Table Of Contents

Protection Rights

Various legal protections and rights are available to these shareholders that can help to safeguard their interests and prevent unfair treatment. Some of these protection rights include:

- Every minority shareholder, regardless of their minimal ownership, can vote in significant decisions.

- They have a right to receive compulsory dividends from time to time from the company.

- Furthermore, every majority shareholder has fiduciary duties towards these shareholders, to which they are entitled.

- Minority shareholders' rights allow them to raise questions, ask for a particular report, and document and inspect company records as per their interest.

- In most cases, they also enjoy voting rights in board elections.

- They share the right to the price discount offered to non-controlling interest shareholders.

- The company appoints a transferor to supervise the payment initiation to minority shareholders.

- A minority shareholder can take legal action against the majority shareholder for fraudulent, intentionally unfair, and illegal practices on the grounds of oppression.

- A court may give remedies in favor of the minority shareholders by ordering asset liquidation.

- The court can order the majority shareholders to buy out the minority shares at a reasonable price.

Examples

Let us understand the concept better with the help of an example.

Example #1

Let's assume that John and Jane are two owners of a pharmacy company where John owns 60% of the company, while Jane owns the remaining 40%. Hence, Jane is a minority shareholder who owns less than 50% of the company.

Therefore, Jane is entitled to a proportionate percentage of the company's profits and has the right to participate in company decisions. However, if John makes a decision that requires a majority vote, for instance, taking out a large loan, Jane may need more voting power to sway the outcome.

Hence, if John wants to take out $100,000 to expand the business, and the decision requires a 51% majority vote, in such case, he can approve the loan on his own as he owns 60% of the company's shares. Jane would need more voting power to block the decision in this situation.

Besides, as a minority shareholder, Jane could voice her concerns to John, suggest alternative financing options, or take legal action if she believes John is not acting in the company's best interest.

Example #2

An excellent example of minority shareholders' rights comes from Atos, a French IT solutions company, in September 2022, where a minority shareholder called for the company's chairman's resignation when the shares traded at a 30-year low.

They have requested that the chairman step down and the board be restructured, replacing people who have been part of the board for a long time. They also explained how they have engaged with the management, but now it's time for them to speak up.

Atos, as a company, has always given much significance to shareholders, but the shares of the company have dropped by 15%. As per Goldman Sachs, the company has lost the goodwill of investors, and changing the board is a good way to regain market trust. Many believe that lousy administration is the real problem of the firm.

In response to the request of the minority interests, the company has issued a statement affirming its commitment to developing a successful strategy that will also benefit the employees.

Advantages And Disadvantages

Advantages

- Such shareholders enjoy the minority shareholder discount in shares.

- They are free from involvement in business meetings and decision-making processes.

- Legal rights are given to shareholders to ask for any document, report, file, or error they want to discuss.

- These shareholders are not personally liable for the company’s debts or legal issues beyond the value of their investment.

- Moreover, these shareholders are entitled to a proportionate share of the company’s profits based on their ownership stake.

Disadvantages

- They become the victim of the majority shareholders' power abuse.

- Such shareholders observe a thick power imbalance between them and the majority shareholders.

- There is brewing oppression among minority interests.

- Limited control over the company’s decision-making process.

- They need more voting power to block major decisions.

Frequently Asked Questions (FAQs)

If a single or group of shareholders operating together owns 98% of the company's voting rights, they can force out the minority shareholder. For example, in a public company, when majority shareholders become eligible, these shareholders present their shares to them to buy. If any claims are not purchased within three months, the majority shareholders can force out these shareholders.

