Table Of Contents

NOPAT Meaning

NOPAT or Net Operating Profit after Tax is a profitability measure in which a company’s profit is calculated excluding the effect of leverage by assuming that the company does not have any debt in its capital and, in turn, ignores the interest payments and the tax advantage which companies get by issuing debt in their capital.

It considers the EBIT (Earnings before interest and taxes) and then deducts the adjustable tax amount. It is a common metric that is used for the assessment of Economic Value Added (EVA), which gives a good level of accuracy in operating efficiency calculation. However, it does not account for tax deductions received due to heavy debt.

Key Takeaways

- NOPAT, or Net Operating Profit after Tax, is a profitability metric used to estimate a company's profit without factoring in the influence of leverage, assuming the company has no debt in its capital structure.

- By excluding interest payments and tax benefits gained from issuing debt, NOPAT focuses solely on the company's operating performance.

- This metric provides insights into a company's core operations by considering its performance after accounting for applicable taxes.

- It serves as a meaningful representation of a company's operating profitability, providing a clear picture of its performance without the impact of debt-related financials.

NOPAT Explained

The financial term NOPAT stands for net operating profit after tax. It is a financial metric that reflects the level of the company’s performance through its primary operation after taking into consideration the taxes. It provides a very clear and precise view of the company’s operation and its efficiency level through assessment of its net operating profits.

The value is NOPAT calculation dependable because it excludes the impact of tax that may vary to a significant extent due to the impact of tax and laws and strategies that the company of the industry follows in the country where it is operating form. It is a common benchmark for measuring the efficiency of leveraged companies that have high debt level.For example, let’s say that EBIT is $40,000, and the adjustable tax is $8,000. Then the Net Operating Profit After Taxes would be = $(40,000 – 8,000) = $32,000.

However, the NOPAT calculation does not take into consideration the savings from taxes the company makes if it has a lot of debt. It gets tax considerations or deductions, which are not accounted for in the calculation.

Analysts and investors in the financial market can use this calculation for the purpose of evaluating the organization’s profitability and performance level. But sometimes the true picture may not get reflected since it may not consider some one-time charges or losses like mergers, acquisitions, etc.

The figure of company sales provides the investors and the management with top line performance measures but does not say anything about the operational effectiveness. Similarly, net income includes the tax savings from debt repayment in operating expenses. But NOPAT is a combination of both, that considers the performance level without the impact of leverage.

NOPAT Video Explanation

Formula

The net operating profit after tax formula measures the company's performance from its core operations after taking into consideration the applicable taxes and is calculated by multiplying the one minus tax rate by the company's operating income.

Mathematically, the net operating profit after tax formula is represented as below,

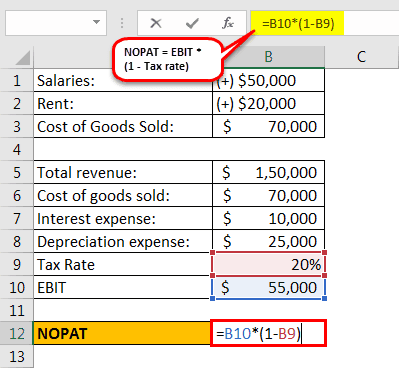

NOPAT Formula = EBIT * (1 – Tax rate)

Net Operating Profit After Tax Formula is also known as Net Operating Profit less adjusted Taxes (NOPLAT). It is to be noted that the formula for NOPAT equation doesn’t include the one-time losses or charges. As such, it is a good representation of a company's operating profitability.

How To Calculate?

Now let us identify the various steps required to calculate the value as per the details below.

- Firstly, the EBIT of the company is determined based on information available in the income statement. EBIT is calculated by deducting the cost of goods sold and operating expenses from the company's total revenue.

EBIT = Total revenue – Cost of goods sold– Operating expenses

- Now, the company's tax rate is noted from the company's annual report. Next, the tax-adjusted value is calculated by subtracting the tax rate from one, i.e. (1 – Tax rate).

- Finally, the formula for net operating profit after tax is derived by multiplying the EBIT with the value calculated in step 2, as shown above.

Examples

Let’s see some simple to advanced examples to understand NOPAT equation better.

Example #1

Let us consider an example for the calculation of NOPAT for a company called PQR Ltd, which is in the business of manufacturing customized roller skates for both professional and amateur skaters. At the end of the financial year, the company had generated $150,000 in total revenue and the following expenses.

Now, the operating income or EBIT of the company can be calculated as,,

- EBIT = $150,000 - $70,000 - $25,000

- = $55,000

Therefore, it can be calculated as,

- NOPAT = $55,000 * (1 – 20%)

Therefore, the NOPAT in finance of PQR Ltd is $44,000 for the given financial year.

