Table Of Contents

What Is Money Illusion?

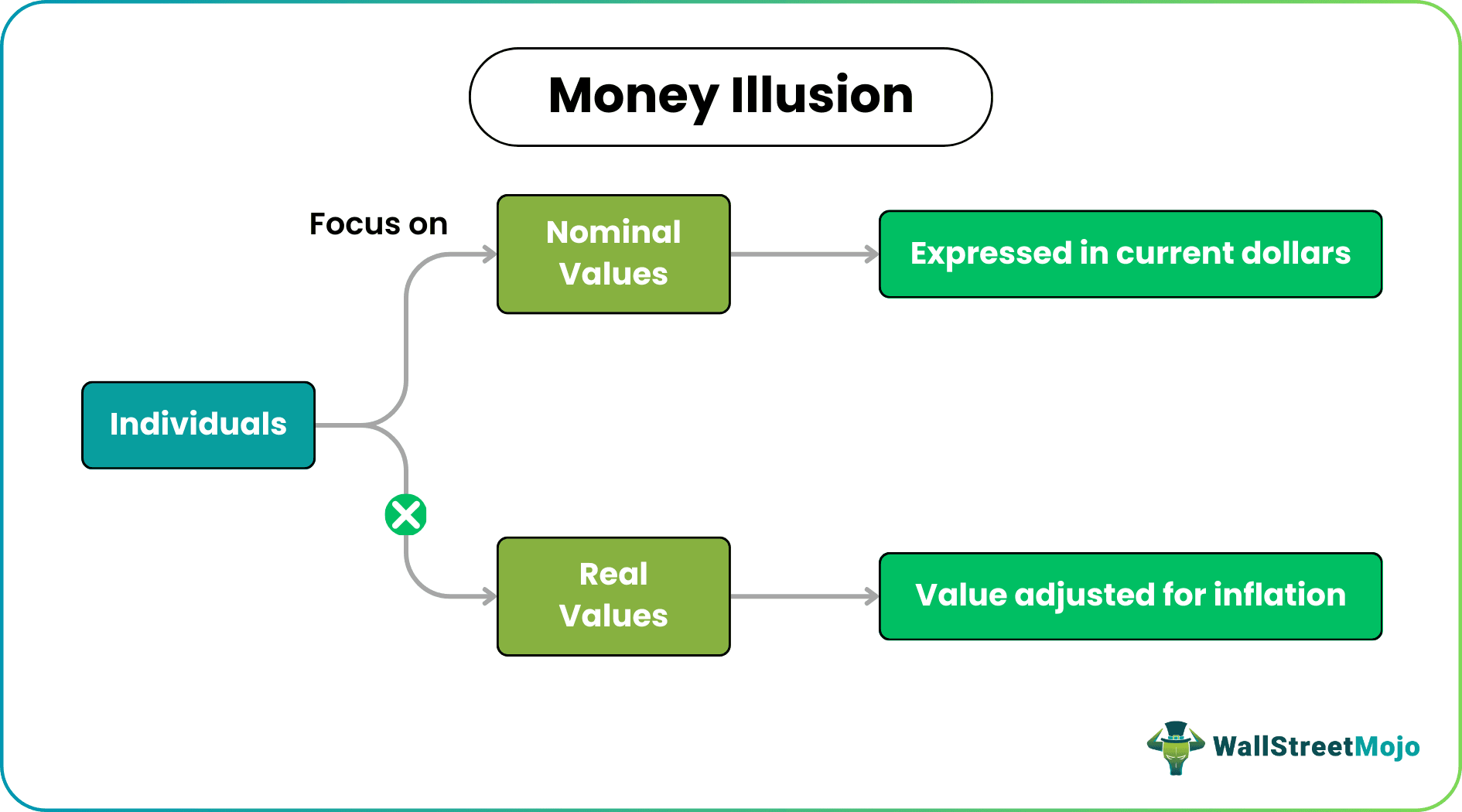

Money illusion refers to a cognitive bias where people mistakenly perceive changes in nominal monetary values (such as prices or wages) as changes in real monetary values without considering the effects of inflation or deflation. In other words, individuals may focus on the nominal amount of money rather than its purchasing power.

Money illusion stems from economic illiteracy among the public and consistent pricing of goods. This can lead to unfair employee wages as employers overlook inflation or deflation. Psychology also perpetuates money illusion, causing people to make misguided financial decisions based on nominal values instead of purchasing power, resulting in a focus on quantity rather than the true worth of money.

Table of contents

- What is Money Illusion?

- Money illusion refers to the tendency of individuals to focus on nominal monetary values (such as prices or wages) without considering the effects of inflation or deflation, leading to a perception of changes in nominal values as changes in real values.

- Lack of financial literacy and understanding of economics can contribute to money illusion. For example, many people may not fully grasp the impact of inflation or changes in the value of money over time, leading to misguided financial decisions.

- Money illusion can affect various aspects of decision-making, including wage negotiations, investment decisions, and strategic planning.

