Table Of Contents

Money Market Definition

The money market is a financial market wherein short-term assets and open-ended funds are traded between institutions and traders. The market offers very high liquidity as the assets can easily convert into cash. Thus, it helps businesses and the government in meeting their working capital requirements.

Investments here fall under the range of a day to a year, with the risks and gains both being low.

Table of Contents

- Money Market Definition

- Money Market refers to the financial segment for the trade of liquid and short-term assets that can be easily converted into cash. Businesses and governments particularly benefit from this market as it helps in meeting their working capital requirements.

- Unlike a capital market where long-term securities are exchanged, here the trades investments range from a day, three months, 365 days, etc.

- Longer the period of investment, higher the risk and gains. As such, the assets traded here come with low risk and gains.

- Due to high transaction value, market investors are largely insurance companies, governments, NBFCs, banks, credit institutions, etc. Retail investors invest using money market funds and accounts.

- Popular investment instruments include treasury bills, certificate of deposit (CDS,) bills of exchange, etc.

Money Market Explained

A money market provides easily available cash to businesses, institutions and governments for day-to-day operations. For example, businesses borrow short-term loans available in the market to fulfill daily business needs such as uninterrupted electricity, timely wage payments, etc.

In 2020, the US money market assets grew to $4.77 trillion, which throws light on the massive role the market plays in keeping liquidity in the economy. The trading instruments are open market funds and short-term securities that come with high liquidity. As such, assets can be easily converted into cash.

Moreover, the tenure of investments ranges from a day to a year, usually not more than 365 days. Since investments with longer tenure earn better, the assets traded here have low risks and gains. Thus, money markets differ from capital markets where long term securities trade, and rates, risks and returns are high.

Besides, the high-value transactions make it difficult for retail investors to supply funds. The predominant market investors are insurance companies, governments, NBFCs, banks, and credit institutions, among others. Retail investors can invest their savings through the indirect route of mutual funds and specialized banking accounts.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Role of Central Bank

