Table Of Contents

Net Cash Meaning

Net cash depicts the liquidity position of a company. It is calculated by deducting the current liabilities from the cash balance reported on the company's financial statements at the end of a particular period and is looked at by analysts and investors to understand the financial and liquidity position of the company.

It is different from net cash flow, which is calculated as the cash earned by the company in a particular period after paying all its operational, financial, and capital dues, including dividends to shareholders.

Net Cash Formula

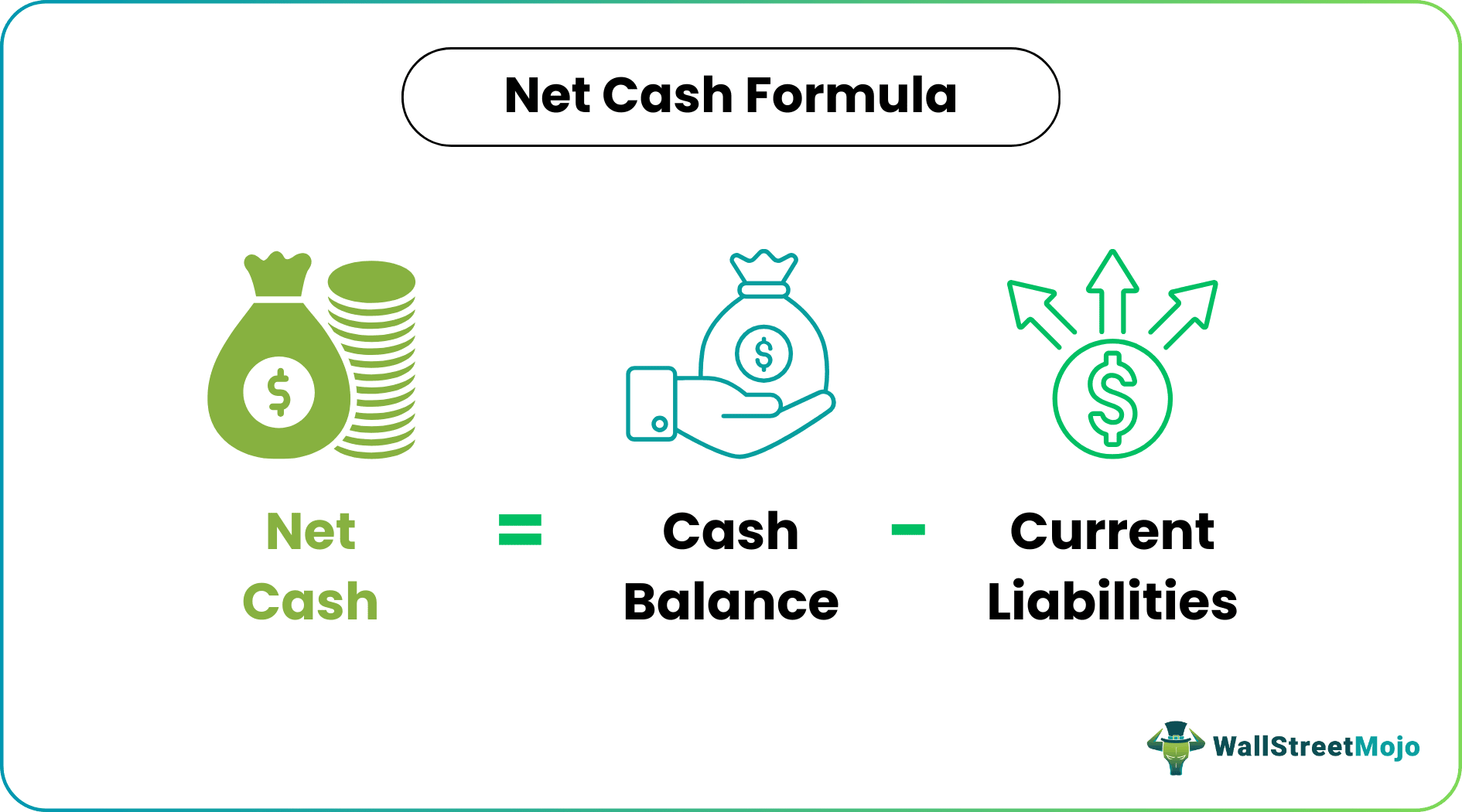

We calculate Net cash by deducting current liabilities from the cash balance (cash and cash equivalents) at the end of the period. Cash balance here includes cash, liquid assets (assets that we can quickly convert into cash). Current liabilities are calculated by summing up all financial and non-financial liabilities.

