Table of Contents

What Are Non-Bank Financial Institutions (NBFC)?

Non-bank financial institutions, also known as NBFCs (Non-Bank financial companies), are financial institutions that have not been provided with a banking license and are not regulated or governed by a domestic or international regulatory body. They do not accept deposits from the public. However, they facilitate other financial services such as financial consulting, investments, and money transmission.

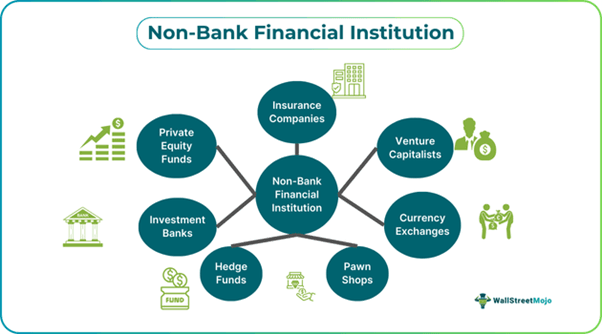

Institutions such as insurance companies, currency exchanges, pawn shops, venture capitalists, and currency exchanges fulfill non-bank financial institution functions. While these NBFCs are not banks exactly, their services compete with banks in one way or another. The mandates of the Dodd-Frank Wall Street Reform & Consumer Protection Act govern these entities.

Key Takeaways

- Non-bank financial institutions are entities that provide services akin to banks but do not possess a banking license. Therefore, they cannot accept deposits from the public.

- They are not subject to the same strict regulations as traditional banks. However, they are regulated by the Dodd-Frank Wall Street Reform Act.

- The most common types of NBFIs are mortgage lenders, insurance companies, investment banks, private equity funds, P2P lenders, and hedge funds.

- These institutions provide services to the generally underserved sections of the market or society in general. As a result, they provide customized solutions and tailored services.

Non-Bank Financial Institution Explained

Non-bank financial institutions (NBFIs) or NFBCs (Non-bank financial Companies) are financial entities that provide services similar to those of banks but do not possess a banking license. Therefore, they do not fall under the ambit of banking or other regulatory authorities’ rules that govern banks.

Mortgage lenders, investment banks, money market funds, P2P lenders, insurance companies, private equity funds, and hedge funds are some of the most prominent examples of NBFIs. While these institutions perform some critical financial functions, they do not have the authority to conduct some services akin to banks, such as accepting cash deposits.

Since these entities are not as strictly regulated as conventional banks, they are preferred choices for wholesale, institutional, and retail market consumers. Moreover, they provide funding or other such services to sections of society that find it challenging to be included in the orthodox financial services system.

There is a dark past involving a handful of NBFCs collaborating with a few other entities, which contributed to the onset of the financial crisis in 2008. Reacting to these findings, the Dodd-Frank Act was passed to regulate these institutions as well, safeguard the best interests of investors, and uphold the integrity of the market.

However, non-bank financial institution news often includes information about how these institutions are filling the gap of ever-increasing demand for credit and creating a larger credit pool that the orthodox banking system might need help to fulfill alone.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Types

According to the Consumer Protection Act and the Dodd-Frank Wall Street Reform Act, there are three major types of NBFIs. All three types are discussed in detail below.

- Foreign NBFIs: These NBFIs are registered, organized, or incorporated outside the United States of America. They engage in financial activities such as underwriting, retirement planning, currency exchange, and credit facilities. These foreign NBFI entities might or might not have branches in the US.

- US NBFIs: Like most NBFIs, even US-incorporated NBFIs are predominantly restricted to non-banking financial activities. However, there are a few restrictions in terms of the groups or sectors they can service. For instance, these entities cannot serve as national security exchanges or farm credit system institutions.

- Governed NBFIs: The fundamental factor that separates these NBFIs from other non-bank financial institution functions is that the Federal Reserve Board of Governors oversees governed NBFIs. It is based on the discretion of the directors that the scope, size, nature, interconnectedness, or a combination of all these factors may shake the financial stability of the country

Examples

Below are two distinct Now that the basic theoretical explanation of the non-bank financial institution's purpose is well-established, it is time to touch upon the concept’s practical applicability through the examples below.to help you understand the concept better:

Example #1

XYZ & Co is a financial company registered in Australia that provides retirement and financial planning services to farmers and other entities in the agricultural industry. It also has a registered branch in the United States.

They understand the ins and outs of the agricultural business and provide detailed planning for these professionals. In fact, they also help them determine which crop might give them the best margins and the turnaround times for each season.

XYZ’s team of experts also includes weather experts who predict whether the weather might be suitable for the rare-determined plan or if adjustments will be necessary. Therefore, the company has built a formidable base in the country.

Example #2

In February 2024, the Federal Reserve reported that the ties between banks and non-bank companies may cause systemic risks for the market. In 2024, the loans extended by banks to non-banks crossed a mammoth $1 trillion, 12% above the previous year’s number.

Around this time, many significant banks developed even closer ties with these companies. For instance, Citi extended a $310 million loan to SunBit, a company that focuses on dentist offices and repair shops through their buy-now-pay-later model.

Importance

The importance of non-bank financial institution functions has been mentioned in the article. However, the specific points of their importance include:

- NBFIs work in tandem with traditional banking systems. As a result, the financial ecosystem is more inclusive.

- These entities cater to sections of society that are underserved by the banking system, such as small businesses, individuals with limited credit history, and start-ups.

- It leaves the market with scope for improvement, allowing companies to come up with innovative financial solutions that ultimately benefit the whole economy.

- NBFIs in the hedge fund and insurance space help individuals and businesses hedge their risks effectively.

- These companies create a massive number of jobs by providing much-needed support to small and medium enterprises in terms of sorting financing.

Difference Between Commercial Bank And Non-Banking Financial Institutions

The distinctions between commercial banks and Non-bank financial institutions purpose are:

Commercial Banks

- Commercial banks welcome public deposits and offer a wide range of banking services, such as loans and mortgages.

- Central banks and other regulatory authorities heavily regulate it to ensure the protection of depositors and consumers in general.

- They offer consumers the services to open savings and checking accounts. They also provide business and personal loans.

- Typically, these banks fund large-scale projects and the general financial needs of their customers.

- Their primary source of raising funds is through deposits and loans acquired through other banks.

NBFIs

- NBFIs are specialists in providing financial services like insurance, asset management, and investment. However, since they do not have a banking license, they cannot accept deposits from the public.

- They are regulated, but the regulation and oversight are minimal compared to commercial banks.

- They usually provide financial support to a specific sector or group through services like factoring or venture capital.

- They facilitate funding and other services for sectors that are underserved by the traditional banking system.

- These companies use bonds, equity, and other financial instruments to raise capital.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.