Table Of Contents

Mortgage Payment Loan Calculator in Excel

A mortgage calculator in Excel is not a built-in feature in Excel. But, we can make our mortgage calculator using some formulas. To make a mortgage calculator and calculate the amortization schedule, we need to create our categories column for all the types and data to be inserted. Then, we can use the formula for mortgage calculation in one cell. Now for the future, we can change the values and have our mortgage calculator in Excel.

Formula to Calculate Mortgage Payment in Excel

Like many other excel mortgage calculator, we also have the formula to calculate the monthly EMI amount. In addition, we have a built-in PMT function to calculate the monthly EMI in Excel.

PMT function includes three mandatory and two optional parameters.

- Rate: This is the interest rate applicable to the loan. If the interest is per annum, then you need to convert this to a monthly payment by dividing the interest rate by 12.

- Nper: This is simply the duration of the loan. How many EMIs are you going to clear the loan? For example, if the loan tenure is for 2 years, then the loan tenure is 24 months.

- Pv: This is the present value of the loan amount you are taking. Simply borrowing money, i.e., loan amount.

All the above three parameters are good enough to calculate the monthly EMI, but on top of this, we have two other optional parameters.

- : This is the future value of the loan. If you ignore this default value will be zero.

- : This is nothing but whether the loan repayment is at the start or end of the month. If it is at the beginning, the argument is 1. If the payment ends at the month's end, the argument will be zero (0). By default, the argument will be zero.

Examples

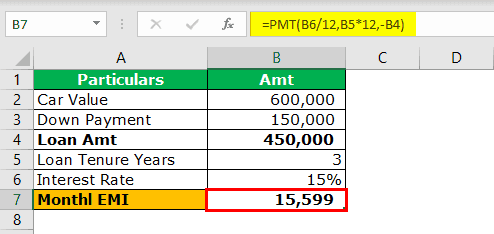

Mr. A wants to buy a car, which costs ₹600,000. So he approached the bank, and the bank agreed to sanction the loan based on the below conditions.

- Down Payment: Rs 150,000

- Loan Tenure: 3 years and above

- Interest Rate: 15% PA.

Now, Mr. A wants to evaluate his monthly savings and decide on the loan-taking possibilities.

In Excel, using the PMT function, we can calculate the EMI.

- We must first insert all this information in Excel.

- Open PMT function in the B7 cell.

- The first thing is the rate, so the interest rate selects the B6 cell. Since the interest rate is per annum, we need to convert it to month by dividing the same by 12.

- NPER is the number of payments to clear the loan. So, the loan tenure is 3 years, 3*12 = 36 months.

- PV is nothing but the loan amount Mr. A is taking from the bank. Since this amount is a credit given by the bank, we need to mention this amount is negative.

- Close the bracket and press the “Enter” key. We have an EMI payment per month.

So, to clear the loan of ₹450,000 in 3 years at an interest rate of 15%, Mr. A has to pay ₹15,599 per month.

Things to Remember

- It would help if we filled the only orange-colored cell.

- The loan amortization table may show the breakup of the principal amount and interest amount each month.

- It will also show you the extra amount you are paying as a percentage.