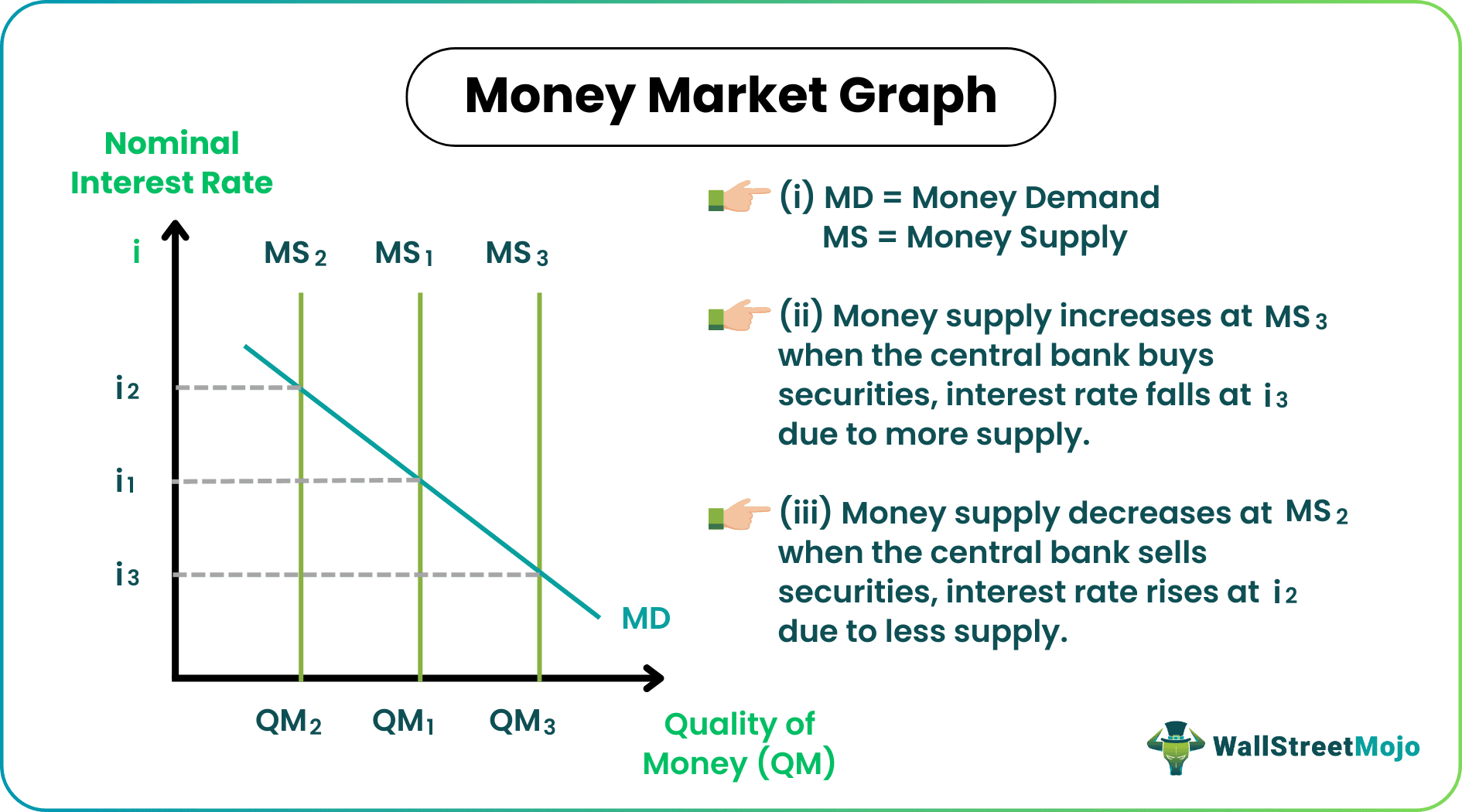

Central banks like the US Federal Reserve control the supply of money and curtail inflation/deflation using the money market. To tackle deflation, the central bank buys bonds and securities. As a result, more money is pumped into the economy.

When the money supply increases, nominal interest rates fall. The nominal interest rates can be understood as the cost of borrowed money. In inflation, the central bank buys back bonds and securities. As a result, it reduces the supply of money in the economy, pushing up the nominal interest rates. A money market graph depicts the above action of the central bank.

Money Market and Capital Market Video Explanation

Money Market Functions

- The market helps to bring a balance between the demand and supply of short-term funds, bringing a monetary equilibrium.

- By making funds available to various different participants in the market, the market promotes economic growth of the economy.

- Governments can keep a check on the liquidity in the country by influencing the money supply. In addition, as explained above it helps keep a control on deflation or inflation.

- Also, the market promotes saving and investment by giving a platform to wholesale as well as retail investors for investing/borrowing of funds.

