Table Of Contents

Negotiated Sale Meaning

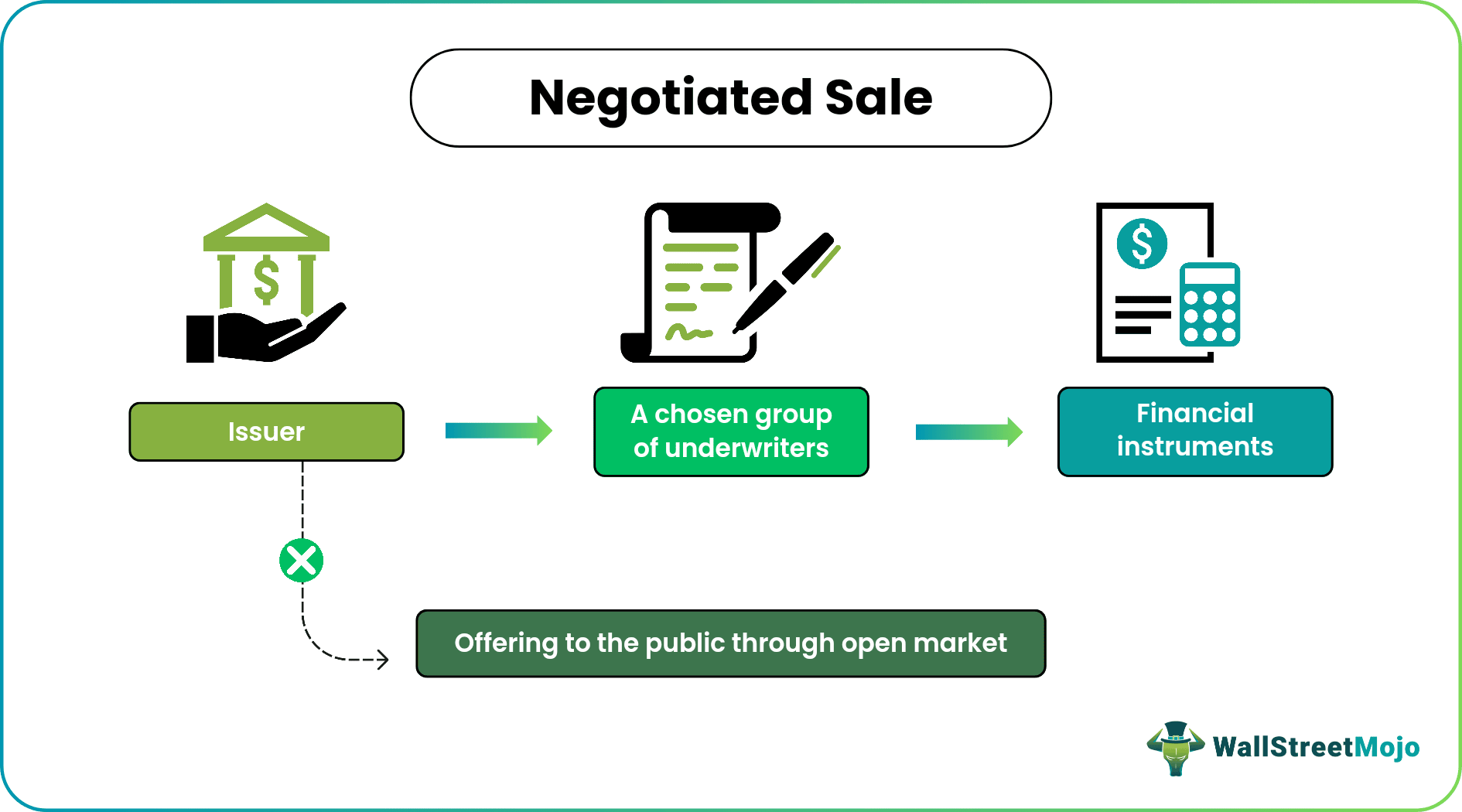

A negotiated sale is a strategic method of bond issuance where the issuer engages directly with a select group of underwriters. Instead of making the bonds available to the public through the open market, the issuer purchases the entire bond issue from the underwriters.

This approach offers the issuer greater control over the terms of the sale and allows for customization of features such as interest rates, maturity dates, and other conditions. Negotiated sales are pursued when the issuer's specific needs cannot be met through competitive bidding. This method prioritizes tailored arrangements, confidentiality, and efficiency in the transaction.

Key Takeaways

- A negotiated sale refers to a type of transaction in which parties engage in direct discussions to determine terms and conditions, usually through private negotiations, as opposed to using a competitive bidding process.

- This approach is chosen when secrecy, customization, alignment, ownership, uniqueness, and integrity are essential, meeting diverse needs efficiently.

- Its benefits include tailored terms and strong relationships, whereas its drawbacks involve minimal to zero buyer competition.

- It involves private negotiations, whereas an auction requires public bidding, and a competitive sale entails a formal bidding process.

Negotiated Sale Explained

A negotiated sale involves the bond issuer collaborating with chosen buyers to determine the terms of the bond issuance. This eliminates the need for an extensive bidding process and streamlines the buying procedure. The process begins with the issuer selecting an underwriter, which gauges investor interest through a presale offer before finalizing the price.

