Table Of Contents

Nonaccrual Loan Meaning

Nonaccrual Loan is a popular term used for those loans that failed to receive any interest or principal for the past 90 days or more. It is most commonly seen in unsecured loans where the borrower has stopped paying any amount on the loan.

The term accrued is used when the banks collect some amount from the borrowers on the lent out money. But there are no interest payments in the picture, there is no accrued amount. Hence, the loan turns out to be nonaccrual. Repayments being at stake, such loans are also known as doubtful, sour, or troubled loans.

Key Takeaways

- A nonaccrual loan refers to the type of loan that arises when the borrower does not make any repayment towards the loan for 90 days or more.

- It is also known as doubtful, sour, or troubled loans. When banks do not receive any amount, they keep the loan on a cash basis.

- For a loan to become non-accrued, the borrower must deny payments for at least 90 days, neglect interest income, or keep the loan on a cash basis.

- Likewise, to change the loan status, the borrower must either perform debt restructuring, create reassurance, or deposit collateral with the lender.

How Does Nonaccrual Loan Work?

A nonaccrual loan is the one that has any interest accumulated for 90 days or more. It happens because the borrower fails to make any interest or principal payments for the loan. Thus, the lender has no payments received on nonaccrual loans. With time, the loan's status slowly changes from accrued to nonaccrual. If the borrower still cannot do what is needed, the risk of default arises.

In such cases, the nonaccrual loan policy directs the bank to set aside a reserve that will act as a contingent liability. So, even if the borrower defaults, this amount will protect the financial interests of the bank. However, there is also alternative treatment available for such loans.

Accounting for nonaccrual loans allows such income to be suspended for the time being until it is received. However, banks usually wait for some time before acting upon it. They put the loan on a cash basis. Thus, any interest payments received on nonaccrual loans can again be considered income. The bank later informs the credit reporting agencies about it and follows up with the borrower. In contrast, these regulations are just made by the financial institutions. A proper prescription is needed for such nonaccrual loan accounts under the United States Generally Accepted Accounting Principles (GAAP).

Various consequences of this loan affect both the lender and the borrower. For instance, if the borrower fails to make payments, they create a default risk. As a result, the bank has to write it off later. And the impact becomes visible in the bank's financial statements. At the same time, the person may witness a drop in their credit score. However, under certain circumstances, it becomes difficult for them to regain loan status.

