Table Of Contents

Occupancy Rate Meaning

The occupancy rate is the ratio of rented units to the total number of available units in a building, tower, housing unit, state, or city. It is one of the critical concepts for those investors who are fairly interested in dealing with real estate transactions.

Usually, a real estate player purchases several accommodation units and maintains a portfolio. Their primary intent is to derive rental income from such units. Therefore, such investors try to assess the performance of the real estate portfolio by determining the occupancy. This also helps them to make understand their current income and make future estimates and projections regarding how much useful this kind of investment can turn out to be.

Key Takeaways

- The occupancy rate is the ratio of rental apartments to the total number of available units in a building, tower, housing unit, state, or city. It is one of the most essential principles for real estate investors.

- The occupancy rate is related to the vacancy rate. The vacancy rate is computed by dividing the number of empty units by the total available space. It may be separated into two categories: physical and economic.

- A high occupancy rate usually indicates that the real estate properties are used to generate the most rental income possible. It clearly shows how much cash a real estate investor may expect from their portfolio.

Occupancy Rate Explained

Occupancy rate is a ratio or a percentage that is used in various industries to assess the usage or the occupancy level of available spaces or an asset. Thus, it is a proportion of the rentable space in relation to the available ones that are currently occupied by the users.

The occupancy rate is inversely related to the vacancy rate. The vacancy rate is expressed as the ratio of vacant units to the total available space. It can be bifurcated into physical and economic.

It helps evaluate the usage of properties that can be rented out, like office spaces, residential apartments, hotel occupancy rate etc. It gives an insight into how much rental income the spaces can generate, which can be used to assess the performance of the real estate sector and accordingly make investments.

In other words, it indicates how effectively the places are utilized, and the data is highly useful for property owners and investors who can evaluate the return on their investment in real estate with such data.

Formula

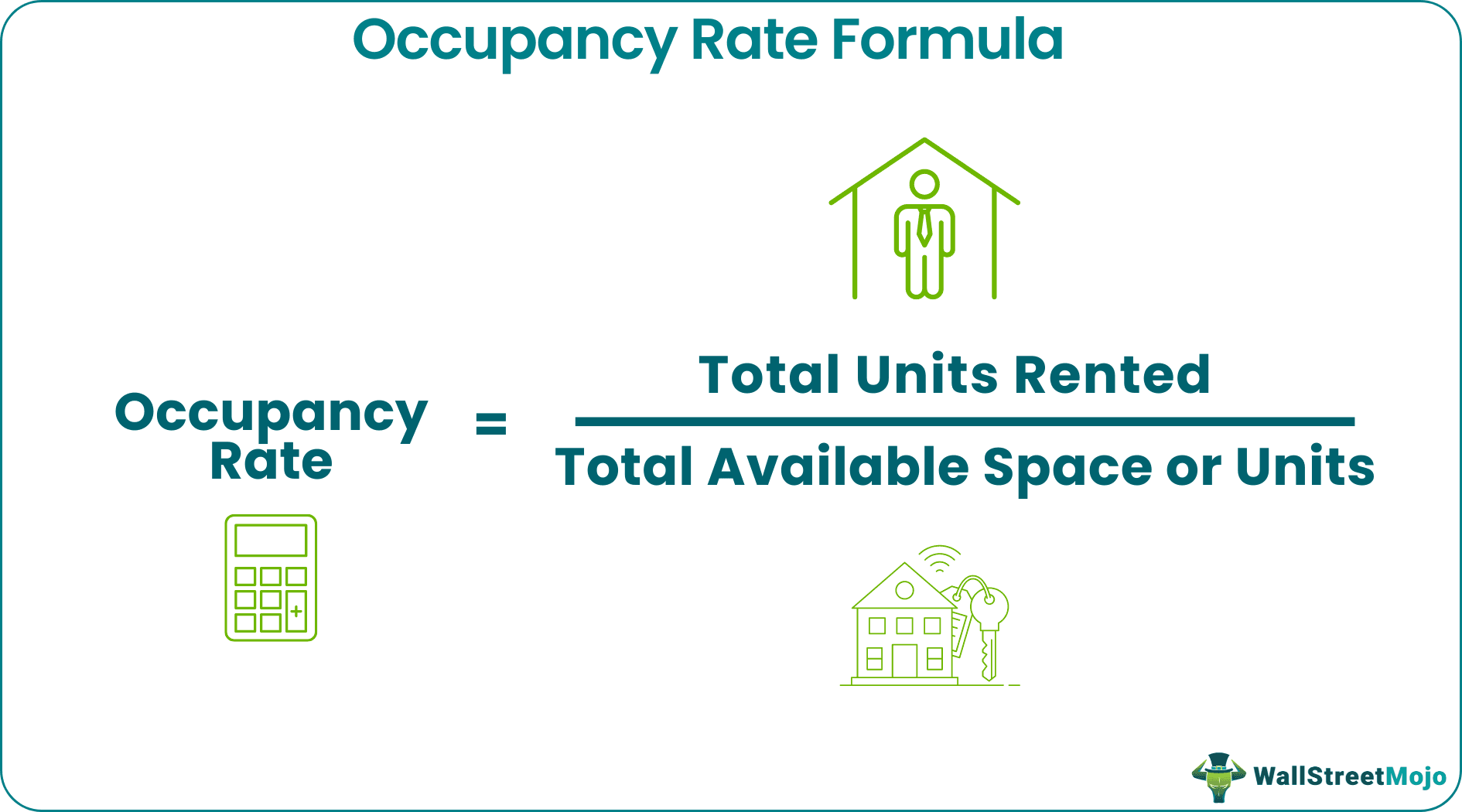

Mathematically, the physical level is expressed as follows: –

Occupancy Rate = Total Units Rented / Total Available Space or Units

The economic occupancy rate is a metric that analyses potential gross rent collected by the owner. Mathematically it can be used to calculate occupancy rate ,which is expressed as follows: –

Economic Occupancy Rate = Total Gross Rent Collected / Total Gross Potential Rent

If we take the case of hotel industry and try to calculate the hotel occupancy rate, it is possible to compute the percentage of rooms occupied at a given point of time and analyses the demand for hotel accommodation.