Example #2

Let us take the real-life example of Apple Inc.'s annual report on 2016, 2017, and 2018. Calculate the NOPAT for Apple Inc. based on the following available information:

EBIT

Now, the EBIT of Apple Inc. can be calculated as,

EBIT (in Millions) = Net sales-Cost of sales – Research and development expense – Selling, general and administrative expense.

EBIT for Sep 24, 2016

- =$2,15,639 - $1,31,376 - $10,045 - $14,194

- =$60,024

EBIT for Sep 30, 2017

- =$2,29,234 - $1,41,048 - $11,581 - $15,261

- =$61,344

EBIT for Sep 29, 2018

- = $265,595 -$163,756 -$14,236 - $16,705

- = $70,898

Now, the calculation of NOPAT in finance of Apple Inc. for Sep 24, 2016 is as follows,

Calculation of NOPAT for Sep 24, 2016

- NOPAT Formula = $45,687 * (1 – 35.00%)

- = $39,016

Calculation for Sep 30, 2017

- NOPAT = $61,344 * (1 – 35.00%)

- = $39,874

Calculation of NOPAT for Sep 29, 2018

- NOPAT = $70,898 * (1 – 24.50%)

- = $53,527.99 ~ $53,528

Therefore, Apple Inc.’s NOPAT stood at $53,528 Mn for the financial year ended on 29th September 2018.

Example#3

Let’s look at the Income statement of Nestle

Consolidated income statement for the year ended 31st December 2014 & 2015

source: Nestle Annual Report

We have the Net Income now (Profit for the year) and the EBIT (Operating Profit). But to get the adjusted tax rate, we need to calculate the rate.

As the tax rate is not mentioned, we will calculate the rate –

| Profit before taxes, associates, joint ventures (A) | 11784 | 10268 |

| Taxes (B) | 3305 | 3367 |

| Tax rate (B / A) | 0.28 | 0.33 |

Using this tax rate, we will calculate Net Operating Profit After Taxes for both years.

| Operating Profit (X) | 12408 | 14019 |

| Tax rate (Y) | 0.28 | 0.33 |

| Net Operating Profit After Taxes | 8934 | 9393 |

This is the way you should take into account the income statement information and then calculate NOPAT from the EBIT and adjusted tax rate.

Example#4

Let us now calculate Net Operating Profit After Taxes for Colgate. Below is the Income Statement of Colgate.

source: Colgate SEC Filings

- We note that the EBIT of Colgate in 2016 was $3,837 million

The EBIT above does contain noncash items like Depreciation and Amortization, Restructuring costs, etc. However, non-recurring items like restructuring costs need to be adjusted for calculating NOPAT.

Below are Colgate's restructuring costs from its 10K filings.

- Colgate’s restructuring charges in 2016 = $228 million

Adjusted EBIT = EBIT + Restrucutring Expenses

- Adjusted EBIT (2016) = $3,837 million + $228 million = $4,065 million

Let us now calculate the tax rate required for calculating NOPAT.

We can directly calculate the effective tax rates from the income statement.

source: Colgate SEC Filings

Effective Tax rate = Provision for Income Taxes / Income Before income taxes

- Effective tax rate (2016) = $1,152/$3,738 = 30.82%

NOPAT Formula = Adjusted EBIT x (1-tax rate)

- NOPAT (2016) = $4,065 million x (1-0.3082) = $2,812 million

Relevance And Use

The formula for net operating profit after tax is a profitability metric that helps assess how a company is operating efficiently, calculated by measuring profit that is adjusted for the costs and tax benefits of debt financing. NOPAT provides such a view that it is not affected by the company's leverage or the massive bank loan on its books. Such adjustment is essential because these interest payments on debt shrink the net income, which eventually reduces the company's tax expense. Therefore, the formula for NOPAT helps an analyst view how well the core operations of a company are performing (net of taxes). It is a profitability calculation measured in terms of dollars and not in percentages like most other financial terms.

However, there remains a limitation of the NOPAT accounting that it is particularly useful when comparing similar companies in the same industry. Since it only measures profit in terms of dollar amount, investors and other financial users usually find it difficult to use this metric to compare differently sized (small & medium enterprise, mid-corporate, and large corporate) companies within an industry.

NOPAT Vs Net Income

Both the above are two different financial metric that are widely used in the assessment of financial performance of a business. However, there are some differences between the two interims of calculation and purpose. Let us identify the differences.

- The former shows the profit from the company’s main operations after tax, but the latter show the profit after tax and also after considering all expenses.

- The former is calculated by taking the earning before interest and tax (EBIT) and then deducting the tax part from it. However, the latter is calculated by deducting all expenses from the total revenue.

- The former is widely used in financial analysis and valuation model like cash flow analysis or economic value added(EVA) computation, but the latter indicates the company’s financial health, which is reported in the income statement.

- Unlike, NOPAT accounting, net income gives a comprehensive view of the financial level of the business since expenses are also accounted for.

Therefore the above are some of the basic differences between the two standards.