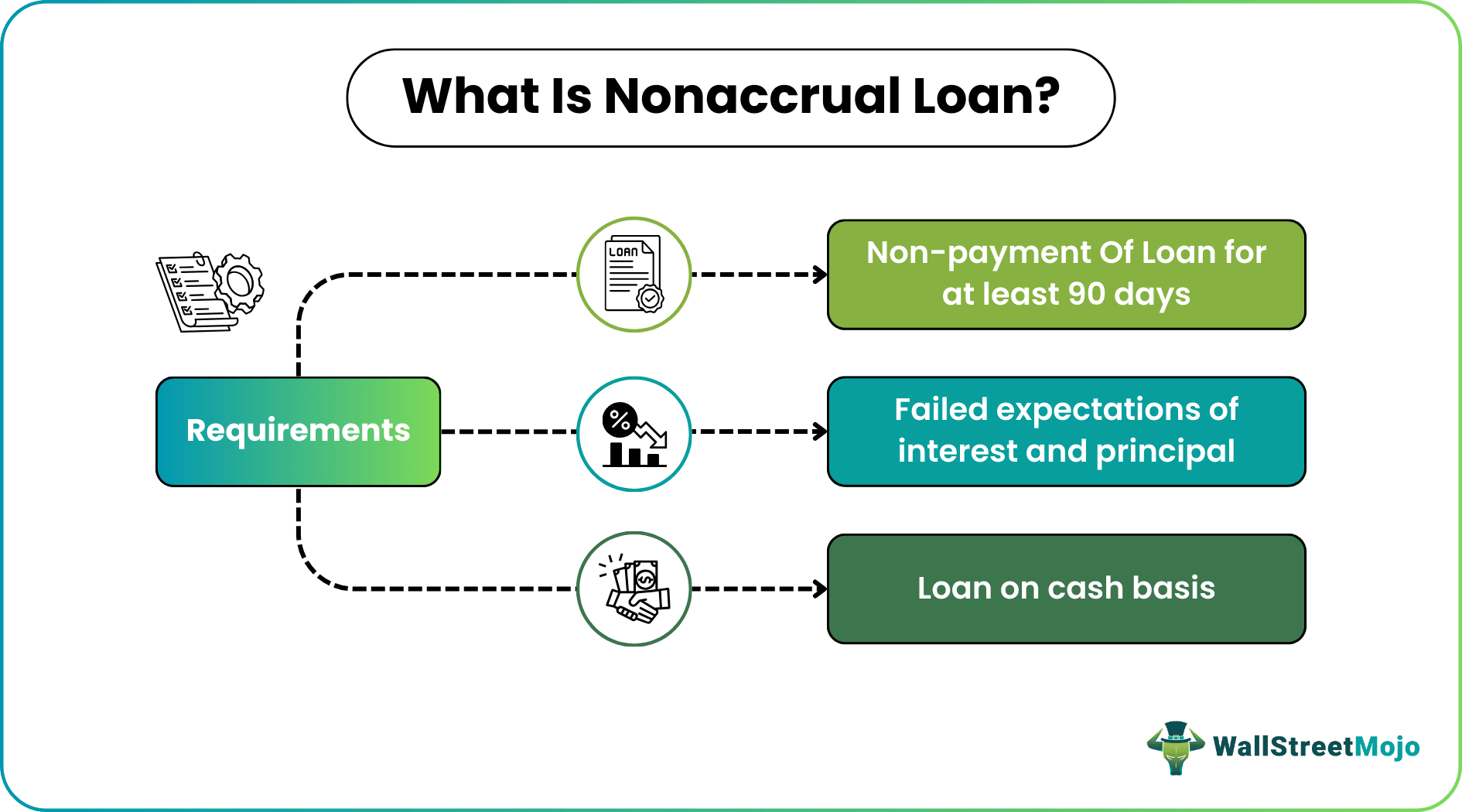

Requirements

For any unsecured loan to classify as non-accrued, it is necessary to meet any of the criteria. It is possible only then for banks to declare it as a nonaccrual loan. Let us look at some requirements as per the Federal Deposit Insurance Corporation (FDIC):

#1 - Non-Payment Until 90 Days

The first requirement for a loan to become nonaccrual is non-receipt of payment for 90 days or more. It includes principal as well as interest. However, the only exception to the rule is that there should be no asset securing the loan. It means if there is any collateral included, it cannot fall under the nonaccrual loan policy.

#2 - No Interest Received

When the interest is not received for long, banks lose hope on such loans. The second criteria, therefore, focus on the principal and interest that seem not receivable. In short, the bank now does not expect the borrower to make any payments against the loan.

#3 - Cash Basis

Lastly, the lender must place the loan on a cash basis if it recognizes any of the above patterns. So, if the lender receives any interest payments in the future, they will be recognized as income. It is part of the basic accounting for nonaccrual loans and expenses.

Examples

Let us look at some natural and hypothetical examples of nonaccrual loan accounts to understand the concept better:

Example #1

Suppose Peter has taken an education loan from Cash-Win Bank in 2020. He wanted to pursue his higher studies at a renowned university for the next two years. So, the bank sanctioned a loan amount of $90,000 to Peter at an interest rate of 6.87%. For the next 12 months, the payment was regular, but in the very next year, it stopped from his side. As a result, the bank waited for three months, yet the situation remained the same.

Now, the bank had tied up with Sam-James (a credit agency) to follow up on payments. The agency found out that Peter had no job, so he could not pay it back. So, the bank had declared the loan as nonaccrual. However, the bank decided to keep Peter's loan on a cash basis. It is when they receive payments from their clients that it will become income for the lender. However, Peter had promised to get one soon, so later, with his employment, the status was successfully changed. Likewise, Peter could now repay the education loan he had taken.

Example #2

According to recent news updates as of January 2024, the financial institution, Carter Bankshares Inc., faced a net loss of around $1.9 million in the last quarter of 2023, nonaccrual loans being a significant part affecting their performance. They accounted for a loss of $30 million in 2023. It further led to a substantial decrease in interest income for the bank. But, at the same time, the deposits grew by 11.3% on a yearly basis.

As a result, Carter Bankshares Inc. started concentrating on the settlement of its non-performing assets and keeping up its capitalization level.

Status Change

Once the borrower debars from making any payment towards the loan taken, the status remains non-accrued. However, in some situations, the lender may change it back to normal. Let us understand which events bring that status change:

#1 - Repayment Of Debt

The first recommendation in such cases is to repay the loan anyhow. Now, in this scenario, the borrower may work with the lender on a plan for repaying the debt. It will allow the former to arrange funds and repay them in a manner that is acceptable to the lender. For instance, both parties may agree to settle the overdue principal and interest before resuming the monthly installments.

#2 - Providing Reassurance To Lenders

The following solution to bring back accrual status is to create reassurance regarding loan repayment. To achieve this, the borrower may promise the lender to repay the amount within a set time. It is mainly seen in cases where troubled debt restructuring (or the first option) is not feasible. Likewise, if the borrower resumes the debt payment within six months, the status can still change.

#3 - Bringing Collateral

Likewise, the parties may agree to bring collateral and turn it into an unsecured loan. The collateral brings a sense of security that the borrower will repay. Otherwise, the bank can claim the property or the proceeds from it.