How To Calculate?

The formula for physical occupancy Rate formula can be computed by using the following steps:

- Step 1: Firstly, determine the number of available units to be occupied.

- Step 2: Next, Determine the count of occupied units.

- Step 3: Next, Divide the occupied units by the total available units.

The formula for economic occupancy rate formula can be computed by following the below steps: –

- Step 1: Initially, determine the rent provided by each unit.

- Step 2: Next, determine the sum of the total rent derived from the portfolio.

- Step 3: Next, determine the rent collected from the occupied units and add them up.

- Step 4: Next, Divide the gross rental income collected by the potential gross rent derived from the economic or accommodation unit.

The above details give a step-by-step description of how to calculate occupancy rate for both physical occupancy, which is how many units are actually occupied and economic occupancy, which is how much rental income is being generated.

Examples (with Excel Template)

Let us try to take some examples to understand the concept.

Example #1

Let us take the example of commercial property. The commercial property is composed of 200 units. The count of units that are occupied accounts for 140 units. Help the investor determine the physical occupancy rate.

Solution

- =140/200

Therefore, the physical occupancy for commercial property is at 70 percent.

Example #2

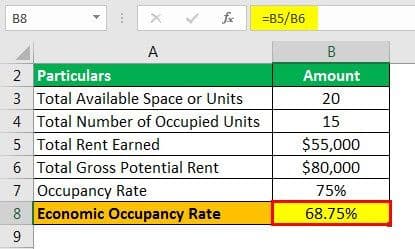

Let us take the example of a real estate investor who holds 20 units of residential accommodation. The investor can derive $80,000 from the entire portfolio, whereas it earns $55,000 from the occupied units. The number of occupied units stands at 15 units. Help the investor determine the physical and rental occupancy rate.

Solution

- =15/20

Therefore, the physical occupancy rate for the portfolio is at 75%.

Calculation of Economic Occupancy Rate can be done as follows,

- =$55000/$80000

Uses

A high occupancy rate typically signifies that the real estate properties are being utilized to derive maximum rental income. The rental occupancy rate gives a clear indication of how much-expected cash flows a real estate investor can earn from its portfolio. Further, a well-maintained real estate portfolio can generate a good stream of income and can be regarded as the gold mine in disguise or a true money maker.

An investor who may be interested in investing in the shopping mall or medium shopping centers can earn a steady stream of income if he goes ahead with the investment. If the investor has to face a situation of low occupancy, then an investor has to pitch hard and locate more tenants who can occupy such vacant units. In short, it can infer that this rate helps predict a steady stream of income.

The investor with low occupancy has to quickly achieve this so that they don't have to bear the maintenance cost of the empty units. They can break even over their investments and make up for their property taxes from these derived income streams. Additionally, since these spaces are vacant, the investor loses the opportunity to earn maximum income.

Apart from commercial real estate, real estate occupancy rate has significant applications in hospitals, hotels, senior housing units, and call centers. The investor who is bugged with the problem of prolonged low occupancy rates suggests that the units are not well maintained, or such units may be located at an undesirable location, or the units may be brought up with bad construction materials. In call centers, a team leader usually assesses how much time an associate spends in the call-in line with the allocated hours.

How To Increase?

There are several ways to increase the rate, which are as given below:

- Effective marketing and advertising through social media, real estate portals or through other ways to promote the property and its uses so that more people are interested in taking it on rent.

- The amount charged as rent should be competitive, which means it should neither be too high nor too low. It should be ableto generate enough income depending on the type of property as well as be affordable.

- The appearance and maintenance of the property should be good enough to attract prospective tenants. It should have the regular amenities and facilities so that tenants need to face any unnecessary problems during their stay.

- The customer service from the owner’s side as well as the people who manage it, should be of good quality. Otherwise, it will be very difficult to retain clients. If tenants are satisfied, they may agree to even pay a higher rent to stay there.

- The lease terms should be flexible, depending on the market demands.

- Some incentives can be given to the tenants so that they are motivated to rent the property and continue to stay there.

Thus, in the above ways, the occupancy rate may be increased.

Occupancy Rate Vs Vacancy Rate

The above two topics are opposite to each other and are very important metric in the real estate industry for assessing the sector performance. Let us try to understand the difference between the two.

- The former shows the proportion of occupied units to the total number of available units and the latter shows the proportion of unoccupied units to the total number of available units.

- The former is calculated by dividing the occupied units by the total number of units and the latter is calculated by dividing the unoccupied units by the total number of units.

- The real estate occupancy rate indicates how much income is being generated from real estate, and the latter indicates how much income is being lost but could have been generated.

Both of them are great indicators for property owners and professionals, providing an insight into the market performance.