-à-vis other players in the industry. Also, comparing a company's current operating cycle to its previous year can help conclude whether its operations are on the path of improvement or not.