Table Of Contents

What is a Money Market Account?

A money market account (MMA) yields a higher interest than a traditional savings account. The minimum balance is also higher. MMAs are offered by credit unions and banks. For withdrawal, their customers use debit cards and checks.

The Federal Deposit Insurance Company (FDIC) insures MMAs offered by credit unions. Similarly, the National Credit Union Administration (NCUA) insures MMAs offered by banks. Insurance is capped at $250,000 for a single owner account and $500,000 for a joint account.

Table of Contents

- What is a Money Market Account?

- A money market account (MMA) is a deposit account. Customers can open MMAs at a bank or credit union. MMAs offer better interest rates than savings accounts.

- Unlike savings accounts, there is a limit on the number of MMA withdrawals—restricted to six transactions per month.

- The minimum balance requirement for an MMA is higher. Also, the money market is less regulated—customers are heavily charged for various infractions—for example, exceeding the withdrawal limit.

How Does a Money Market Account Work?

A money market deposit account offers better interest rates than a regular savings account. It can be opened with a bank that insures clients' FDIC deposits (Federal Deposit Insurance Corporation). Credit unions also provide Money Market Account (MMA) services—secured by the National Credit Union Administration (NCUA). Insurance is capped at $250,000 for a single owner account and $500,000 for a joint account.

MMAs are quite different from regular savings accounts. MMA users need to maintain a minimum balance over time. Banks usually limit transaction frequency—to six transactions per month. Banks impose high charges on non-maintenance of minimum balance and on transactions that exceed the specified limit. Compared to a savings account, even the number of checks allowed is very limited.

MMAs suit investors who do not require funds for routine transactions—those who withdraw during extreme conditions only. It is also beneficial to investors who need short-term investments (liquid investments) that yield high returns.

Money Market and Capital Market Video Explanation

Example

Anna has $190,000, set aside for emergencies. Therefore, she decides to deposit the sum in a money market account—she can withdraw the amount whenever she needs it. In addition, she would receive higher interest (compared to a savings account). She opted for additional services—debit card withdrawal and checks.

For the next two years, Anna withdrew very less and ended up with a closing balance of $165,000 in 2020. In 2021, the bank was robbed. But, FDIC insures Money Market Accounts (MMA), so Anna recovered $165,000 through insurance claims.

