Table Of Contents

What is Net Cash Flow?

Net cash flow refers to the difference in cash inflows and outflows, generated or lost over the period, from all business activities combined. In simple terms, it is the net impact of the organization's cash inflow and cash outflow for a particular period, say monthly, quarterly, or annually, as may be required.

Explanation

- It means how much money is coming into the business and how much of it is going out of business and gives an idea of the amount of free cash flows the business has at the close of a particular period.

- It covers the cash flow changes on account of operational activities and takes into consideration cash flow changes occurring on account of the finance and investment activities of the business.

- This formula provides detailed information relating to the number of cash flows, whether positive or negative, of the business from each activity, whether it pertains to operational activity such as revenue earned or expenses incurred for running the business, finance activity such as raising of funds or investing activity such as investment made in fixed assets or income earned by way of dividends and so on.

How to Calculate Net Cash Flow?

Net Cash Flow = Cash Inflow – Cash outflow

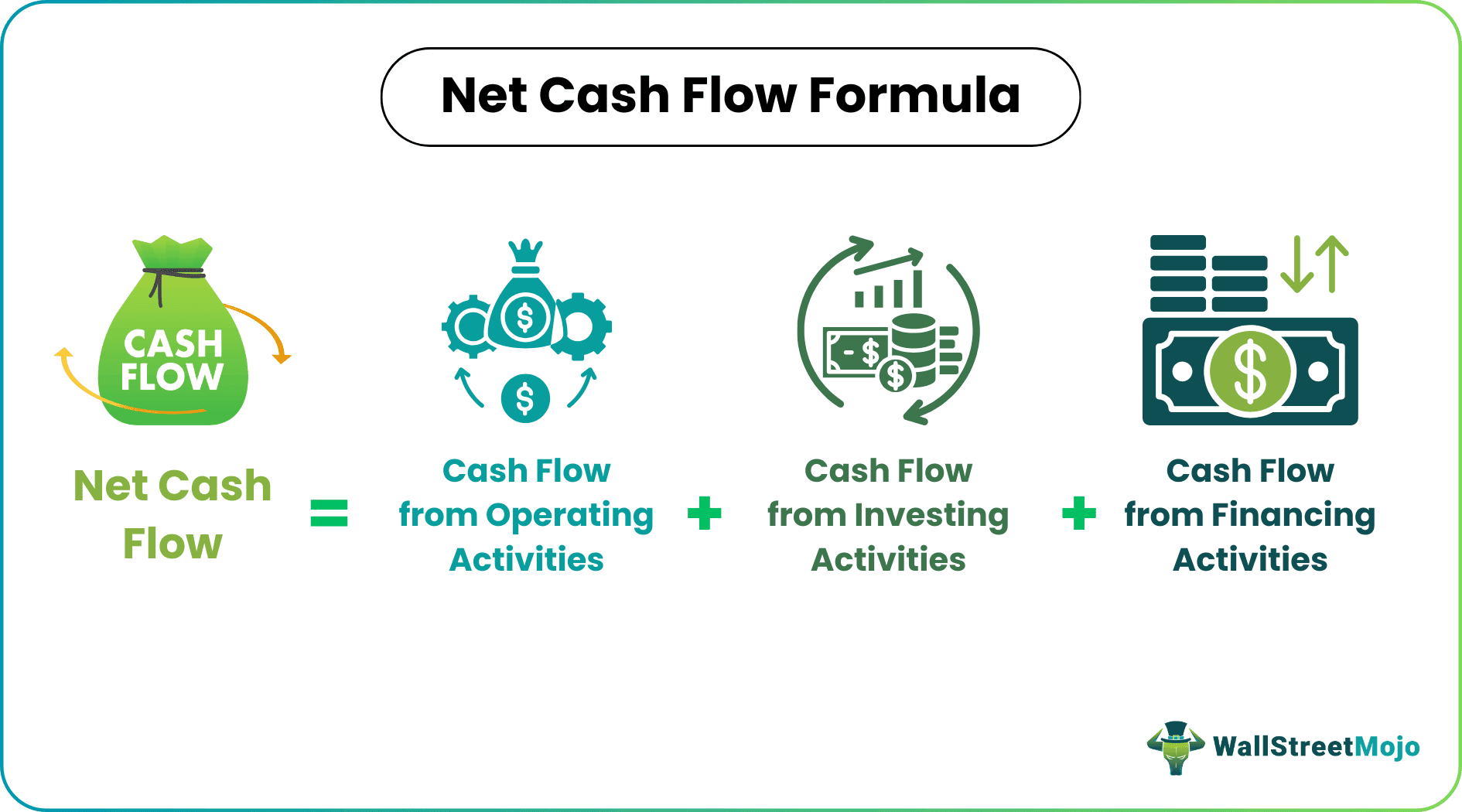

Alternatively, it can also be calculated by applying the below formula, which provides a detailed picture of cash flow activities.

