Table Of Contents

What Is Mosaic Theory?

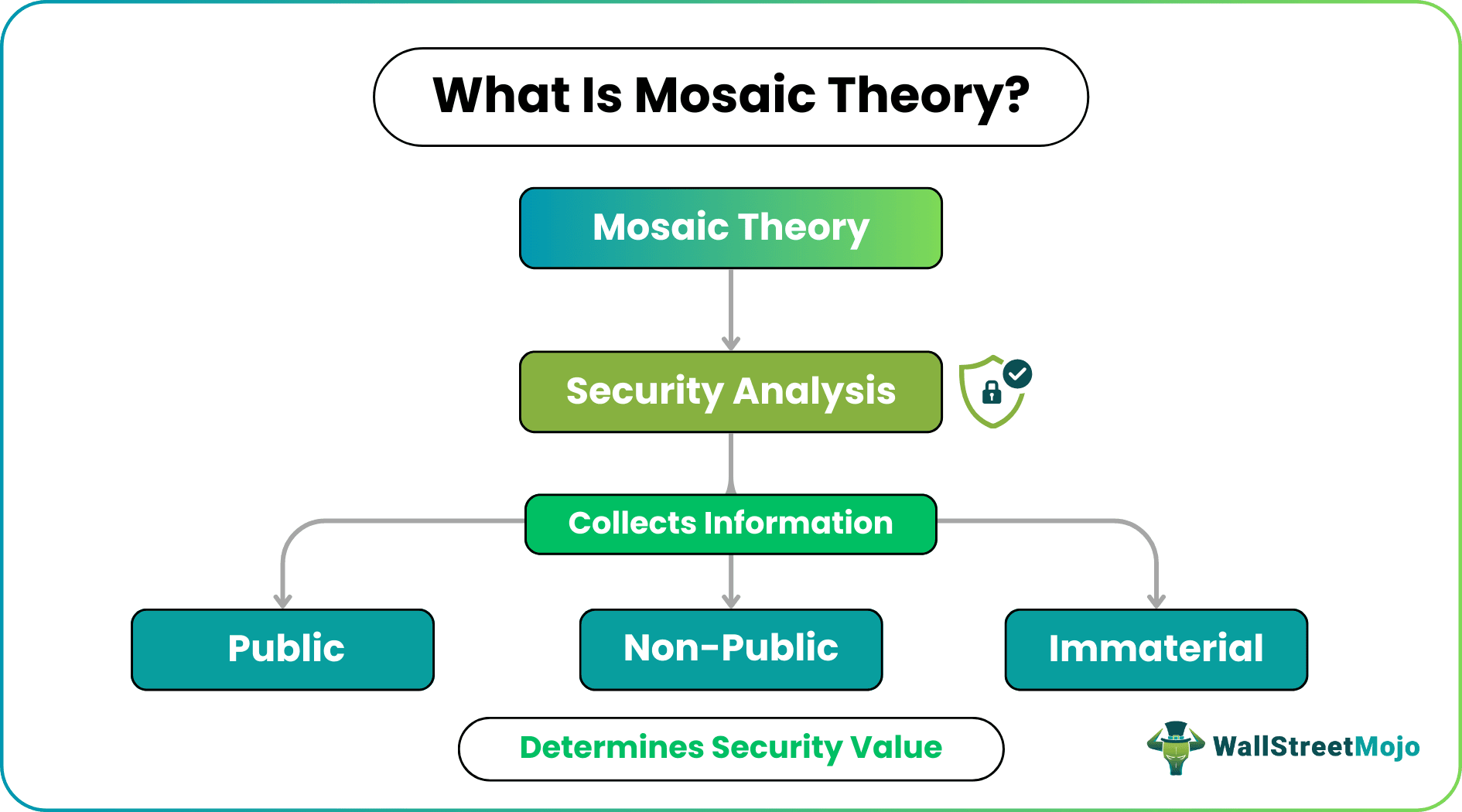

The Mosaic theory is a concept used in the field of security analysis. The analyst gathers information regarding a firm's public, non-public, material & immaterial information to derive the company's value or security. Measurement of a business's economic & financial stability lays this theory's primary purpose.