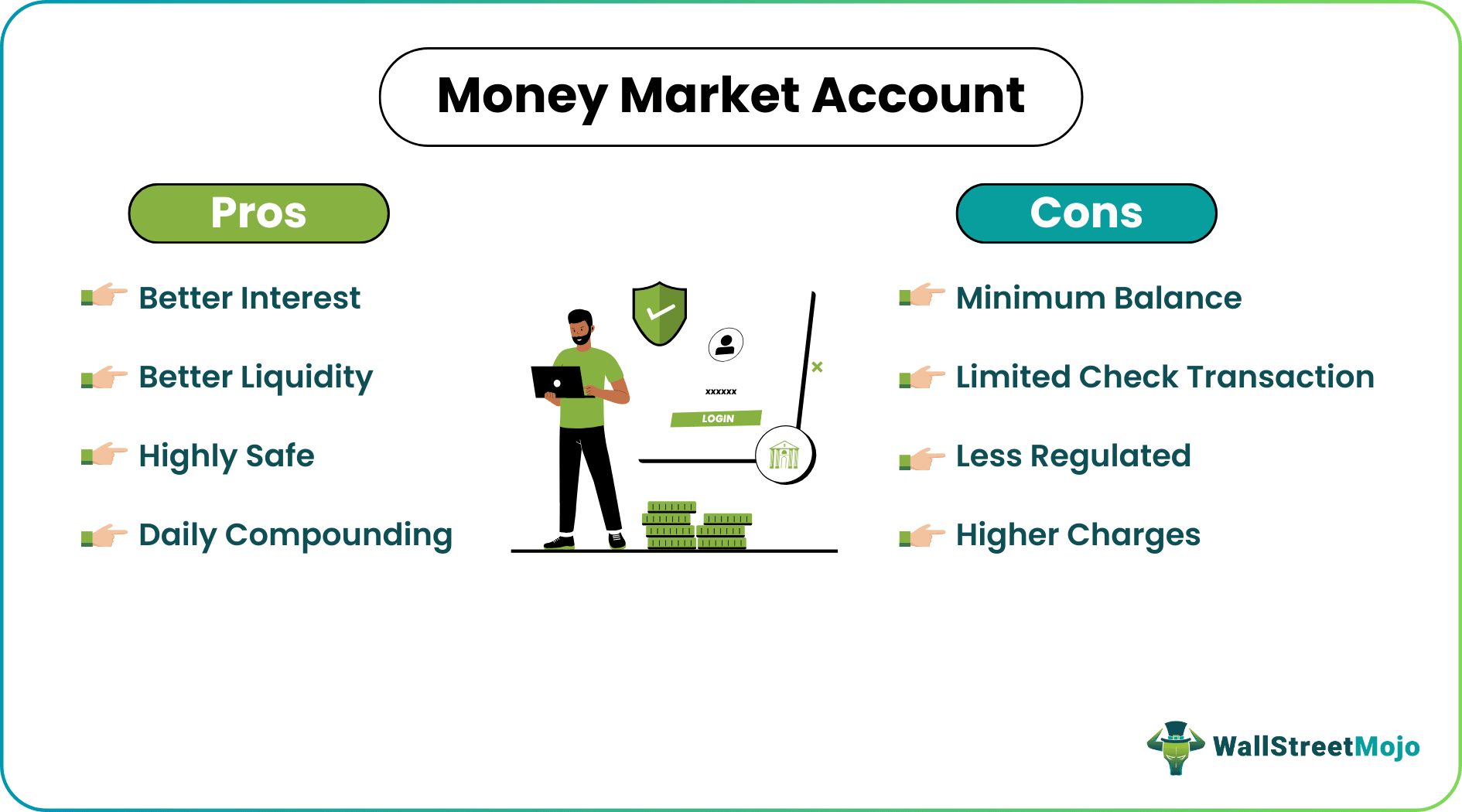

Pros and Cons

The biggest MMA advantage is the higher interest rate. MMA funds are subject to daily compounding. In addition, MMAs offer flexibility and liquidity—a convenient withdrawal facility. Just like other accounts, they offer check-writing and debit card facilities. Money market balances are insured by national institutions like FDIC and NCUA—added security.

Money Market Accounts (MMA) are not for everyone. The minimum balance requirement is high. Only a limited number of transactions are allowed in a period; this is a huge disadvantage. As a result, MMA users may face liquidity issues.

The money market is less regulated—customers are charged for various infractions—for example, exceeding the withdrawal limit. Also, these charges are steep when compared to savings accounts.

Money Market Account vs Savings Account

Though MMA is a kind of savings account, it differs from the traditional savings account in the following ways:

| Basis | Money Market Account | Savings Account |

|---|---|---|

| Interest Rate | Higher interest rate | Comparatively low-interest rate |

| Number of Transaction | Limited to six transactions | Unlimited transactions |

| Minimum Balance | Requires minimum balance | No minimum balance |

| Check-writing | Allows only six checks per month | No restriction on check-writing |

| Debit Card | Provides debit card facility | No debit card facility |

| Withdrawal Limit | Yes | No |

| Fee Structure | Moderate fees | Low fees or None |

| Insurance | Deposits in MMA are insured by FDIC or NCUA | No security or insurance |

| Flexibility | Moderate | Less |

Money Market Account Vs. Money Market Fund

MMAs are completely different from money market products like Mutual Fund and certificates of deposit. Following are the differences between a money market account and a money market fund.

| Basis | Money Market Account | Money Market Fund |

|---|---|---|

| Meaning | A deposit account maintained with a bank or credit union | A financial instrument or mutual fund managed by an Asset Management Company |

| Type | Bank deposit | Investment Product |

| Industry | Banking | Mutual fund or Asset Management Company (AMC) |

| Insurance | Deposits in MMA are insured by FDIC or NCUA | No security and no insurance |

| Return | In the form of periodic interest at a particular rate | Market-based returns which are irregular and unpredictable |

| Debit Card | Provides debit card facility | It can be linked to a debit card |

| Transaction / Withdrawal Limit | Limited to six transactions | Unlimited transactions |

| Time Limit | Transactions allowed during banking hours | Transactions can be executed anytime |

| Minimum Deposit or Investment | Low | Comparatively high |

Frequently Asked Questions (FAQs)

Since Money Market Accounts (MMA) are secured by the FDIC and NCUA, funds within the prescribed insurance limit are safe. Individual account holders have an insurance limit of $250,000, and joint account holders have a limit of $500,000.

Though MMA holders can withdraw funds from their account at their discretion, the banks have set a limit for the number of such withdrawals. Once customers exceed the limit, the bank charges a hefty fee.

MMAs suit investors who want to deposit huge sums long-term. An MMA yields a decent interest on deposits and offers adequate flexibility (withdrawals). MMA investments are very safe—insured by FDIC or NCUA.

Recommended Articles

This article has been a guide to What are Money Market Accounts (MMA) and Definition. We explain Money Market Account (MMA) meaning, interest rates, high yield examples, FDIC & MMA vs. savings account. You can learn more about financing from the following articles –