Table Of Contents

What Is Opco (Operating Company)?

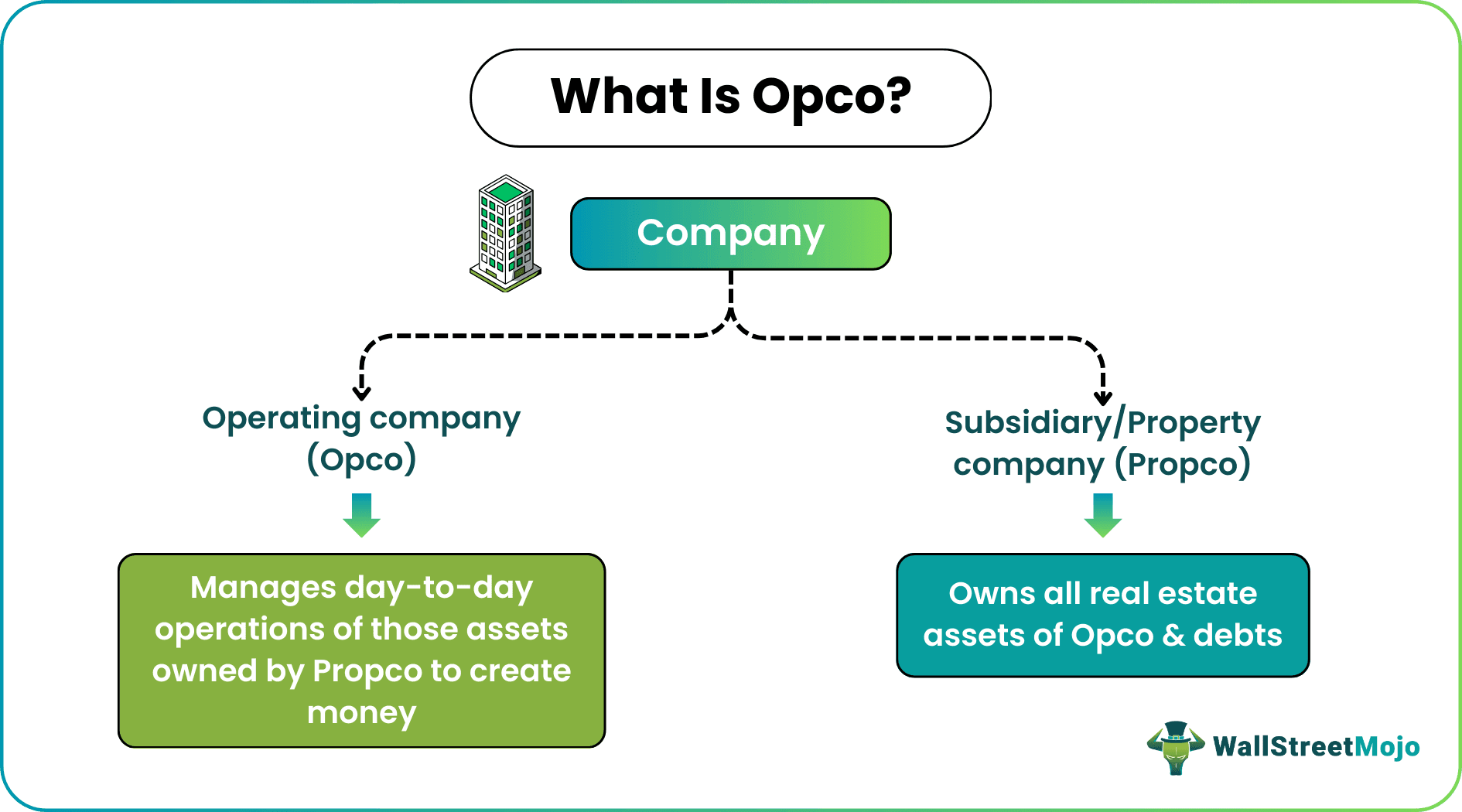

Opco or operating company holds indirect ownership, leasehold, or other interests in assets owned by its direct or indirect subsidiary. It is an essential part of the Opco/Propco organizational model with the rights to sell all its revenue-generating assets to its subsidiary and then lease them back to run its business.

The subsidiary created with Opco formation owns all its real estate assets and associated debts and hence is also known as a property company (Propco). However, the operating company is only responsible for managing operations of those properties to generate revenues. The structure is widely popular among real estate companies, investment banks, hospital groups, and hotel chains to ensure long-term financial benefits to both companies.

Key Takeaways

- Opco (operating company) is a vital component of the Opco/Propco organizational paradigm, with indirect ownership, leasehold, or other interests in assets owned by Propco.

