Table Of Contents

What Is The Net Sales Formula?

The net sales formula in accounting refers to the mathematical expression that helps calculate the company’s total sales less its return, discounts, and other allowances. Net sales are the foremost thing that investors and stakeholders notice on an income statement. Hence, accuracy is vital, which comes from proper use of the net sales formula.

Net sales formula allows firms to get a clear picture of what their actual revenue figures are. This, in turn, helps the management to know how the company is performing financially. In addition, it helps investors to know the exact financial status of a company, helping them make wiser investment decisions.

Net Sales Formula Explained

Net sales formula indicates the expression that helps calculate the net sales, which allow firms to be aware of its actual revenue over a period. It calculated net sales as the difference between the gross sales revenue and the sales returns, discounts allowed to the customers, and allowances.

The formula of net sales in accounting calculates the net revenue after accounting for any sales return, discounts, or allowances. The return would also include any damaged products or missing products.

The gross sales or gross revenue depicts the total income a company or a firm shall earn during a specified time, which could be a year or a quarter, and that shall include all the credit card, cash, trade credit sales, and debit card sales performed during that time, including the discounts and allowances for sales.

At the end of the accounting period, the company shall calculate the total sales discount and total sales allowances, and this figure will be subtracted from the gross sales to arrive at the net sales. The amount received from the customer or says the amount realized from them is the net sales figure, and the same gets reported on the income statement.

How To Calculate?

When it comes to calculating net sales using the formula, it is important to understand the components that are used for calculation. The formula that helps in calculating and showing net sales in the balance sheet is:

Net Sales = Gross Sales – Sales Return – Allowances – Discounts

Thus, the components that let the calculation happen accurately are gross sales, sales return, allowances, and discounts.

- Gross sales is the total sales revenue that is generated before deductions or adjustments.

- Sales returns are the goods or items that are returned to businesses for a refund. The reason can be anything from non-requirement to dissatisfaction.

- Allowances are reduction in the prices in case damaged or defective pieces are delivered to consumers.

Discounts are additional benefits given to customers when they meet certain criteria, like minimum purchase limit either cost wise or quantity wise.

Revenue vs Sales Explained in Video

Examples

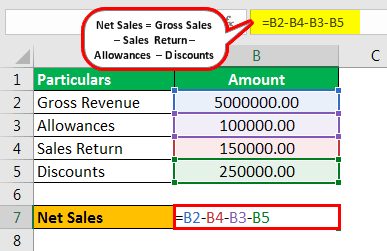

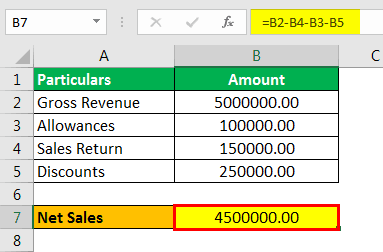

Example #1

ABC limited wants to record the revenue figure in the income statement for the year ended 20XX.

- Gross Revenue: 5000000.00

- Allowances: 100000.00

- Sales Return: 150000.00

- Discounts: 250000.00

It would be best to compute the net revenue figure based on the above information.

Solution

Net Sales can be calculated using the above formula as,

- 50,00,000 – 150,000 – 100,000 – 250,000

- Net Sales = 45,00,000.00

Therefore, the firm must record 45,00,000 as Net Revenue in its income statement.

Example #2

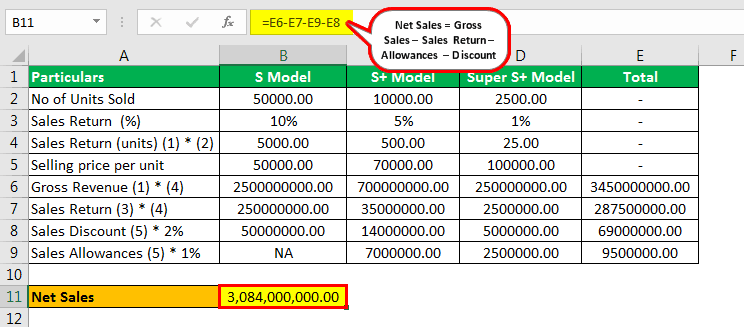

Vijay started a new business around a year ago. He entered the business of bike sales. Last year the firm sold 50,000 units of S model bikes, 10,000 units of S+ model bikes, and 2,500 units of Super S+ model bikes. However, there were some complaints related to the bike's performance, and as a percentage, some of the bikes that came back were: 10% of S model bikes, 5% of S+ bikes, and 1% of the Super S+ bikes.

