Table Of Contents

What Is Modified Adjusted Gross Income (MAGI)?

Modified Adjusted Gross Income (MAGI) is a metric used by the Internal Revenue Service in the United States. It determines eligibility for certain tax deductions and credits, as well as for determining eligibility for specific government programs such as Medicaid and premium tax credits for purchasing health insurance on the Affordable Care Act (ACA) marketplace.

It aims to create a standard measure of income that applies to multiple tax provisions and government programs. At the same time, ensuring that tax benefits and government programs target those most in need.

Key Takeaways

- Modified Adjusted Gross Income measures income used for tax and government program purposes.

- It starts with Adjusted Gross Income (AGI) and making certain adjustments based on the program or tax provision.

- It determines eligibility for specific government programs like premium tax credits for purchasing health insurance on the Affordable Care Act (ACA) marketplace.

- The specific adjustments and rules for calculating MAGI can vary depending on the program or tax provision, so carefully reviewing the practices and instructions for each case is essential.

Modified Adjusted Gross Income Explained

Modified Adjusted Gross Income (MAGI) in the US tax code determines an individual's eligibility for certain tax benefits and government programs.

The origin of Modified Adjusted Gross Income can be traced back to the Tax Reform Act of 1986, which established a set of standardized income definitions to simplify the tax code and make it easier to calculate tax liability. In addition, it was to determine eligibility for certain tax benefits, such as IRA contributions and the deduction for student loan interest.

Over time, it has become essential for determining eligibility for government programs, particularly healthcare-related. For example, it determines eligibility for premium tax credits under the Affordable Care Act and Medicaid and the Children's Health Insurance Program (CHIP). It also determines eligibility for certain education-related tax benefits and deductions.

The significance of it lies in its ability to ensure that tax benefits and government programs are for those most in need. By using it to determine eligibility, the government can ensure that benefits go to those with lower incomes and may have a more challenging time affording healthcare or other expenses.

How To Calculate?

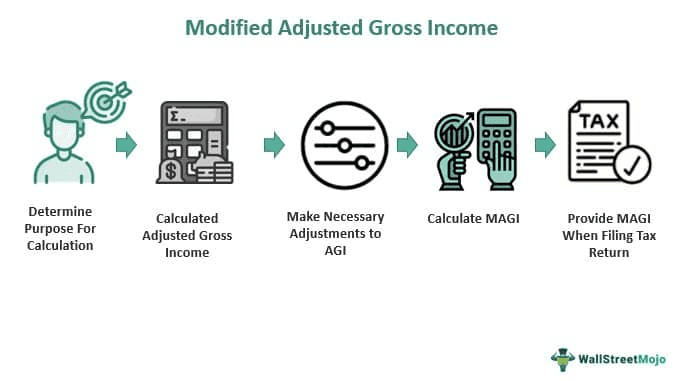

To calculate Modified Adjusted Gross Income, one must start with Adjusted Gross Income (AGI) and then make certain adjustments to that figure. The specific adjustments will depend on the purpose of calculation, as different programs and tax provisions may have different rules and adjustments. First, however, here is a general overview of how to calculate it :

- Start with Adjusted Gross Income (AGI): AGI is on line 11 of Form 1040.

- Add back certain deductions: Add certain assumptions taken on tax returns. Some standard deductions include:

- Student loan interest deduction

- IRA contributions

- Deductible contributions to a Health Savings Account (HSA)

- Deductible contributions to a retirement plan (such as a 401(k) or 403(b)) - Add in certain types of income: Add certain types of income not included in AGI. Some common types of income:

- Tax-exempt interest from municipal bonds

- Foreign earned income

- Social security benefits (if they were tax-exempt) - Subtract certain types of income: Subtract certain income types included in AGI. Some common types of deductible income:

- Taxable Social Security benefits

- Certain types of foreign income

- Deductible contributions to a traditional IRA or retirement plan - Calculate the final amount: After the necessary adjustments, one can calculate the final amount.

Examples

Let us understand it in the following ways.

Example #1

Let's say Rahul’s AGI for the year is $50,000, and he has the following adjustments to make:

- First, he made $3,000 in contributions to a deductible IRA.

- Second, he received $1,500 in tax-exempt interest from municipal bonds.

- Third, he received $2,000 in Social Security benefits, of which $500 was taxable.

To calculate Rahul’s MAGI, he would use the following formula:

MAGI = AGI + (certain deductions) + (certain types of income) - (certain types of income)

MAGI = $50,000 + $3,000 + $1,500 - $500

= $54,000

In this example, Rahul’s MAGI would be $54,000. This amount would determine his eligibility for certain tax benefits and government programs.

Example #2

A recent example of the Modified Adjusted Gross Income being in the news is the American Rescue Plan Act of 2021, which provided additional stimulus payments to eligible individuals and families in response to the COVID-19 pandemic.

Under the act, individuals with a modified adjusted gross income of up to $75,000 and married couples with up to $150,000 were eligible for the entire stimulus payment of $1,400 per person.

This MAGI-based eligibility criterion was the subject of much debate and negotiation in Congress, with some lawmakers pushing for higher income limits and others arguing for more targeted payments to those with lower incomes. Ultimately, the bill passed with the MAGI-based eligibility criteria intact, and millions of eligible Americans received stimulus payments based on their MAGI.

How To Reduce?

A lower modified adjusted gross income can be advantageous, increasing eligibility for tax credits or government programs with income limits. Here are some methods to reduce it:

- Contribute to a tax-deductible retirement account: Contributions to a tax-deductible retirement account, such as a traditional IRA or 401(k), can reduce by contribution amount. For example, if it is $60,000 and one contributes $5,000 to a traditional IRA, MAGI would come down to $55,000.

- Deduct student loan interest: If someone has student loan interest payments, one can deduct up to $2,500 of that interest from taxable income. This deduction can also reduce MAGI.

- Make charitable contributions: Deduction of Charitable contributions to qualifying organizations from taxable income reduces MAGI.

- Use a Health Savings Account (HSA): Deduction of Contributions to an HSA from taxable income reduces MAGI.

- Take advantage of tax credits: Some tax credits, such as the Earned Income and Child Tax Credit, are based on MAGI. Taking advantage of these credits can reduce MAGI and increase a refund.

Modified Adjusted Gross Income vs Adjusted Gross Income

Adjusted gross income (AGI) measures total income minus specific deductions, determining tax liability and eligibility for certain tax deductions. MAGI, on the other hand, starts with AGI and makes certain adjustments to determine eligibility for specific government programs.

Here are some critical differences between MAGI and AGI:

- Definition: AGI is the total income from all sources, minus certain deductions such as contributions to a traditional IRA or student loan interest payments. MAGI, on the other hand, starts with AGI and then makes certain adjustments, such as adding back certain deductions and adding in certain types of income that were not part of AGI.

- Purpose: AGI determines tax liability and eligibility for certain tax deductions, such as the student loan interest or IRA deduction. MAGI, on the other hand, determines eligibility for specific government programs, such as Medicaid and premium tax credits for purchasing health insurance on the Affordable Care Act (ACA) marketplace.

- Calculation: AGI is calculated by subtracting certain deductions from total income. MAGI, on the other hand, starts with AGI and then makes certain adjustments based on the purpose for which it is being used. The specific adjustments can vary depending on the program or tax provision.

- Flexibility: AGI is a fixed number based on income and deductions for a specific tax year. MAGI, however, can vary depending on the purpose of its use. Therefore, different programs and tax provisions may have different rules and adjustments for calculating MAG, so the specific calculation can go.