The net cash formula is as below,

Net Cash = Cash Balance - Current Liabilities

Where

- Cash Balance = Cash + Liquid Assets

Examples of Net Cash

Below are the examples of this concept to understand it in a better manner.

Example #1 - Apple.Inc

Below is a balance sheet snapshot of Apple Inc. showing different components of cash, which can be summed to arrive at the cash balance of $205.89 billion and total current liabilities of $105.7 billion. With this data, we can arrive at Apple’s net cash of $100 billion. See the below illustration for details.

Solution

Total Cash & Cash Equivalents

- =48.844+51.713+105.341

- =205.898

Calculation of Net Cash

- =205.898 - 105.718

- = 100.18

Source:- Apple.Inc

Example #2 - Alphabet.Inc

Below is a balance sheet snapshot of Alphabet Inc. – Google showing different components of cash, which can be summed to arrive at the cash balance of $121.177 billion and total current liabilities of $39.224 billion. We can arrive at Alphabet Inc. – Google net cash of $81.953 billion with this data. See the below illustration for details.

Solution

Total Cash & Cash Equivalents

- =16.032+105.145

- =121.177

Calculation of Net Cash

- =121.177-39.224

- =81.953

Source:- Alphabet Inc.

Effects of Net Cash

Positive cash is a positive indication of any business. It essentially means that the company will not have difficulty surviving if it pays all its current liabilities right away. While such situations do not arrive, analyzing them gives a great stress test for the company under consideration. Companies with a high net cash position also comfort current and prospective investors.

The liquidity condition of the business is essential because businesses have to be in a condition to honor their liabilities, which become due shortly. Also, businesses face uncertainty at all times, and unfortunate events, within or outside the company's control can upset the entire liquidity situation of the company. Therefore, to ensure that the company has enough liquid assets to survive those events, a liquidity test is essential, which can be done by using the net cash position.

Net Cash vs. Gross Cash

Gross cash is the cash balance of the company that we derive by adding cash and marketable investments without any deduction from liability. There could also be other definitions of gross cash; wherein it implies the gross proceeds of cash from the transaction before deducting any fees commissions and expenses.

While it tells a refined and more stringent liquidity position of the company, gross cash tells us the absolute liquidity position without considering immediate payments of liabilities.

Net Cash vs. Net Debt

Another form of net cash is the company's cash plus marketable investments minus the company's total debt (short-term borrowings plus long-term borrowings). If it is positive, this number tells us that the company is in sound financial health as it will be able to honor its borrowings if they become due immediately. However, if this figure is negative, it means that the company does not have enough cash at hand to honor all of its borrowings immediately.

The company can be termed debt-free if it has a net cash position defined this way. Therefore, analysts and investors will look at a debt-free or a cash-rich company more favorably than a company that carries a net debt.

Limitations

- Sometimes it may not be as straightforward as it looks like the cash balances or current liabilities could be distorted due to one-off events. Such circumstances require scrutiny, and the figures may need adjustment to arrive at a clear cash and current liabilities balance.

- Some businesses with decent businesses may still have negative net cash. It does not mark their liquidity position, but the observers may still view them negatively.

Conclusion

Liquidity is essential for any business, and if real cash backs liquidity, that makes the business super strong. Conversely, a weaker liquidity position puts the company's business at risk in critical situations. For example, in the financial crisis of 2008, many investment banks were loaded with leverage to the throat. All it took was a little devaluation in the value of the assets to put them out of business. Had they been cautious in maintaining enough liquidity, they would have done business differently.

It gives us an initial indication of how leveraged the company is. If a company fails the net cash test (after considering extraordinary circumstances), the company is looked at less positively than a company with a positive cash position.

However, investors may favor the net cash company over a cash negative company if these companies are in the same business.

It is just one factor used to analyze a company's liquidity position. However, cash forms an integral part of the overall equation for whatever parameter one uses. No matter how big the company is posting, if profits do not convert into cash, the business may not be worth investing in. Therefore, it should also be looked at in conjunction with other parameters like current ratio, working capital days, etc., to determine the company's liquidity situation.