The price range was 50,000, 70,000, and 100,000 for the S model, S+ model, and Super S+ model, respectively. These bikes are subject to service semi-annually; hence, those are treated as a firm's expenditure: 1% of the gross amount for the S+ model and Super S+ model only. It's the company's policy to provide a flat 2% discount on the gross amount of bikes as a completion of one year of the firm.

Considering all of the above facts, you are required to calculate the net revenue that Vijay’s firm should record in its books of account.

Solution

Here, we are not given any of the figures directly, so we will first calculate all of those individually.

= 3,45,00,00,000.00 – 28,75,00,000.00 – 95,00,000.00 – 6,90,00,000.00

- Net Sales = 3,08,40,00,000.00

Therefore, the firm needs to record 3,08,40,00,000.00 as Net Revenue in its income statement.

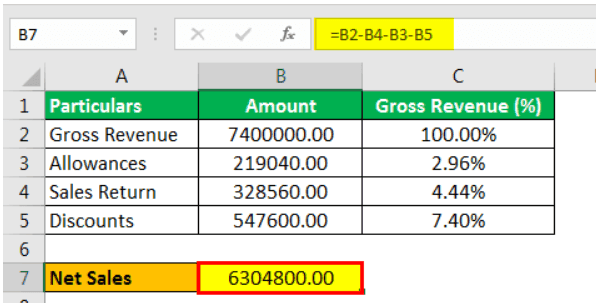

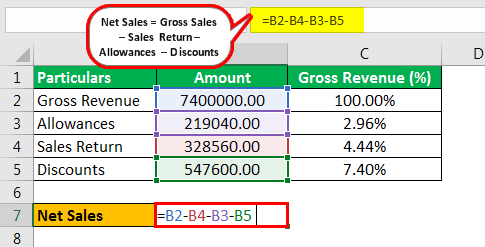

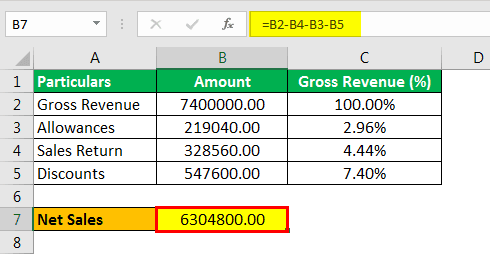

Example #3

BBZ is in the sales of software in the Kurla market. Below are the common size statements for the income statement, which was reported to the bank for loan approval.

As an accountant for the firm, he was asked to help the bank provide the numbers. The bank has requested him to provide the net revenue figure.

He noted that 3,700 units of software were sold at the rate of 2,000 per piece. You are required to calculate the net revenue figure.

- Gross Revenue: 100.00%

- Cost of Goods Sold: 66.84%

- Allowance: 2.96%

- Sales Return: 4.44%

- Discounts: 7.40%

Solution

We shall first calculate gross revenue and arrive at the net revenue after considering all of the sales returns, allowances, and discounts.

Gross sales will be no of units * selling price per unit, which is 3,700 units * 2,000 which equals 74,00,000

We can now calculate other figures per percentage of revenue as given in the question.

- 74,00,000.00 – 3,28,560.00 – 2,19,040.00 – 5,47,600.00

Net Sales will be -

- Net Sales = 63,04,800.00

Therefore, the firm needs to record 63,04,800.00 as Net Revenue in its income statement and report it to the bank.

Relevance and Uses

Net Sales can be used for many purposes; if the difference between a company's net and gross sales is more than the figure of the industry average, the firm may be offering lucrative discounts, or they may be realizing a greater amount of sales returns when compared with their peers. While comparing income statements, say monthly, could help them identify any potential problems and look for viable solutions.