Table Of Contents

Moral Hazard Definition

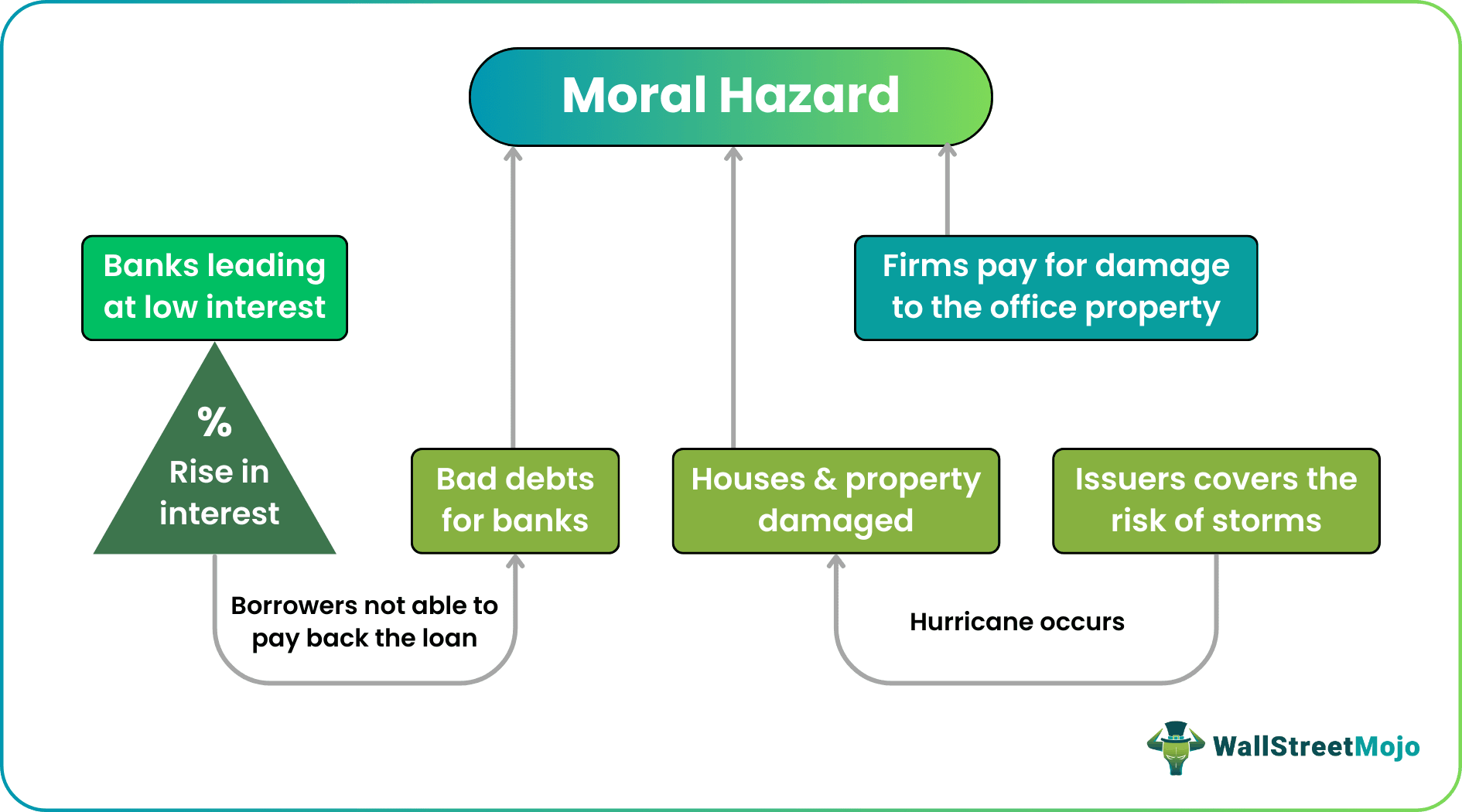

A moral hazard is a situation where a party can engage in a risky action because some other party is bearing the consequence. The party taking the risk has minimal responsibility related to it and the consequence's cost. However, the party bearing the fallout is contractually bound to do so.

It is a term that describes a situation where an individual or a company is biased toward or has the incentive to take risks since somebody else will bear the result. Such situations usually occur during financial transactions where the risk-taking party is insured, due to which it will not have to bear the entire cost of risk.

Key Takeaways

- Moral hazard is a term used to describe how a person or an organization tends to indulge in risky undertakings by knowing they are protected against the consequences.

- The risk-taking party has minimal responsibility towards the loss and its cost, which instigates them to do so.

- This arrangement is usually made during a financial transaction, where the insured party is prepared to undertake a venture that might have negative consequences borne by the insurer.

- The loss-bearing party is bound by a contract and has to abide by its terms and conditions.

Moral Hazard Problem Explained

A moral hazard is a circumstance where a person or an organization is incentivized to take a risk with the assurance that the result and cost of it will be borne by someone else.

In economics, a moral hazard is a situation where insurance is used to cover the cost of any danger or peril. The insurer bears the liability of the peril. The insurer enters into a contract with the party to be insured. The insurer suffers the consequence, which leaves the insured without any responsibility. Thus, they can do things most beneficially.

In insurance, moral hazard results from information inequality between two parties. The insured has more information regarding a particular situation which they take as an advantage to take up a risky venture. On the other hand, the insurer usually needs access to complete information, or they would charge a very high premium or may not issue a policy.

Apart from an individual or company, this kind of hazard can also be associated with an economy. For example, moral hazard in banking is quite a typical scenario, where the banks sometimes take risks by giving loans to borrowers who cannot pay them back. Banks earn interest from these loans. Thus, the theory of moral hazard applies here because the banks take the risk since they know that the central banks can afford to bail them out to protect the economy.