It aids financial analysts in recommending the best-valued & high-yielding securities to their investors. The CFA institute accepts it as a reasonable legal means of gathering information on a company or investment. This theory can be helpful when a company faces uncertainties not fully reflected in its public disclosure. Therefore, all the information analysts obtain regarding security gets disclosed to investors.

Key Takeaways

- The Mosaic theory definition is used in finance and securities law to analyze and evaluate non-public information about a company. This approach allows investors to make better decisions and gain an edge in the market.

- Besides, this theory aims to give investors a complete picture of a company's financial performance and help them make informed investment decisions.

- The Mosaic theory of investing benefits the evaluation of companies that are not widely followed or publicly traded.

- Moreover, investors must ensure they are not engaging in insider trading or violating securities laws.

Mosaic Theory Explained

The Mosaic theory refers to a CFA institute-approved method of gathering information regarding a company or security. According to this theory, gathering and assembling data from various sources like a mosaic creates a comprehensive investment picture. In addition, the information collected could include financial reports, news articles, press releases, industry reports, and other market-related data.

Furthermore, this theory allows analysts to collect data from various sources. Hence, they must be careful not to use non-public information obtained through illegal means. However, the Mosaic theory of insider trading has a fragile line of difference, so one must be cautious using the approach. Furthermore, engaging in insider trading is illegal under U.S. securities laws, and individuals participating in this type of trading may face civil and criminal penalties.

Although, the theory is also utilized in Mosaic theory in Fourth Amendment cases to assess whether the government’s data collection and use constitutes an unreasonable search or seizure. In addition, once the investors have gathered information from various sources. Moreover, they can use this theory to synthesize the data and identify patterns and trends to help them make better-informed decisions. Overall, the Mosaic theory of investing is a helpful framework for investors who want to gain a detailed understanding of the companies and securities they are analyzing.

This theory also allows analysts to gauge the potential risks and opportunities that may not be available immediately from a single data source. As a result, investors and traders benefit from the information.

Examples

For a better understanding of the topic, let us go through the example of the theory discussed here:

Example #1

Suppose Gabriel, an analyst, researches the company DEF LLC. It is using its 10-K & 10Q published and media reports available publicly. As a result, based on this theory, Gabriel concludes that DEF LLC. has solid financials and is about to add another subsidiary in China to expand its business.

None of the analysts or industry veterans knew that information since DEF LLC. Never disclosed it. Hence, Gabriel conducted research using this theory that falls within the legal framework of the Mosaic theory.

Example #2

Let's assume an investor is interested in buying stocks in a restaurant chain. The research begins with a review of the company's financial statements. Hence, the chain has been consistently profitable in recent years.

By visiting several restaurant locations, the investor notes that customers often wait for tables during peak hours, suggesting that the restaurants are typically busy. The investor then reads some news articles and discovers that the restaurant chain intends to expand into new markets and will launch a new marketing campaign to attract more customers.

After gathering all the information, the investor concludes that the restaurant chain is well-managed, has a solid customer base, and is poised for growth. Based on this analysis, the investor would purchase the restaurant chain's stock.

This example illustrates how an investor can use this theory to gather and analyze information from multiple sources. And therefore, create a more comprehensive understanding of an investment opportunity.

Importance

Collecting information and other details about security or a firm through public input is considered ethically and legally acceptable. Therefore, let us study some of the importance of the Mosaic theory as listed below:

- It is a vital tool for analysts to gather valuable insights into a company's security.

- Analysts can determine the exact values of securities, allowing them to make more informed investment decisions.

- The Mosaic theory helps prevent insider trading by relying on the transparency of profitability through financial statements.

- As a result, by encouraging a disciplined approach to investing. Thus, it assists investors in avoiding impulsive or emotionally-driven decisions that result in poor investing outcomes.

- Law enforcement agencies apply the Mosaic theory's fourth amendment concept in cases concerning surveillance technology, such as GPS tracking devices or cellphone tower records.