Table Of Contents

Examples

Example #1

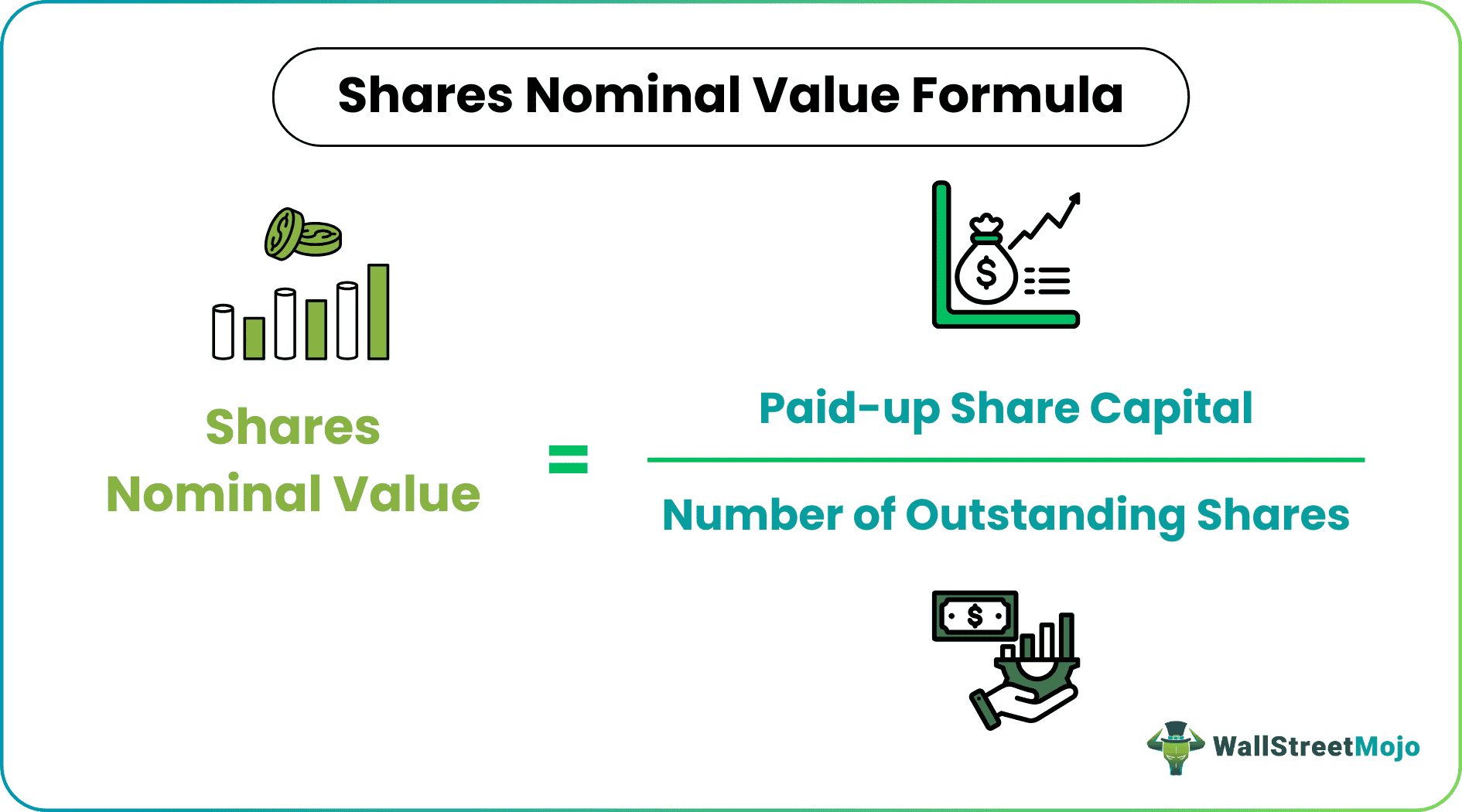

Let us take the example of ABC Ltd to calculate the stock nominal value. ABC Ltd is an ice cream manufacturing company that started its operation last year. So, this financial year was its first reporting year, and as per its balance sheet for the year ended on March 31, 2019, the paid-up share capital stood at $60,000 and retained earnings of $120,000. The company currently has 2,500 authorized shares and 2,000 outstanding shares in the market.

Given,

- Paid-up share capital = $60,000

- Retained earnings = $120,000 (redundant)

- Number of authorized shares = 2,500 (redundant)

- Number of outstanding shares = 2,000

Based on the information, determine the following.

Therefore, it can be calculated as,

= $60,000 / 2,000

= $30.00 per share

Example #2

Let us take the example of Apple Inc.’s balance sheet for the period ended on September 29, 2018. The following financial information is available in the public domain.

Based on the information, determine the following.

Therefore, the calculation can be done as below

= $98,812 / (4,754,986,000 + 5,126,201,000)

= $0.00001 per share

Therefore, the nominal value of Apple Inc. as on September 29, 2018, stood at $0.00001 per share although the market value currently hovers around $200 per share.

Relevance and Uses

Although the concept is most commonly used for stocks or shares, it is equally useful for bonds and preferred stock investors. This is because the nominal value of shares is also known as face value, and it can have any value from the range of $0.00001 per share to $10 per share.