Table Of Contents

What Is Net Interest Margin?

Net Interest Margin is a popular profitability ratio used by banks, which helps them determine the success of firms in investing in comparison to the expenses on the same investments and is calculated as Investment income minus interest expenses (this step is referred to as netting) divided by the average earning assets.

The investment income includes the interest on loans, securities or any other asset that earns interest, while the expenses include the interest that the banks pay on its liabilities or borrowings. A lower value of the ratio indicates that the financial institution has to earn higher income to compensate for its expenses.

Key Takeaways

- Net interest margin (NIM) is a profitability ratio that banks use to evaluate their success in investing compared to the expenses of the same investments.

- NIM provides valuable information about the interest an investor obtains over payout.

- Banks use this ratio because they collect deposits from investors and then use them to gain interest in other investments, allowing them to compare the performance of their investment strategy.

- NIM examines the execution of the investment strategy. If the ratio is lower than expected, the strategy may need improvement. The investor may continue with the same investments if the ratio is on target.

Video Explanation of Net Interest Margin

Net Interest Margin Explained

The net interest margin analysis is the difference in the amount that the banks or the financial institutions generate from the money income that they make from lending out funds to investors and the amount of expense that they need to incur for paying its lenders. This value is expressed as a percentage relative to its assets.

It indicates how profitable the business is and how financially viable it is so that it can continue for many years to come. It is also a metric to help investors determine the financial stability of the institutions so that they can decide to invest their money or take their services.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

A positive value of the net interest margin for banks indicates that the business is profitable and is operating efficiently. In case the value is not profitable, the business should take immediate action to clear off debts, reduce interest payout or increase interest earning. It can also increase the margin by giving financial and advisory services to clients which will add to the income from other different sources other than interest from loans.

The supply and demand factor also plays a role in raising the margin. If customers ask for more savings account then interest outflow will be more and loans are in higher demand then interest income will be more. The monetary policies of the central banks also play an important role in the interest margin calculation.

Formula

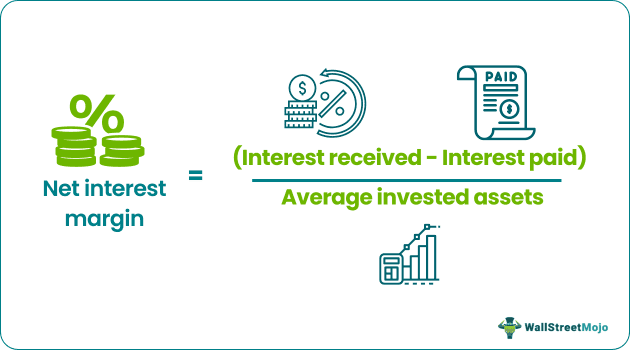

This ratio talks about the NIM, meaning how much interest an investor receives over how much she pays out.

Here’s the formula.

Net Interest Margin = (Interest Received – Interest Paid) / Average Invested Assets

How To Calculate?

When an investor invests money in bonds or other investment instruments, they gets a percentage of interest on her investments.

At the same time, if we assume that the money invested is borrowed, then the investor (and the borrower) also need to pay interest to the lender of the money.

In this formula, we are trying to find out the difference between the interest received and the interest paid. And then, we would compare the difference between the average invested assets to find out the proportion.

Average invested assets are the average of all the investments. We take average invested assets to find out the median of all invested assets to ease out the differences among the invested assets.

Examples

Let’s take a simple example to illustrate net interest margin for banks.

Xavier has been experimenting with different investment instruments. Recently he has tried a bunch of investments, and he wants to see how he is doing. He has borrowed $100,000 from the bank and invested the entire amount in an investment instrument. The bank is charging him a 10% simple interest on the loan. And he has been getting 9% quarterly compounded from the investment. Find out the NIM (if any).

In this scenario, we need to determine the interest rate for each side.

First, we will determine how much Xavier has to pay to the bank. And then, we will calculate the interest that Xavier will receive.

- Xavier will pay = ($100,000 * 10%) = $10,000 to the bank.

- And Xavier will receive at the end of the year = = = = $125,200 from the investment.

- The interest received from the investment would be = ($125,200 - $100,000) = $25,200.

Using the net interest margin calculation, we get –

- NIM = (Interest Received – Interest Paid) / Average Invested Assets

- Or, NIM = ($25,200 - $10,000) / $100,000 = $15,200 / $100,000 = 15.2%.

Uses

Let us look at some uses of the net interest margin calculation.

- It is a ratio every bank uses. It’s because banks are taking deposits from investors and then using the same money to earn interests in other investments.

- NIM is one of the most common ratios used to compare the performance of the banks.

- For an individual investor, the net interest margin would also be useful as she would see how much she earns and how much she pays proportionately.

- NIM is a measure of how well an investment strategy is executed. If the NIM is less, there is room for improvement, and if the NIM is well on target, then maybe the investor may continue with the same sort of investments (the range and the instruments, both).

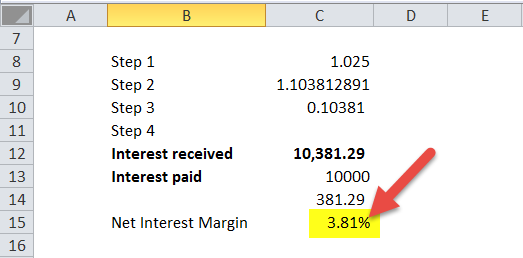

NIM in Excel (with excel template)

Let us now do the same example above in Excel. It is very simple. You need to provide the two inputs of Interest Received and Interest Paid.

You can easily calculate the Net Interest Margin ratio in the template provided.

How To Improve?

Let us understand how to improve the value to increase profitability using the net interest margin formula.

- The banks can increase their rates at which they lend money to customers so that the margin improves by increasing the income.

- • Another option is to reduce the rate of interest that the banks give to the clients on deposits held by them. This will help in reducing their expenses.

- • The banks should try to diversify the portfolio of their loan so that the risk of default is distributed. This will raise the yield on the loans and also increase the margin.

- • They should increase incomes made from other sources like financial services which may include financial or wealth management advisory work. This will reduce the dependence on income earned from interest.

- • It is better to create provision for any kind of loss so that the losses do not affect the income to a very large extent.

However, if the banks or the financial institutions make any changes in the margin in order to increase its profitability, then it is also important to analyse the risk and return and balance it with the overall goals of the bank.

Net Interest Margin Vs Net Interest Income

There are some differences between the two topics given below which are as follows:

The net interest margin formula is the difference between the net interest income and interest expense expressed as a percentage of its assets, whereas the latter the difference between the interest income and interest expense.

• The former is a ratio percentage whereas the latter is an absolute value in dollar terms.