Types of Money Market Instruments

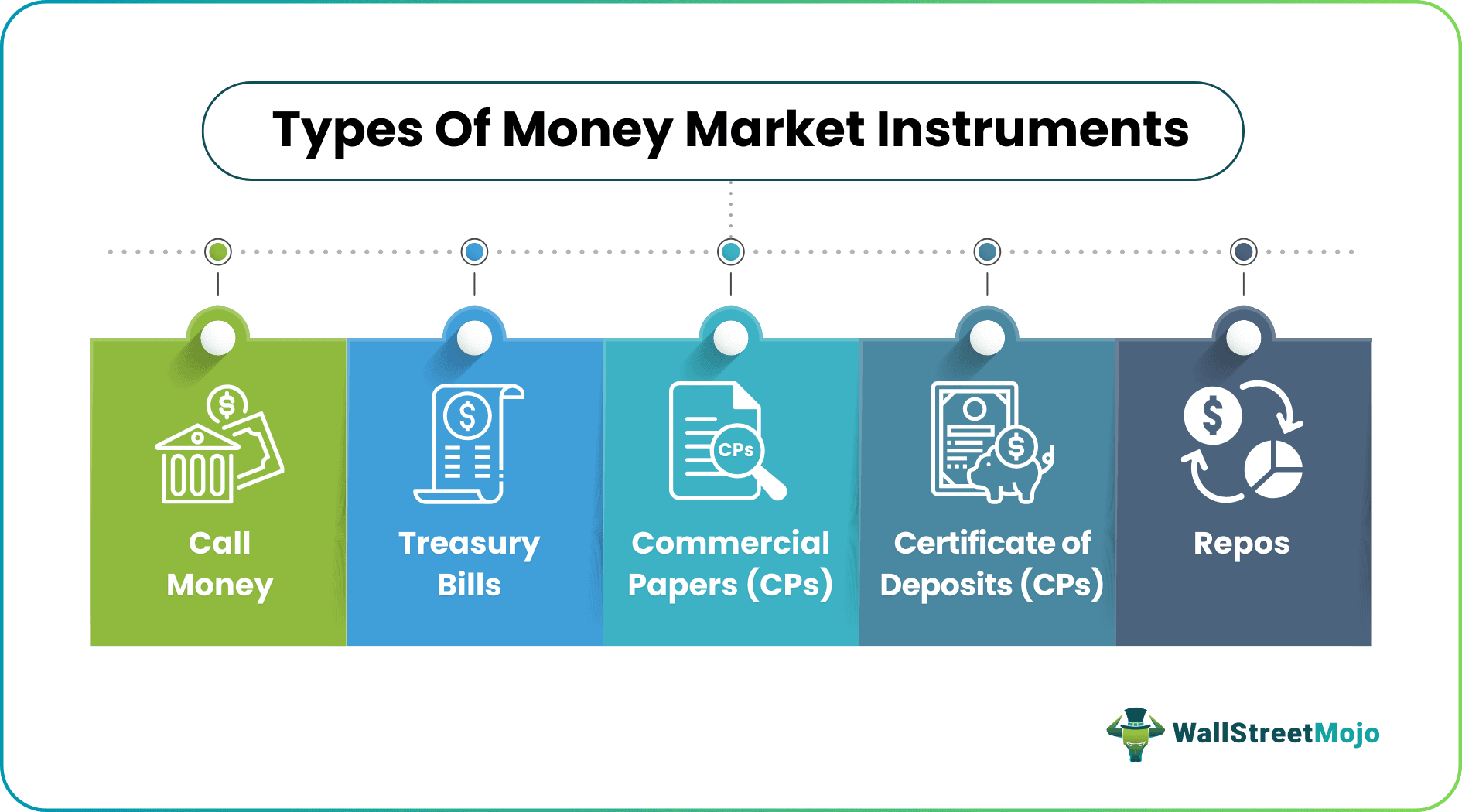

#1 - Call Money

Call money is one of the most liquid instruments. The validity is generally one working day. Banks can face shortfalls that can be solved by borrowing through call money. In contrast, those with surplus cash can invest in other banks through call money.

Call money work as statutory reserves, the minimum cash balance which banks must hold as part of the central bank's mandate to ensure enough liquid cash for daily operations. The investment is available to other financial institutions as well. Borrowing and lending take place at the call rate. With no organized market, the transactions generally occur using phone calls/emails/faxes.

#2 - Treasury Bills

T-bills are issued by a country’s central bank on behalf of its government. The government often raises funds through Treasury Bills that provide quick money. In the money market, it is considered one of the safest investments due to the government backing. They don’t offer an interest income.

T-bills are issued at a discount and redeemed at par, with the investor pocketing the difference as profit. The tenure of T-bills is generally from 14 days to 364 days.

#3 - Commercial Papers (CPs)

Companies generally use commercial papers to fund their short-term working capital needs, such as payment of accounts receivables, inventory purchases, etc. However, these are unsecured in nature. As such, in case of liquidation of the company, they will not have priority against other secured financial short-term instruments.

CPs come with an average maturity of two odd months. However, just like the Treasury Bills, these are also issued at a discount, and therefore, they don't come with separate interests.

#4 - Certificate of Deposits (CDs)

A certificate of deposit is a type of time deposit with the bank. Only a bank can issue a CD. Like all other time deposits, CDs also have a fixed maturity date and cannot be withdrawn before maturity. This acts as a major disadvantage for the instrument.

#5 - Repos

Repo is a repurchase agreement with repo as its abbreviation. For example, Bank A in need of funds, with Bank B having surplus funds. Bank A will enter into an agreement with Bank B to sell its securities (mostly Treasury Bills). Bank B will receive the required funds. However, on a fixed date in future, the Bank A will repurchase these securities from Bank B as part of the agreement.

These are very short-term in nature. Tenure ranges from overnight to a month, while the securities can be directly transferred without the credit risk.

Money Market Funds

Retail investors can gain indirect access to this market through money market funds which are mutual funds with a portfolio of liquid instruments. The portfolio usually contains a mix of CDs, treasury bills, commercial paper, etc. It offers high liquidity, short-tenure and low risk.

Retail investors can buy and sell units of the mutual fund at the prevailing NAV through the mutual fund market, a part of the capital market. Regulators are trying to develop mechanisms to ensure the resilience of this sector as the pandemic exposed many of its vulnerabilities.

Money Market Account Vs Savings Account

Aside from mutual funds, retail investors also invest in this market using a money market account, a hybrid of a current and savings account. Their popularity has emerged from better earnings and withdrawal flexibility than a traditional savings account.

Many banks provide money market accounts; for example, the Bank of America offers high interest in banking rewards to the customers. In addition, the money is insured with Federal Deposit Insurance Corporation (FDIC), giving it safety compared to mutual funds.

As per a report from the FDIC, the average rate or APY on money market accounts under $100000 is 0.07%. The earnings are affected by minimum deposit and fee requirements. As such, finding a bank with better rates and fewer monetary requirements can enhance the earnings.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

FAQs

A money market deals in the trade of cash and cash equivalents to meet the short-term financial needs of businesses, institutions, and governments. Examples include a certificate of deposits (CDs), current account, mortgage-backed loans with short maturities and high liquidity.

Money market investors such as insurance companies, governments, NBFCs, banks, credit institutions invest in highly liquid short term assets providing funds to businesses to fund their daily operations. The risk and return is low in this market.

It is a banking account which is a hybrid of a current and savings account. As a result, they offer higher returns than a traditional savings account. However, the earnings are affected by minimum deposit and fee requirements.