These shareholders are entitled to certain information about the company they have invested in, including:

- Financial statements

- Annual reports

- Shareholders meetings

- Proxy statements

- Insider transactions

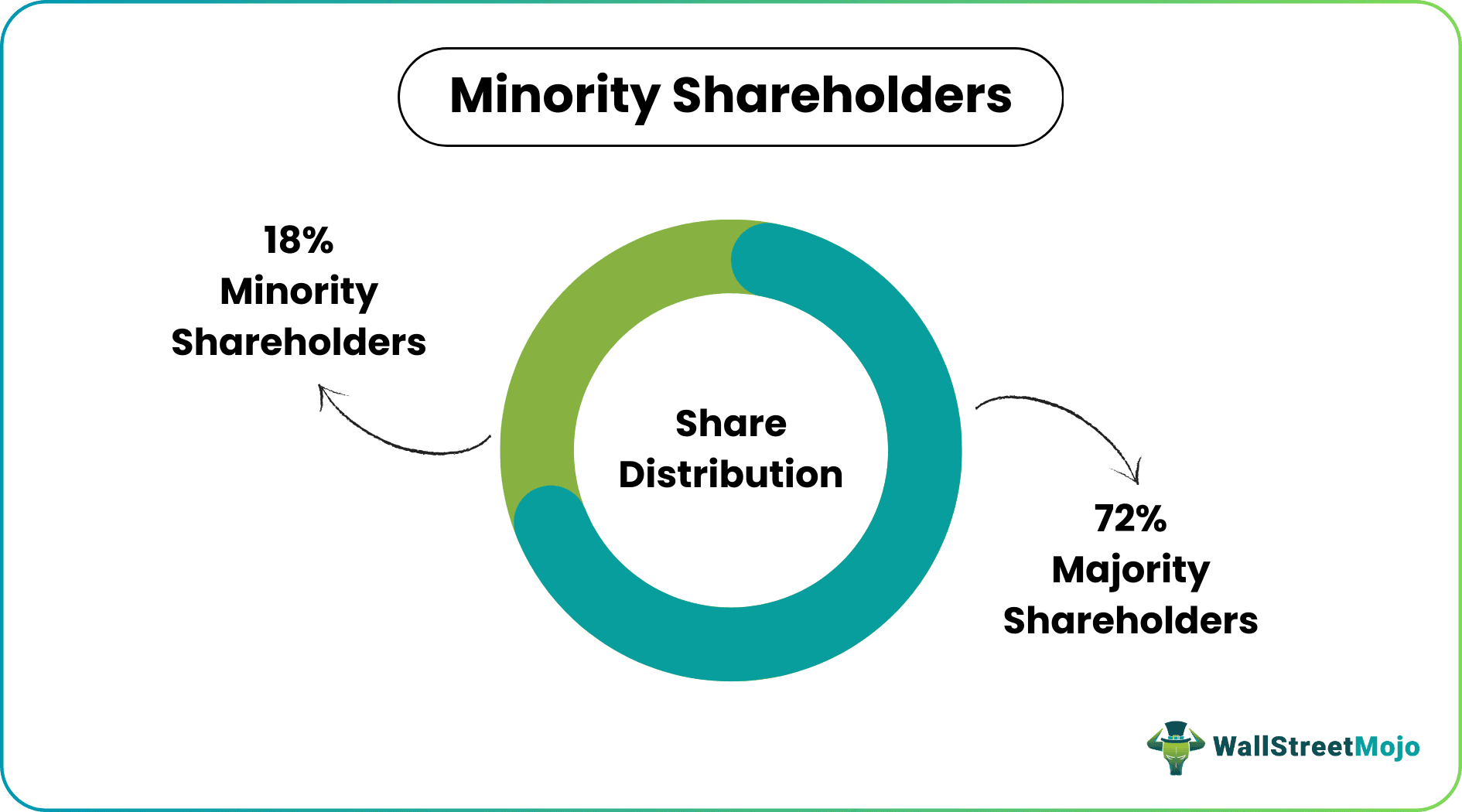

Minority shareholder interest is divided into two types -

1. Active minority interest - varies between 21% to 49% with reasonable voting rights and influence.

2. Passive minority interest - the share ownership is below 20%, has a minimum choice and looks forward to the majority shareholders for any decision regarding the company.

Recommended Articles

This article has been a guide to what is a Minority Shareholder. We compare it with majority shareholders, explain protection rights, advantages, and examples. You may also find some useful articles here -