Table Of Contents

Formula to Calculate Net Assets

Net Assets can be defined as the total assets of an organization or the firm, minus its total liabilities. The number of net assets can be tallied out with the shareholder's equity of a business. One of the easiest ways to calculate net assets is using the formula below.

Net Assets = Assets - Liabilities

Step by Step Calculation of Net Assets

The calculation of Net Assets is quite simple and is easy to understand. We need to cover below three steps, and then we will have Net Asset value.

- First, we need to calculate the total of assets, on the right side of the balance sheet. One can also take a total of assets, or if only trial balance is available, then we need to add assets one by one and then have a grand total of assets.

- After step 1, we can, in a similar fashion, calculate the total of liabilities that the firm is required to pay or is obliged to pay somewhere in the future. Like step 1, one can add line by line liabilities and get a total of liabilities. Total liabilities can include total borrowings, provisions, current, and other non-current liabilities.

- In the last step, we need to deduct the total calculated in step 1, total assets from total liabilities, which was calculated in step2.

Examples

Example #1

PQR Ltd is finalizing its books of accounts, and the MD of the company wants to know its net assets. Below is the information extracted from their trial balance; you are required to calculate Net Asset.

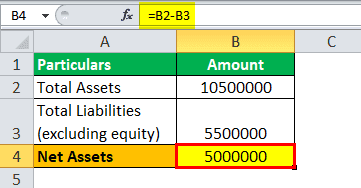

Solution:

So, the calculation of net asset can be done as follows.

Well, this is a straight forward example of calculating net assets.

Net Assets = $10,500,000 - $5,500,000

Net Asset will be -

Net Assets = $5,000,000

Hence, the Net assets of PQR ltd are $5,000,000.

Example #2

HDFC bank one of the leading banks in the industry and one of the best banks operating in India. Sam, a lead analyst at CRISIL, is looking for a new opportunity, and one of the criteria for stock screeners is that the company's net asset should not be negative or zero.

Below is an extract from BS (reported in cr.) for the period ended 2018.

You are required to assess whether an above stock will make up in Sam's screener list?

Solution:

Here we are given a few variables from the liabilities side and a few from the asset side. First, we need to calculate total assets and then total liabilities.

Step 1: Calculation of Total liabilities

Step 2: Calculation of Total assets

Step 3: We can use the above equation to calculate net assets:

Net Assets = 11,03,232.77 – 9,93,633.64

Net Assets will be -

Net Assets = 1,09,599.13

Therefore, the net assets of the HDFC bank for March 2018 were 1,09,599.13, which would compromise equity and reserves.

Example #3

Kedia broker and the company are following TATA motors, one of the listed companies of NSE. TATA motors has recently suffered from declining sales of its most sold product Jaguar Land Rover, and hence its shares have been declining since then. Aman, who is working at Kedia LTD., wants to know the company's net assets first.

You are required to calculate the net assets of the company.

Solution:

Here we are given a few variables from the liabilities side and a few from the asset side. First, we need to calculate total assets and then total liabilities.

Step 1: Calculation of Total liabilities

Step 2: Calculation of Total assets

Step 3: We can use the above equation to calculate net assets:

Net Assets = 3,52,882.09 – 2,57,454.18

Net Assets will be -

Net Assets = 95427.91

Therefore, the net assets of the TATA motors for March 2018 were 95,427.91, which would compromise equity and reserves.

Relevance and Uses

Assets net of the total liabilities will net to the owner’s equity. Essentially, the shareholders or the firm's stockholders or the company or the business owns the assets that shall not have outstanding loans. This would be the same as a home with a mortgage loan. The equity or the net assets in the home is the value of the home and subtracting the outstanding mortgage loan. Net assets are a similar concept.

If desired, owners can increase their net assets in several ways. They can make new investments in the firm or the company, or the management or the owners can leave excess profits in the company's bank account rather than calling for distribution or dividend. If owners, shareholders, or stockholders withdraw money out of business, say in a distribution or dividend, their net assets shall decrease. The ratio of liabilities to total assets shall go up as the owners take out the cash, which is part of an asset, from the firm or the business.