Once the price is established, the underwriter works closely with the issuer to finalize the sale terms. This method facilitates quicker transactions, maintains confidentiality, and allows for customized terms that cater to the preferences of both parties. A key aspect of this approach is the close partnership between the issuer and the underwriter.

While "negotiated sale" is commonly associated with bond issuance, it is not strictly limited to bonds. The concept of a negotiated sale can apply to various financial transactions beyond bonds.

Negotiated sales offer swifter and more confidential transactions. The customizable terms benefit both parties, while underwriters earn higher fees and gain greater control over the process. This method suits substantial bond issues or those with unique financing requirements. It is also advantageous when confidentiality is paramount, during market volatility, or for new entities entering the market. The impact of this approach is evident in the enhanced efficiency of the bond market, favorable terms for issuers, and strengthened relationships between issuers and underwriters.

Examples

Let us use a few examples to understand the topic.

Example # 1

Suppose a company needs to raise funds for a new project and decides to issue corporate bonds. Instead of going through a public auction or competitive bidding, the company approaches a select group of institutional investors, including banks and investment firms. They engage in direct negotiations to determine the terms of the bond issuance, such as the interest rate, maturity date, and any special features. The company and the investors work together to find mutually beneficial terms. This negotiated sale approach allows the company to tailor the bond terms to its specific needs and establish a strong relationship with the investors.

Example # 2

Imagine Claire is a student going on a semester abroad and needs to sublease their apartment for that period. Claire finds a friend who wants to sublease it. Instead of advertising it publicly, they both discuss and negotiate the monthly rent, duration of the sublease, and any responsibilities for maintenance. They reach an agreement that suits both of their needs, and the sublease is finalized based on the negotiated terms.

When To Prefer?

When two parties come together in transactions involving products, they negotiate prices. Parties opt for this mode of dealing under specific circumstances:

- Secrecy: Parties prioritize confidentiality to prevent sensitive deal information from reaching the public.

- Customization: When parties seek tailored terms and relationships, negotiated sales offer flexibility in negotiation and help establish strong buyer-seller relationships.

- Alignment: Parties engaged in the deal must align with their operational synergies and fulfill their aspirations and needs.

- Ownership: Sellers choose this method to control the process, including buyer selection, negotiation terms, and pace.

- Uniqueness: This technique is preferred when dealing with non-standard transactions, such as complex terms or specific market conditions.

- Limited Competition: In cases where buying competition is lacking, or parties prefer not to engage multiple bidders, limited competition options are explored for negotiation.

- Niche: Deals involving high-value or specialized assets benefit from negotiated sales, facilitating effective communication for successful closure.

- Integrity and Reputation: To maintain transaction confidentiality, avoid sale speculation, and preserve reputation, negotiated sales provide the most suitable approach.

Advantages & Disadvantages

Let's look into some of the advantages and disadvantages:

Advantages:

- Negotiated sales allow for tailored terms and foster strong relationships between parties, leading to mutually beneficial outcomes.

- Transactions conducted through negotiated sales maintain confidentiality, preventing sensitive information from becoming public.

- Verbal interactions in negotiated sales enable negotiation flexibility, promoting efficient communication and problem-solving.

- Parties can adapt their negotiation strategies to the specific circumstances, leading to more suitable and flexible agreements.

- Negotiated sales strive to achieve outcomes that satisfy the interests of both parties, contributing to a win-win situation.

- Information regarding transactions and prices remains within the involved parties, reducing the risk of market speculation.

- Negotiated sales encourage creative problem-solving, allowing parties to explore innovative approaches to meet their needs.

Disadvantages:

- The technique may result in limited or no competition among buyers, potentially affecting the final pricing and terms.

- The negotiation process in this technique can extend the sales cycle, causing delays in finalizing the transaction.

- Compared to competitive bidding, negotiated sales might lead to less optimal price discovery for the involved parties.

- There's a possibility of biased terms and conditions favoring one party over the other due to the absence of competitive pressure.

- Negotiations in this method could stretch over a longer duration, which may impact overall efficiency.

- Negotiated sales limit the exposure of the offering to a broader market, potentially missing out on better opportunities.

- The absence of competitive pressure could result in non-optimal pricing, leading to potential financial drawbacks.

- Its dependence on negotiating skills might slow the parties' decision-making process.

- Parties might not attain fair market value due to the lack of competitive pressure that could increase prices.

Negotiated Sale vs Auction vs Competitive Sale

The differences are as follows:

| Negotiated Sale | Auction | Competitive Sale |

|---|---|---|

| Private negotiations between buyer and seller. | Public bidding process. | Formal bidding process with structured interaction. |

| Direct interaction between buyer and seller. | Limited interaction. | Structured interaction between parties. |

| Highest degree of confidentiality. | Limited confidentiality. | Moderate to high confidentiality. |

| Tailored structure for negotiation. | Fixed terms of negotiation. | Customizable deal terms. |

| No buyer competition. | Intense buyer competition. | Similar to an auction. |

| No bidding for price discovery. | Competitive bidding process. | The core mechanism is competitive bidding. |

| Limited market exposure. | Wide market exposure. | Comparable to an auction. |

| Variable time efficiency. | Quick time efficiency. | Typically moderate time efficiency. |

| Logical buyer needing confidentiality. | Transparency and a fair market. | Requires competitive offers. |

| Moderate decision complexity. | Relatively simple decisions. | Similar to a negotiated sale. |