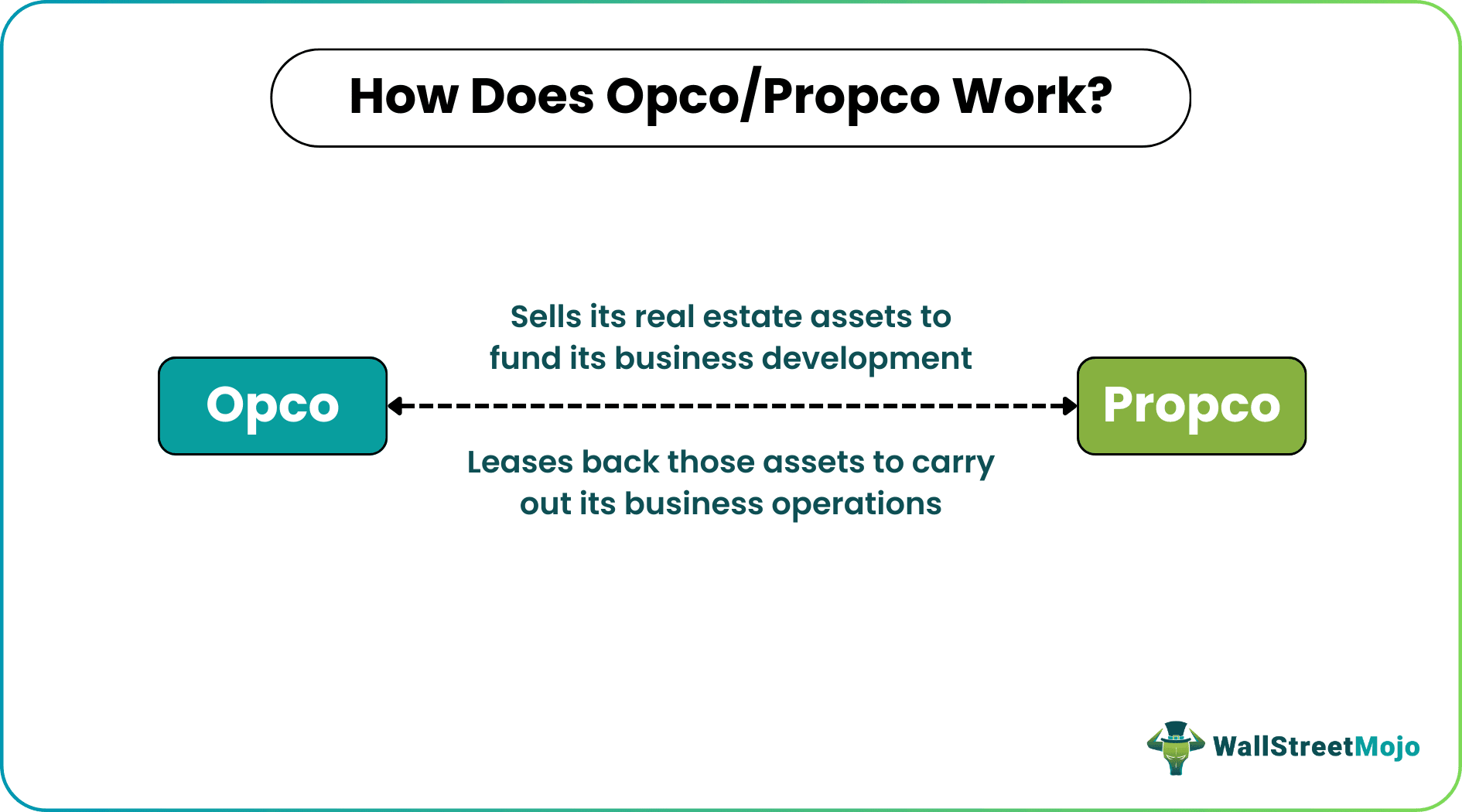

- Opco sells all of its real estate assets to Propco and proceeds to fund its business development. It then leases back those assets from Propco to carry out its operations.

- Propco owns all real estate assets and debts, while operating the company holds all other operating assets and manages day-to-day operations of those properties to create money.

- Two characteristics distinguish REITs from REOCs - tax treatment and government regulations.

How Does Opco/Propco Work?

The Opco/Propco model provides both companies financial advantages, such as improved credit rating and tax avoidance. This structure is quite common in real estate businesses. It usually entails forming a real estate investment trust (REIT) in which operating company serves as the tenant and Propco serves as the landlord. While the latter leases the spun-off assets back to the former (sale-leaseback), the former pays rent on the latter's assets.

The United States Congress first created a REIT in 1960. REITs are companies or trusts that enable investors to invest in real estate holding companies and earn a profit share without owning any property. These are like mutual funds but with only real estate properties in their portfolio.

Companies with substantial real estate assets have to incur a huge cost on carrying these assets. Many companies convert to a REIT to reduce this liability and free up funds to accelerate their growth. A company has three options to convert to a REIT:

- Create an Opco/Propco structure wherein the operating company can spin off the property company as a REIT.

- Use umbrella partnership REIT wherein the company forms an operating partnership through an IPO.

- Form REIT by converting companies using existing rental income from real estate assets.

Opco/Propco Working Structure

Under the Opco/Propco deal, a company splits into two entities - Opco and Propco. Opco meaning refers to the operating company that holds operating assets and manages all the business operations. It sells all its real estate assets to the property company (Propco) for cash. The operating company uses these funds for business expansion. However, since Opco stills need assets of Propco to carry out its business, it leases back those assets from Propco. In return, the operating company pays a periodical rent per the lease agreement.

