Table Of Contents

What is Nonlinearity?

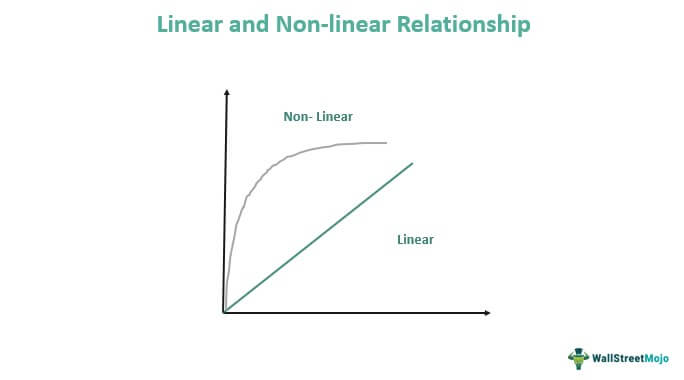

Nonlinearity refers to the indirect correlation between an independent and dependent variable that cannot be encapsulated with a straight line. In a nonlinear relationship, as the independent variable changes, the dependent variable does not change with the same magnitude.

This forces economists to take a moment to consider the economic systems that can be modeled as linear and nonlinear, bearing in mind that nonlinear systems are far more intricate than linear ones and much harder to model effectively. For example, investment categories like options are highly nonlinear, making them unpredictable.

Key Takeaways

- Nonlinearity highlights a relationship between two variables that don’t always move in perfect lockstep with one another.

- Nonlinear models are more complicated than linear ones. So economists always prefer to work with the latter.

- Nonlinearity shows up in a lot of economic scenarios, such as the relation between the unemployment rate and wages.

- Options are nonlinear derivatives, forcing investors to use advanced prediction models such as the Monte Carlo simulator to assess their risk.

How Does Nonlinearity Work?

The relationship between two variables, inflation rate and interest rate, can either be linear or nonlinear.

#1 - A Linear Relationship

A linear relationship would mean that as the interest rate goes up by 1%, the inflation rate drops by 1% as well. More specifically, if the interest rates go from 5% to 6 %, the inflation rate will decrease from 4% to 3 %. And, if the interest rates increase by another point from 6% to 7 %, the inflation rate will drop by another percentage point from 3% to 2 %. And so on.

(Note: The numbers given above are purely hypothetical and have nothing to do with the actual relation between interest rates and inflation rates. They are used for demonstrative purposes only.)

One should note that for a relationship to be linear, the increase or decrease in one variable does not have to be the same for the other. So, for example, you could still have a linear relationship if the inflation drops by only 0.5% for every 1% increase in the interest rates.

Hence, an increase from 5% to 6% in the interest rates could decrease from 4% to 3.5% in inflation. And, an increase from 6% to 7% would cause inflation to go from 3.5% to 3%.

For a relation to be linear, what matters is that it remains the same regardless of what the interest rates and the inflation rate are at any moment.

#2 - A Nonlinear Relationship

Conversely, a nonlinear relationship means that a change in the interest rates doesn’t always result in the same change in inflation rates.

For instance, an economist might find that when the interest rate increases from 5% to 6%, the inflation rate goes down from 4% to 3%. However, increasing the interest rate again from 6% to 7% causes the inflation rate to plummet from 3% to a meager 0.5%.

Here, the relation between the cause and the effect is not constant. So it is not linear and cannot be represented with a straight line. A nonlinear system needs multiple estimates and models to reach an accurate solution. Since the changes in the input do not guarantee predictable outcomes, the nonlinear derivatives are used to test the models hypothetically.

Nonlinearity Examples

Nonlinearity pops up in numerous instances. An interesting case arises if one looks at the relationship between unemployment rates and wages. When unemployment rates are high, they have little to no effect on wages. But, as the unemployment rates go down, the effect starts becoming more and more pronounced on wages.

Put differently. If the unemployment rate is at 7% and then goes to 6%, wages won’t be affected much. Yet, wages will significantly boost if the unemployment rate goes down from 4% to 3%.

Why does this happen?

The argument is that at high unemployment rates, employers have a large supply of capable talent to choose from, giving them a leg up during wage negotiations. But, as the number of employed people increases, the supply of available talent decreases, taking away the strategic benefits enjoyed by employers and forcing them to try to attract excellent talent through higher salaries.

Nonlinearity is also prevalent when it comes to Options in Finance. Options represent a type of derivative class, and they allow you to trade in the underlying asset’s inherent risk. There are a lot of variables that go into calculating the price of an option and given their complexity, they are nonlinear derivatives.

Nonlinearity vs linearity

Given their relative simplicity, linear models are more appealing to economists than nonlinear models. Finding adequate solutions or even approximations to nonlinear models can be challenging, which is why economists will approximate nonlinear models with linear ones if at all possible.

Nevertheless, there are cases where a nonlinear model is unavoidable.

The problem is that most modern economics is built on linear models. And, nonlinear problems can even be hard to explain. After all, a one-to-one linear relationship can be self-explanatory to some extent. All you need to know is that variable A affects variable B.

But, when dealing with a nonlinear relationship, it’s not enough to understand that variable A affects variable B; economists also need to understand why the relationship looks the way that it does. For example, they need to understand why the correlation speeds up or slows down and what factors cause this.

Nonlinearity and Options

Earlier, we mentioned that options represent nonlinear derivatives.

Before we can understand why let’s look at the factors that affect an option’s price:

- Stock price

- Strike price

- Type of option

- Time to expiry

- Interest rates

- Dividends

- Future volatility

Because an option’s price is affected by multiple variables, the relationship between any one factor and the option price is nonlinear. It is supported all the more by the notion that an option’s value breaks down to inherent value and time value. It is also why economists and investors will look at an option’s gamma, delta, and other Greeks to assess this nonlinear relationship.

The effect of nonlinearity of options

When any new investment is taken on, investors need to have a rough idea of the potential loss they face should things go south. It means looking into the future and using prediction models to paint the best and worst-case scenarios.

Investors are fine using a standard value at risk technique for investment classes that follow linear relationships to size up the potential damage.

However, that same technique won’t work with nonlinear assets like options. Consequently, investors need to find alternative techniques, such as a Monte Carlo simulation.