Table Of Contents

What Is Mortgage Formula?

The formula for mortgage basically revolves around the fixed monthly payment and the amount of outstanding loan. . This formula is used to find the amount of payment that a borrower will make to the lender of funds that are taken against a mortgage or collateral.

In such type of loans, the lender has the right to take away the property in case the borrower is not able to pay loan installments. The formula is used to find the fixed monthly amount over the entire term of the loan against which the lender has accepted a collateral.

Mortgage Formula Explained

The mortgage formula is a tool in the financial market that is widely used to assess the financial obligation which the borrower has towards the lender in terms of loan repayment. It helps in calculating the monthly installments with clarity and act as a guide in financial planning and budgeting. Now let us dive into the formula in details as given below.

The fixed monthly mortgage repayment calculation is based on the annuity formula and it is mathematically represented as,

Fixed Monthly Mortgage Repayment Calculation = P * r * (1 + r)n /

where P = Outstanding loan amount, r = Effective monthly interest rate, n = Total number of periods / months

On the other hand, in a loan mortgage formula, the outstanding loan balance after payment m months is derived by using the below formula,

Outstanding Loan Balance= P * /

The simple mortgage formula for fixed monthly mortgage repayment calculation and outstanding loan balance can be derived by using the following steps:

Identify the sanctioned loan amount, which is denoted by P.

Now figure out the rate of interest being charged annually and then divide the rate of interest by 12 to get the effective interest rate, which is denoted by r.

Now determine the tenure of the loan amount in terms of a number of periods/months and is denoted by n.

On the basis of the available information, the amount of fixed monthly payment can be computed as above.

- The fixed monthly payment comprises of interest and a principal component. Therefore, the outstanding loan amount is derived by adding the interest accrued form months and deducting fixed monthly payments from the loan principal, and it is represented as above.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Examples

Let's see some simple to advanced examples of fixed monthly mortgage payment calculation in a loan mortgage formula.

Example #1

Let us take the simple example of a loan for setting up a technology-based company and the loan is valued at $1,000,000. Now the charges annual interest rate of 12% and the loan has to be repaid over a period of 10 years. Using the above-mentioned mortgage formula calculate the fixed monthly payment.

where,

No. of periods, n = 10 * 12 months = 120 months

Effective monthly interest rate, r = 12% / 12 = 1%

Now, the calculation of fixed monthly payment is as follows,

- Fixed Monthly Payment = P * r * (1 + r)n /

- = $1,000,000 * 1% * (1 + 1%)120 /

Fixed Monthly Payment will be -

- Fixed Monthly Payment= $14,347.09 ~ $14,347

Therefore, the fixed monthly payment is $14,347.

Example #2

Let us assume that there is a company which has $1,000 of loan outstanding which has to be repaid over the next 2 years. The EMI will be computed at an interest rate of 12%. Now based on the available information calculate

- Loan outstanding at the end of 12 months

- Principal Repayment in the 18th month

Given,

Loan principal, P = $1,000

No. of periods, n = 2 * 12 months = 24 months

Effective interest rate, r = 12% / 12 = 1%

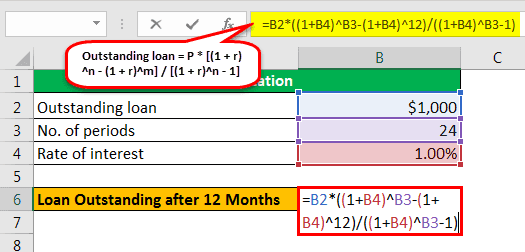

#1 - Loan Outstanding after 12 Months

The calculation of loan outstanding after 12 months will be as follows-

- = P * /

- = $1,000 * /

Outstanding Loan after 12 Months will be-

- Outstanding loan = $529.82

#2 - Principal Repayment in the 18th Month

The principal repayment in the 18th month can be computed by deducting the outstanding loan balance after 18 months from that of 17 months. Now,

Loan Outstanding after 17 Months

- Loan outstanding after 17 months = P * /

- = $1,000 * /

- = $316.72

Loan Outstanding after 18 Months

- Loan outstanding after 18 months = P * /

- = $1,000 * /

- = $272.81

Therefore, the principal repayment in the 18th month will be

- Principal Repayment in 18th Month= $43.91

From the above examples regarding mortgage payment formula, we can clearly understand how the formula is commonly used in the financial market by the lenders to calculate mortgage instalments. It is extremely useful to ensure what is the monthly amount that the borrower needs to pay out, be it individual or corporate. This helps in monthly financial planning and budgeting. Same is the case with the lender, who can calculate the cash inflow that they should expect to get from the investment.

Both borrower and lender use this simple mortgage formula for their own purpose, because it helps in informed decision making while making any major purchase or investment. The monthly fund outflow gives an idea about exactly how much money is being paid out after considering the principal and interest.

Relevance And Uses

Let us understand the practical uses of the mortgage payment formula, as given below:

- It is of great importance for a business to understand the concept of a mortgage. The Mortgage Equation can be used to design a loan amortization schedule, which shows in detail how much is being paid in interest instead of focusing just on the fixed monthly payment.

- Borrowers can calculate mortgage formula and make decisions based on the interest costs, which is a better way to measure the real cost of the loan. As such, a borrower can also decide, based on the interest savings that which loan to choose when different lenders offer different terms.

- It is also a great way to plan out the finances and budget for the month both in case of the borrower and the lender. The lender already knows how much cash inflow they can expect to get from the investment and the borrower is sure of the cash outflow to be made, for which they can make provisions beforehand.

- This calculation helps in selecting a suitable borrowing option as per their own affordability. This is also a way to evaluate the creditworthiness and financial strength of the borrower, which is extremely important in case of lending.

- It gives a very clear idea about the loan amortization schedule,which is commonly made by both the parties who calculate mortgage formula. This schedule outlines how the loan will keep on reducing every month with the payment of each installment. Therefore, over time the reduction of loan can be successfully tracked and according financial planning is done.

Thus, the above are some important uses of the formula.

Mortgage Calculation (with Excel Template)

Now let us take the case mentioned in example 2 to illustrate the concept of mortgage calculation in the excel template. The table gives a snapshot of the amortization schedule for a mortgage.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.