Propco uses real estate assets as a security to obtain cheap mortgage loans. It also uses the lease rent received from the operating company to service loans. In addition, since Propcos have access to capital, they can use it to advance their real estate business.

A company can opt for an Opco/Propco structure that utilizes real estate investment trust (REIT) for tax benefits. Thus, the operating company spins off Propco as a REIT.

Special tax laws govern REITs. As per Internal Revenue Code (IRC), a company must comply with some general requirements to qualify as a REIT. REITs get significant tax benefits on the corporate income tax level. However, they also have to pay an equally important part of their earnings as dividends.

The Opco/Propco model has gained a lot of recognition over the years. It serves as a successful model throughout the world. However, businesses must avoid this structure in the event of a significant drop in property values.

Opco Examples

Let us look at some Opco/Propco examples to understand the concept better:

Example #1

Suppose a company, Marcus Hotels, operates a hotel chain with 15 hotels. It decides to follow the Opco/Propco model. It will transfer all of its real estate assets to its Propco Comfy Stays.

As per the structure, Marcus Hotels is an operating company holding operational assets and handling all the business operations, while Comfy Stays is a Propco owning of all of Marcus Hotels’ real estate assets.

Marcus Hotels may then lease back those assets to use them to carry on its business and generate income. It is also called sale-leaseback. Comfy Stays gets the lease rent per the lease agreement.

Separating the ownership of different types of assets enables both the companies to ring-fence their finances and focus on their respective operations. Comfy Stays can obtain attractive financing terms and cheaper debt using real estate assets as security. Marcus Hotels, too, can release held-up capital in the real estate for its business expansion. It is a win-win situation for both of them.

Example #2

Hilton Worldwide Holdings Inc. executed the tax-free spin-off of its Park Hotels & Resorts Inc. in 2016. The Park Hotels & Resorts (Opco) spun off the Propco Park Parent as a REIT.

The French hotel company Accor did the same with AccorHotels (Opco) and AccorInvest (Propco). However, AccorInvest was later divested.

The Opco/Propco structure was quite popular during the 2004-2007 real estate boom. It helped companies raise funds through the sale-leaseback approach without losing control over their assets. However, the 2008 global financial crisis exposed drawbacks of this business structure.

Advantages

- Access to an additional source of capital – Companies holding considerable real estate assets incur a high cost of capital for carrying them. But creating this structure through the sale and leaseback of their real estate assets, they can release held-up capital and use it to finance growth.

- Better real estate asset management – By creating a subsidiary Propco, the Opco can rest assured that its real estate assets will be owned and operated well.

- Additional stability and financial growth – Every company strives for growth, and this structure acts as a catalyst. It offers Opco and Propco the freedom to utilize the capital to improve their ongoing businesses effectively.

- Cheaper financing – Lenders offer loans at more reasonable rates with a fully collateralized mortgage and the lease rent servicing the loan. Thus, propco obtains efficient and less expensive real estate-backed financing.

- Reduced financial liabilities – The operating company can profit from the structure and avoid dealing with debt payment responsibilities, credit ratings, and related debts.

- Tax benefit – A REIT, formed due to the spin-off, does not have to pay double taxes on its income distribution at the company level, provided it conforms to specific IRC provisions.

Real Estate Operating Company (REOC) vs REIT

REOCs and REITs differ from each other in terms of investment, operation, taxation, and regulation. Let us look at those differences outlined below:

| Particulars | REOC | REIT |

|---|---|---|

| Definition | REOC is a public company that owns, manages, develops, or sells real estate but does not comply with certain IRC provisions to qualify as a REIT. | REIT is a corporation, trust, or association that owns and manages real estate. It functions like a mutual fund but must comply with certain IRC provisions. |

| Tax treatment | REOCs are taxable entities like any other company. They have to pay income taxes at normal corporate rates as per federal law. | REITs enjoy exemption from federal taxes (on meeting specific statutory requirements) under federal tax law. |

| Federal regulation | No IRC restrictions | Subject to IRC guidelines |

| Investment focus | Acquire new properties, fund refurbishment or new construction, and then resell them for profit | Generate revenues via the lease or rent yielded by holding real estate assets. |

| Profit disbursement | Management has the discretion to distribute earnings to the shareholders or use them for business development, such as acquisitions, new constructions, or refurbishments | The company is legally obliged to distribute 90% (at least) of its earnings as dividends among its shareholders. |

| Flexibility | Greater flexibility with respect to capital deployment due to no federal restrictions | Lack of flexibility due to restrictions imposed by federal law |

| Potential | Better growth opportunities | Preferred for immediate income |

| Investor goals | Higher return on equity | Steady and high dividends with the benefit of higher liquidity |

| Investor goals | Double taxation for shareholders, once at the company level and then on receiving the dividend income | Shareholders are taxed only once on receiving the dividend income, no tax at the company level |