Types

Let us look at the various types of moral hazards:

- Financial crisis – The banking system is highly prone to moral hazard. Banks loan out money to borrowers at a low-interest rate, which borrowers cannot pay back if it rises.

- Misuse of office goods – Employees often misuse office stationery or electronic devices since they know the company will bear the cost or loss.

- Insurance hazard – Insurance companies are also high risk because the insured may indulge in risky behavior of projects knowing that the insurance company will pay the claim.

Causes

A moral hazard can happen due to various reasons:

- The incentive to take risks – The leading cause of such a situation is one party's incentive to indulge in a risky venture because the result is a loss, and another party will bear the cost.

- Lack of information – In insurance, moral hazard results from a lack of communication between both parties. As a result, the insurer usually has fewer facts about a situation and issues insurance, which the insured takes as an advantage.

- Commission and profits – Sometimes, many financial institutions accept this kind of hazard to earn commission and incentives. For example, moral hazard in the banking sector is widespread because banks give loans to borrowers who might fail to pay them back. But these financial institutions provide loans in the hope of earning a commission.

- Lack of ownership – Sometimes, an individual might not completely own a valuable thing. Thus, this instigates the person to take less responsibility to protect it, knowing that somebody else will bear the loss.

Consequences

The consequences of moral hazard are as follows:

- Economic downfall – When financial institutions start lending out vast amounts as loans to borrowers, they may not always verify the creditworthiness of borrowers. Thus, the hazard leads to the collapse of the banking system, which is an integral part of the country's economy, because the borrower may not repay the loan.

- Risk eventually passed on to investors – The investors suffer in the end because if the financial system goes down, the return that an investor should earn also goes down.

- Loss of faith – Investors or people who hope to earn good returns eventually lose faith in the financial system.

- The burden on the insurer – In insurance, moral hazard leads to huge claims because the insured entity may take risks that can easily be because of a lack of proper communication.

- People become less conscious – It tends to make people less protective of their possessions since they know that insurance claims will protect them from loss.

- Wastage – Employees in offices tend to overuse or misuse things since they know the company will bear the loss.

How To Reduce?

There are ways and means to reduce a moral hazard. They are as given below:

- Creditworthiness assessment – When banks lend money to borrowers, they should assess the creditworthiness so there is no bad debt.

- Offer incentives to be responsible - A straightforward method to reduce this kind of hazard in society is offering incentives to encourage people to act responsibly.

- Monitoring – A continuous monitoring system should be in place, especially in offices or public places, where multiple people handle many things.

- Fine or punishment – Another way to reduce this problem is by introducing fines or punishment, which will stop the misuse of property or information for one's benefit at the cost of someone else's loss.

- Control of central banks over financial institutions – The country’s central banks should adequately control the banks and finance companies that give out loans. Their criteria for a bailout process should be stern and strict.

Examples

Some examples will help in understanding the theory of moral hazard better.

Example #1

Sunshine Ltd., a company in the software business, has its office in Florida. It has been a start-up in the market for the last three years. It has invested well in infrastructure facilities like ample office space, good laptops, high-speed internet for its employees, other office necessities, cars for pick and drop facility for employees living far away, etc.

However, the company notices that office workers often misuse the facilities. They mishandle the laptops, use the internet for personal purposes, and waste stationery and other things kept for office use. Even people availing the pick and drop make the cars dirty.

To avoid this kind of hazard, the company has set up cameras in various office parts to identify employees mishandling the devices and blocking websites unrelated to office work. It has also set up car cameras to keep track of people misusing the facility. This strict supervision led to a considerable reduction in costs for the company.

Example #2

In economics, moral hazard plays its part in the global financial market, where the competitive policies of central banks that control inflation will eventually put investors at risk.

The bond market, which has an important place in a country’s financial system, will face a lot of chaos. This is because policymakers are trying to control consumer prices by raising interest rates within the least amount of time, which leads to less purchase of government debt and less borrowing by investors, creating a drought of liquidity.

Thus, it threatens retirees, pension fund holders, or people looking for safe investments. These investors are bearing the brunt of the moral hazard of the bond market. The banks, which can make markets, are at a loss. Even some essential American debt buyers need clarification with the chaotic condition of the US bonds.

Example #3

Moral hazard has created havoc as the private insurers in Florida are struggling to meet claims of up to $67 million due to hurricane Ian ravaging the southwestern coast of Florida and destroying houses, leaving 125 people dead.

The coastal areas are highly prone to storms similar to this, requiring upgraded climate-resilient constructions. But the concern is that homeowners fail to do so because they think it is a waste of money since storms may change directions, and above all, insurers will pay for the damage.

Moral Hazard vs Adverse Selection vs Morale Hazard

A moral hazard is a tendency to risk by knowing that there is protection against loss. Adverse selection is the tendency to arrange risk cover to limit the loss one cannot minimize. Morale hazard is the increase in the probability of occurrence of loss. First, however, let us look at the differences.

| Moral Hazard | Adverse Selection | Morale Hazard |

| Tendency to take risks knowing that there is protection. | Tendency to take risk cover to transfer the loss. | Tendency to act in a way that will increase the chance of loss. |

| The behavior is triggered after taking the cover. | The behavior is triggered before taking the cover. | The behavior is triggered before taking the cover. |

| Information asymmetry exists after taking cover. | Information asymmetry exists before taking cover. | Information asymmetry exists before taking cover. |

| The intent of taking cover is consciously made to transfer risk. | The intent to transfer risk is consciously made. | The intent of taking cover is subconsciously or indifferently made to transfer risk. |