Table Of Contents

MIRR Function in Excel

The MIRR in Excel is a built-in financial function used to calculate the modified internal rate of return for the cash flows supplied with a period. This function takes the initial investment or loan values and a set of net income values with the interest rate paid on the initial amount, including the interest earned from reinvestment of earned amount, and returns the MIRR (Modified Internal Rate of Return) as output.

Syntax

Parameters

The details of the parameters used in the MIRR formula in Excel are as follows:

- Values: Values are an array of cash flow representing a series of payment amounts, range of references, or set of income values, including the initial investment amount.

- Finance_rate: The finance rate is a rate of interest paid on the amount used during cash flow.

- Reinvest_rate: Reinvest rate is the interest rate earned from the reinvested profit amount during cash flow.

How to use the MIRR Function in Excel? (with Examples)

Example #1

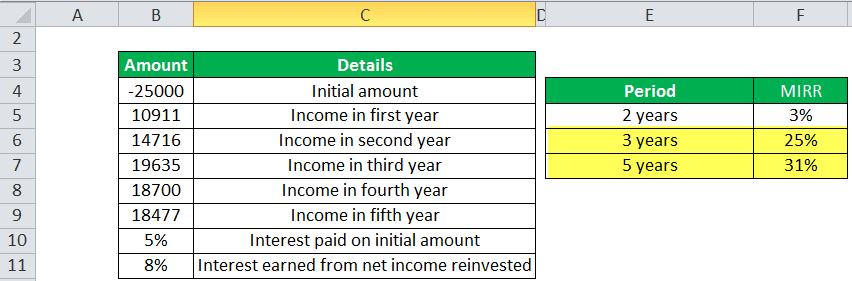

Consider an initial loan amount of 25,000 as an initial investment amount (loan amount) with an interest rate of 5% yearly. You have earned an interest rate of 8% from the reinvested income. In MIRR, the loan or initial investment amount is always considered as (-ve) value.

Below is the table that shows the income details after a regular interval. For example, the cash flow for the 1st, 2nd, 3rd, 4th, and 5th years are as follows: 10,911, 14,716, 19,635, 18,700, and 18,477.

Now calculate MIRR in Excel (Modified internal return rate) after two years:

=MIRR(B4:B6,B10,B11) and output MIRR is 3%.

Similarly, calculate MIRR (Modified internal rate of return) after 3 and 5 years:

MIRR, after three years, will be =MIRR(B4: B7, B10, B11), and output is 25%.

MIRR, after five years, will be=MIRR(B4: B9, B10, B11), and output is 31%.

Example #2

Consider an initial loan amount of 10,000 as an initial investment with an interest rate of 5% yearly, and you have earned an interest rate of 8% from the reinvested income.

Below is the table showing the income details after a regular interval. For example, the cash flow for the 1st, 2nd, 3rd, 4th, and 5th years are as follows: 7,505, 5,338, 9,465, 5,679, and 6,004.

Now calculate MIRR after 2 years:

=MIRR(B15:B17,B21,B22)and output MIRR is 16%.

Similarly, calculate MIRR after 3 and 5 years:

MIRR after three years will be =MIRR(B15: B18, B21, B22), and output is 34%.

MIRR after five years will be =MIRR(B15:B20,B21,B22) and output is 32%.

Things to Remember

- The loan amount is always considered a negative value.

- After regular intervals, the modified internal return rate is always calculated on a variable cash flow.

- Error handling:

- #DIV/0!: MIRR excel will return #DIV/0! The exception occurs when the supplied error does not contain at least one negative or positive value.

- #VALUE!: MIRR will return this kind of exception when any supplied value is non-numeric.

Recommended Articles

This article is a guide to MIRR Function Excel. We discuss using the MIRR Excel function, practical examples, and a downloadable template. Also, you can learn more about Excel from the following articles: -

- Examples of IRR

- IRR vs. ROI

- Excel NPER Function

- RANKX Function in Power BI

- Excel Paste Transpose