Table Of Contents

What is a Not-For-Profit Organization?

A Not-for-profit organization is set up for any social, religious, educational, or public service purpose wherein the motive is not to earn profits. However, any profits earned during business are donated to achieve the organization's goals.

Key Takeaways

- A Not-for-Profit organization is typically established for social, religious, educational, or public service objectives, aiming not to generate profits.

- Any profits made during business are typically used to further the organization's goals through donations or reinvestment.

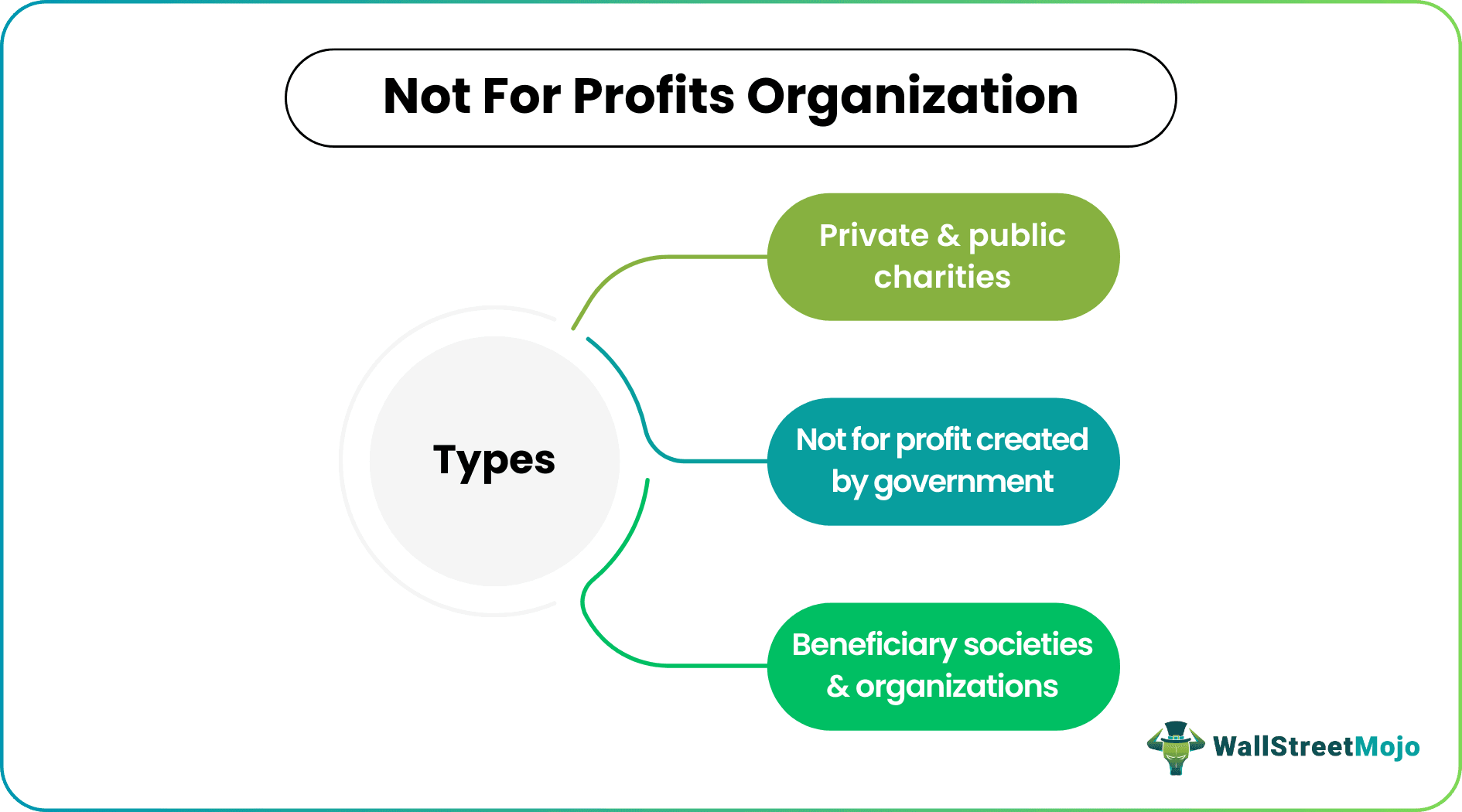

- Not-for-Profit organizations can be categorized into different types, including private and public charities, not-for-profits created by the government, and beneficiary societies and organizations.

- Not-for-Profit organizations may enjoy benefits such as tax exemption, government grants, tax-deductible donations, personal satisfaction from contributing to a cause, and limited liability for its members or directors.

Explanation

The main purpose of setting up any business is to earn profits. But certain organizations are set up with the motive to provide service to their members or to the general public, which is called Not-for-profit organizations. These organizations need to apply for tax-exempt status. This status grants exemption from most forms of taxation like sales tax, property tax.

Types of Not for Profit Organizations

#1 - Private and Public Charities

According to the Internal Revenue Service, this section applies to charitable, religious, educational, scientific, and literary testing for public safety to foster national or international amateur sports competition or prevention of cruelty to children or animals organizations. Most of these organizations are registered under section 501(c)(3) of the tax code. These are further classified into two categories, Private Charities and Public Charities. Private individuals run private charities, and Public foundations are run by larger groups such as schools, hospitals, and churches.

#2 - Not for Profits Created by Government

These organizations fall under section 501(c)(1) of the tax code. These organizations are 'created by the act of Congress.'

#3 - Beneficiary Societies and Organizations

These are the small group of people working together to help their members and society, as a group of teachers providing free education.

Difference Between Not-for-Profit and For-Profits Organizations

- As the name suggests, the For-Profits organization's main aim is to maximize its profits. Not for Profits' aim is not to maximize profits.

- For-profit organizations' profits are distributed to their shareholders/owners. This organization's profits are invested back to achieve its goals.

- Not-for-profit organizations are exempt from paying taxes, but profit organizations have to pay taxes on their income.

- For-Profit organizations can diversify their business and engage themselves in a huge range of activities but not for profit have to operate as per the objectives for which they were formed.

- The sole purpose of not for profits is to serve society. For them, society comes first, and personal motive comes next, which is the opposite in the case of for-profit organizations.

- The financial Statements of for-profit include Income Statements, Balance sheet, and Cash flow statements. Not for profits has to prepare a Receipt and Payment Account, Income and Expenditure Account and Balance Sheet.

Benefits

- Tax Exemption: These organizations are exempted from paying taxes; hence all the income is diverted to businesses to achieve their goals.

- Government Grants: It is one of the biggest sources of income since these organizations work to better society, getting government favors.

- Tax-Deductible Donations: The donations given by individuals to these organizations are often tax-deductible, so this is another incentive for the people to contribute to these organizations.

- Personal Satisfaction: Working for society and social welfare provide a sense of fulfillment and personal satisfaction to the people working for it.

- Limited Liability: It has limited liability i.e., the board members are not personally liable for any organization’s debts and liabilities.

Conclusion

Not-for-profit organizations are set up for a social cause. There is no profit-earning motive. Anyone who wants to serve society and has an idea can put up a business plan and decide how to achieve its objectives. Not-for-profit and Nonprofit are both set up for not working for profit. However, there are some differences. Nonprofit is a bigger term and includes not-for-profit organization.