Money Illusion in Economics Explained

Money illusion refers to a psychological phenomenon where individuals perceive their wealth and income solely in nominal terms without considering their real worth. Economists have recognized this bias as a purely psychological effect. For instance, people may mistakenly believe that increasing their wealth will keep them financially secure without considering the impact of inflation.

The term "money illusion" was coined by Irving Fisher, an American economist, in his book "Stabilizing the Dollar." Later on, economist John Maynard Keynes popularized the concept of money illusion to such an extent that Fisher wrote an entire book on economics related to money illusion in 1928. Furthermore, it's important to note that the concept of money illusion is not directly related to the Phillips curve, which describes the negative relationship between employment and inflation.

In general, nominal prices are commonly used to calculate the value of goods and services. However, during hyperinflation, one might consider real prices when determining the value of money. As a direct consequence of the money illusion, workers may base their wage demands on nominal prices of goods and services rather than the actual prices. This can result in companies maintaining low wages during periods of low inflation and hiring more workers than they would if real money value was considered for wage determination.

Reasons

Many people fall into the illusion of money from ignorance of economics and the sticky price effect. Let us see the reasons why this phenomenon is widespread globally.

- Inadequate financial literacy can be a reason for the illusion related to money. Many people do not have proper economics knowledge and keep on thinking that money's value does not change. Inflation and other factors like interest rates do not matter in ascertaining their wealth. Hence, they keep on accumulating wealth in the hope that in the future, their wealth will remain the same. Simultaneously, their money value keeps on decreasing with time and underinflation.

- Sticky prices occur when manufacturers do not change the prices of their products commensurate with inflation or change the value of money. As a result, it creates an illusion that the value of their money has not decreased with time or inflation. Moreover, they feel their monetary value will always remain the same.

- Media and social media also fail to show money's falling or rising value. As a result, one's illusion about its intactness remains unbroken. Advertisers also tend to manipulate the situation to show that monetary value does not change with time or inflation.

- Government laws and taxes do not change with a change in monetary value, creating an impression that monetary value does not change at all. However, even if it changes, the effect remains little and far from reality.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Effect

There seem to be many common but widespread money illusion effects. Let us go through all such effects listed below:

- Employers set low wage increase levels for their workers.

- Employees feel that their wage increase for inflation remains correct.

- It has a serious impact on the expectation of individuals.

- Strategic decision-making gets hampered due to the price illusion.

- It leads to inertial price adjustment expectations followed by a negative monetary shock.

- Furthermore, these sticky expectations transform into inertial pricing judgments when strategic complementarity prevails.

- Positive and negative money shocks having asymmetric effects get produced by the illusion.

- Most working class fail to estimate the actual money for their retirement.

- Many people feel their wealth can beat the bad economy in the future, but they get it wrong.

- Traders wrongly estimate their wealth and do not act timely to match the prevailing real inflation of money value to save their business.

Examples

Let us surf through some money illusion examples to clarify the concept.

Example #1

Imagine John, a worker, receives a 3% raise in his salary from his employer. However, during the same period, the inflation rate in the economy is 4%. Despite the increase in his nominal salary, John may still feel happy and satisfied with the raise, thinking he has received a "real" increase in his purchasing power. However, he may not fully realize that the 3% raise is lower than the inflation rate, meaning that his real wages have decreased in terms of purchasing power.

This example showcases the money illusion effect, where John is focused on the nominal increase in his salary (3%) and fails to consider the impact of inflation (4%) on his real wages. Due to this illusion, John may not adjust his spending or savings habits accordingly, leading to potential financial challenges in the long run if inflation continues to erode his purchasing power.

Example #2

Money illusion, or the tendency to focus on nominal numbers without considering inflation, can impact investment decisions by distorting perceptions of real returns and masking underlying fundamentals during inflationary periods. Nominal returns may appear positive, but when adjusted for inflation, the actual purchasing power of those returns may be diminished.

For example, during the 1970s, the stock market experienced a nominal return of 98% over 15 years. Still, when accounting for inflation, it took 25 years for it to bounce back to its pre-inflation-adjusted level. Similarly, earnings and valuation ratios may also be distorted by nominal numbers, leading investors to overestimate the attractiveness of investments potentially. Adjusting for inflation and using metrics such as the Shiller P/E ratio or other inflation-adjusted valuation measures can provide a more accurate assessment of an investment's true value.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Money illusion refers to the cognitive bias where individuals perceive changes in nominal monetary values (such as prices or wages) as changes in real monetary values without considering the effects of inflation or deflation. On the other hand, price confusion refers to a situation where individuals have difficulty distinguishing between price changes due to inflation or changes in relative prices of goods and services.

Money illusion can affect consumption in several ways. First, when individuals perceive changes in nominal prices without considering the effects of inflation, they may make misguided financial decisions based on nominal values instead of considering the purchasing power of their money. This can result in overestimating or underestimating the affordability of goods and services, leading to changes in consumption patterns.

The concept of neutrality of money suggests that changes in the money supply have no real effect on the economy in the long run and only affect nominal variables such as prices and wages. Money illusion challenges this concept by highlighting that individuals may not always perceive changes in nominal values accurately and may make decisions based on nominal values without considering the effects of inflation or deflation.