Table of Contents

Introduction

With the advent of online platforms, it has become extremely easy for individuals to buy and sell financial instruments, for example, stocks, bonds, contracts for difference or CFDs, and exchange-traded funds, online. They can now trade securities from their preferred location at their convenience. Moreover, as technology keeps evolving over time, traders will have access to new features and tools on such platforms that will enhance their trading experience.

That said, although such platforms offer various benefits, there are some hidden risks of online trading that one must be aware of before they open their trading account and start buying and selling securities. In this article, we’ll be discussing online trading dangers in detail. But before that, let us understand what online trading is.

What Is Online Trading?

Online trading or electronic trading refers to a process that involves buying and selling assets, including commodities, CFDs, and debt instruments, via an online platform. Usually, a brokerage firm provides such an electronic interface that facilitates trading. Any person with an internet connection can utilize the platform to buy and sell securities. Individuals can engage in online trading to meet different kinds of objectives, for example, capital appreciation and capital protection.

One must make sure to consider key factors before engaging in online trading. Some of the aspects are their financial goals, investment risks, and investment time horizon.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

How It Works (and How It Can Go Wrong)

The process of online trading involves the following steps:

- Individuals open an online trading account with a trustworthy brokerage firm.

- Once the account becomes active, traders can transfer funds to it from their bank account.

- Individuals can use the platform to get access to market data, carry out analysis of charts, and execute orders based on aggressive or safe trading strategies.

- Post-execution, the transfer of assets occurs via the settlement process.

If traders do not conduct thorough research or trade without a proper plan, they might incur significant financial losses. Also, they must not let their emotions impair their decision-making. Opening or exiting positions without proper analysis can lead to losses or failure to capitalize on opportunities to make profits.

Traders should also make sure that they open an account with a trustworthy brokerage firm. If they open an account with a fraudulent online trading platform, they’ll end up losing all their money. In addition to this, there are more hidden risks of online trading. Let us explore them in the next section.

What Makes It Risky?

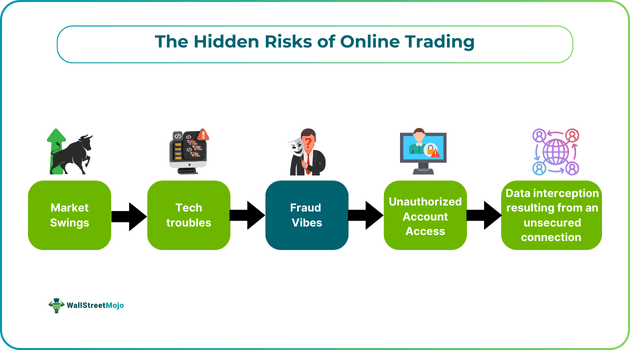

Let us look at the different factors that make online trading risky.

#1 - Market Swings

Market swings are significant fluctuations in the price of an asset over a short duration owing to high volatility. One can identify market swings when a financial instrument’s market price suddenly changes direction. Note that this sharp change in price is a market swing.

#2 - Tech Troubles

Another significant risk of online trading is technological disruption. Such an issue may arise due to issues related to internet connectivity, hardware, the mobile application, etc.

#3 - Fraud Vibes

Generally, a fraudulent trading platform will have an appealing, professional design and claims to make individuals richer quickly. Usually, such platforms target victims via advertisements on social media platforms. These online trading platform providers often have an aggressive approach; they might even want to control the trader’s device remotely and execute transactions. Moreover, the fraudsters even try to persuade the victims to allocate increasingly higher amounts to securities.

Biggest Risks We Face

Security with respect to access and connection is a vital thing to focus on for all online traders. After all, when there's fraud, and any hacker gets access to your trading account or the highly sensitive data transmitted online, you may suffer substantial losses. Moreover, hackers may utilize your personal information to conduct illicit activities that can lead to serious legal issues.

How To Avoid the Risk?

Individuals can download a VPN to secure their connection. A VPN will encrypt the sensitive data being transmitted across the internet. Hence, your personal information, trading strategies, and account details will remain safe. The encryption will make it impossible for any hacker to decipher or intercept the data.

Also, one way to secure access to the trading account is by utilizing the dual authentical feature for your account. Besides this, traders must make sure not to leave their system unattended while they are logged in. If you are leaving your seat for a short duration, make sure to log out.

How To Keep The Account Safe

Let us look at the different steps one can take to eliminate some risks of online trading and keep their account safe:

- Open a trading account with reputed trading platforms.

- Utilize strong passwords by incorporating numbers, letters, and special characters.

- Activate dual or two-factor authentication.

- Be careful of phishing scams and verify the authenticity of messages and emails you receive to avoid them.

- Utilize a VPN to secure the connection and keep personal data and account details safe.

- Be sure to monitor the trading account activity from time to time to identify anything suspicious.

- Use a strong password for the trading account, keeping in mind the password safety rules, and be sure to log out once you decide not to trade for a certain duration.

The Good And Bad

Now that you are aware of the risks of online trading, let us look at some of the benefits and limitations of buying securities using an electronic interface.

| Benefits | Limitations |

|---|---|

| Convenience and accessibility | Security risk |

| Access to analysis tools, charts, and real-time market data | Technological issues |

| Higher trade execution speed compared to offline trading via brokers | The possibility of overtrading or emotional trading because of easy access |

| A high degree of transparency with regard to account-related information, for example, portfolio performance, account balance, transaction history, etc. | Information overload because of the availability of vast data and various tools |

Conclusion

Without a doubt, online trading has made individuals’ lives so much easier by enabling them to buy and sell stocks and other financial instruments online. However, with this convenience comes certain risks. Everyone must ensure to become aware of such risks of online trading and take the necessary steps to minimize or eliminate them to have an optimal trading experience and become a successful trader.

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.