Net Cash Flow = Cash Flow from Operating Activities + Cash Flow from Investing Activities + Cash Flow from Financing Activities.

Net cash flow can be calculated in 3 simple steps. They are as follows:

First and foremost, calculate the cash flow from operating activities.

Operating activities reflect the cash flow moves towards the core area of operation of the company and include cash flows from income and operations of the company, depreciation, taxes, and changes in working capital.Now, move on to calculating cash flow from investing activities.

Investing activities consider any change in cash movement from an investment perspective, say purchase or sale of fixed assets, investments made in other companies, and similar aspects.Lastly, calculate the change in cash flow from financing activities.

Financing activities relate to the cash flow generated or lost on account of any finance-related activity such as an increase or decrease in borrowings or debt, buyback of shares, dividend payments, etc.

Voila…!!! You now have all the required numbers. Add all the three numbers arrived, i.e., Step 1, Step 2, and Step 3, and the resultant answer gives you the Net Cash Flow.

Video Explanation Of Cash Flow

Examples

Let us understand with some examples.

Example #1

First, let's take a simple example to understand the concept.

Jonath has been operating his proprietary concern for a few years now. He wishes to calculate the net cash flow for the current year. His concern has an opening cash balance amounting to $1 million. His concern earned $0.78 million from operating activities, $-0.53 million from investing activities, and $0.82 million from financing activities.

Solution:

Thus, the Net cash Flow of Jonath's proprietary concern is $1.07 million.

Adjust the net cash flow with the opening cash balance to arrive at the closing cash balance. Thus, the closing cash balance will be @2.07 million (i.e., $1 million + $1.07 million)

Example #2

Let us take a practical example to understand the concept in detail. Below is the unaudited cash flow statement of The Walt Disney Company for the period ended in September 2019. Calculate the Net cash Flow for the Walt Disney Company based on the given information.

Solution:

To calculate Net Cash flow for The Walt Disney Company, we first need to segregate the information provided under the following three categories:

- Transactions covered under operational activities;

- Transactions covered under Investing activities; and

- Transactions are covered under financing activities.

Step 1: Calculate the cash flow from operating activities:

Therefore, Cash flow from operating activities is $ 6,606 million

Step 2: Calculate the cash flow from investing activities:

Therefore, Cash flow from operating activities is $ -4,118 million

Step 3: Calculate the change in cash flow from financing activities

Therefore, Cash flow from operating activities is $ -1,188 million

- = $6606 + (-$4118) + (-$1188)

- = $1300

The Net Cash Flow for the Walt Disney Company for the given period is $1,300 million.

Importance

Net Cash Flow has its importance when it comes to an understanding and analyzing the cash flows of a business. In addition, it provides useful information, such as stated below:

- The amount of cash the business is generating or losing.

- The sources of cash infusion into the business;

- The utilization of the cash introduced into the business;

- Investments made by the company.

- Passive income generated through investments in other companies;

- The company undertakes any internal restructuring.

- The amount of money returned to shareholders in the form of dividend or buyback;

- Idle cash lying with the company;

- The financial strength of the company;

Difference between Net Cash Flow and Net Income

- People often get confused and use the terms Net Cash Flow and Net Income interchangeably. However, it is essential to note that these terms are very different from each other.

- As already discussed above, Net Cash Flow refers to the net cash impact, whether generated or lost, from various business activities such as operational activity, investment activity, and finance activity, taken altogether for a given period.

- Net Income refers to the Net profit earned by the business after reducing all expenses for the given period.Net income is equal to revenue earned reduced by all expenses incurred to earn the revenue.

- Net income will offer information only concerning the organization's profitability for the given period. In contrast, Net Cash flow gives an overall picture of cash flow movement, including how and where money has been sourced into business to how and where it has been spent.

Conclusion

To sum up, everything discussed above in one line; Net Cash Flow is the difference between how much cash the company generates or loses viz a viz how much cash the company spends or incurs on account of engaging in various activities involving management of operations, taking care of investments and handling the finances.